The conversation surrounding a potential leveraged buyout (LBO) of Target Corporation (TGT) has intensified this October, as DA Davidson, an investment firm, reignited talk of the retail heavyweight possibly going private. The idea isn’t as far-fetched as it sounds. Target’s share price has tumbled more than 33% year-to-date (YTD), and the stock remains down nearly 43% over the past five years, a reminder of how far the company has fallen since its pandemic-era highs.

Adding to the intrigue of Target’s share price drop, the retailer just rolled out its biggest Circle Week to date, spanning Oct. 5 to 11, with savings up to 50%. This aggressive promotional strategy is an urgent bid to spark demand and recover lost ground during a challenging year, especially as TGT stock remains deep in red territory.

Meanwhile, the Federal Reserve’s recent rate cuts, including a quarter-point reduction that lowered benchmark lending rates to roughly 4.1%, have brightened prospects for leveraged financing. That’s precisely the kind of environment where buyouts thrive. With borrowing costs easing and valuations compressed, the question now is whether the red bullseye could soon belong to private hands. Let’s find out.

Target’s Financial Strength

Target Corporation, with a market cap of $40.42 billion, operates as a retail chain that offers general merchandise across apparel, home goods, food, and essentials to U.S. consumers. The company’s dividend remains steady, with an annual forward payout of $4.56 per share and a yield of 5.22%.

The stock performance has weakened sharply, with the shares currently priced at $90.26, falling 33.42% YTD and 42.26% over the past 52 weeks.

Its forward price-to-earnings (P/E) ratio is 11.77x, below the retail sector’s median multiple of 15.89x, while the PEG ratio of 2.54x also trails the sector median of 2.71x. This suggests Target’s valuation remains compressed relative to peers, potentially supporting the LBO thesis promoted by DA Davidson.

The company’s second-quarter 2025 earnings report, released on Aug. 20, provided more in-depth insight into its current financial standing. This showed net sales of $25.2 billion, down 0.9% year-over-year (YoY), though improving by nearly two points from the first quarter’s pace.

It also confirmed that traffic and sales trends strengthened, particularly in physical stores, with all six core merchandising categories improving sequentially. The report noted that digital comparable sales rose 4.3%, boosted by more than 25% growth in same-day delivery through Target Circle 360 and consistent Drive Up momentum.

This revealed that non-merchandise sales climbed 14.2%, underlining the success of Target’s advertising and membership initiatives. It reflected a GAAP and adjusted EPS of $2.05, down from $2.57 a year ago, as higher tariffs and cost inputs trimmed margins. Target’s operating income reached $1.3 billion, down 19.4% YoY, and its operating margin contracted to 5.2% from 6.4%.

What’s Shaping Target’s Future

Target’s leadership transition in Aug. 2025 marked a decisive shift in its corporate direction. The company appointed Michael Fiddelke, a long-serving executive with over two decades at the retailer, as its next CEO. He will officially assume the role on Feb. 1, 2026, succeeding Brian Cornell, who will move to executive chair.

The news immediately pressured the stock, with shares sliding roughly 10% as markets reacted to the choice of an internal successor rather than an external reformer. Fiddelke’s appointment comes as the retailer works to regain growth and efficiency after several quarters of sliding sales.

To support operational efficiency, Target entered a 364‑day credit agreement on Oct. 9. The facility provides enhanced liquidity and flexibility for working capital and debt management. This step arrives as the company navigates tighter margins and higher tariff costs. Such stability strengthens its near-term balance sheet while creating headroom for restructuring if strategic opportunities arise.

In a separate move, Target’s collaboration with Woolrich highlighted continued attention to product innovation. The limited-time collection, launched in October, featured over 100 products across apparel, outdoor gear, home goods, and consumables. With introductory prices at just $2, the launch underscored Target’s focus on accessibility and breadth of offering. The partnership’s debut in New York, featuring Olivia Palermo, Sean Kaufman, and Lukas Gage, highlights Target’s continued cultural relevance and appeal.

Analysts Remain Cautious Ahead of Earnings

Target’s upcoming earnings report is set for Nov. 19, a date drawing close attention given the company’s weaker YTD performance and persistent pressure on discretionary spending. Analysts expect earnings per share (EPS) of $1.78 for the current quarter ending October 2025, slightly below last year’s $1.85, signaling a modest quarterly decline of 3.78%.

This trend follows the company’s existing 2025 guidance, which reaffirmed expectations for a low single-digit decline in overall sales. Target maintained its forecast for GAAP EPS between $8 and $10, while adjusted earnings, excluding litigation settlement gains, are forecast at $7 to $9.

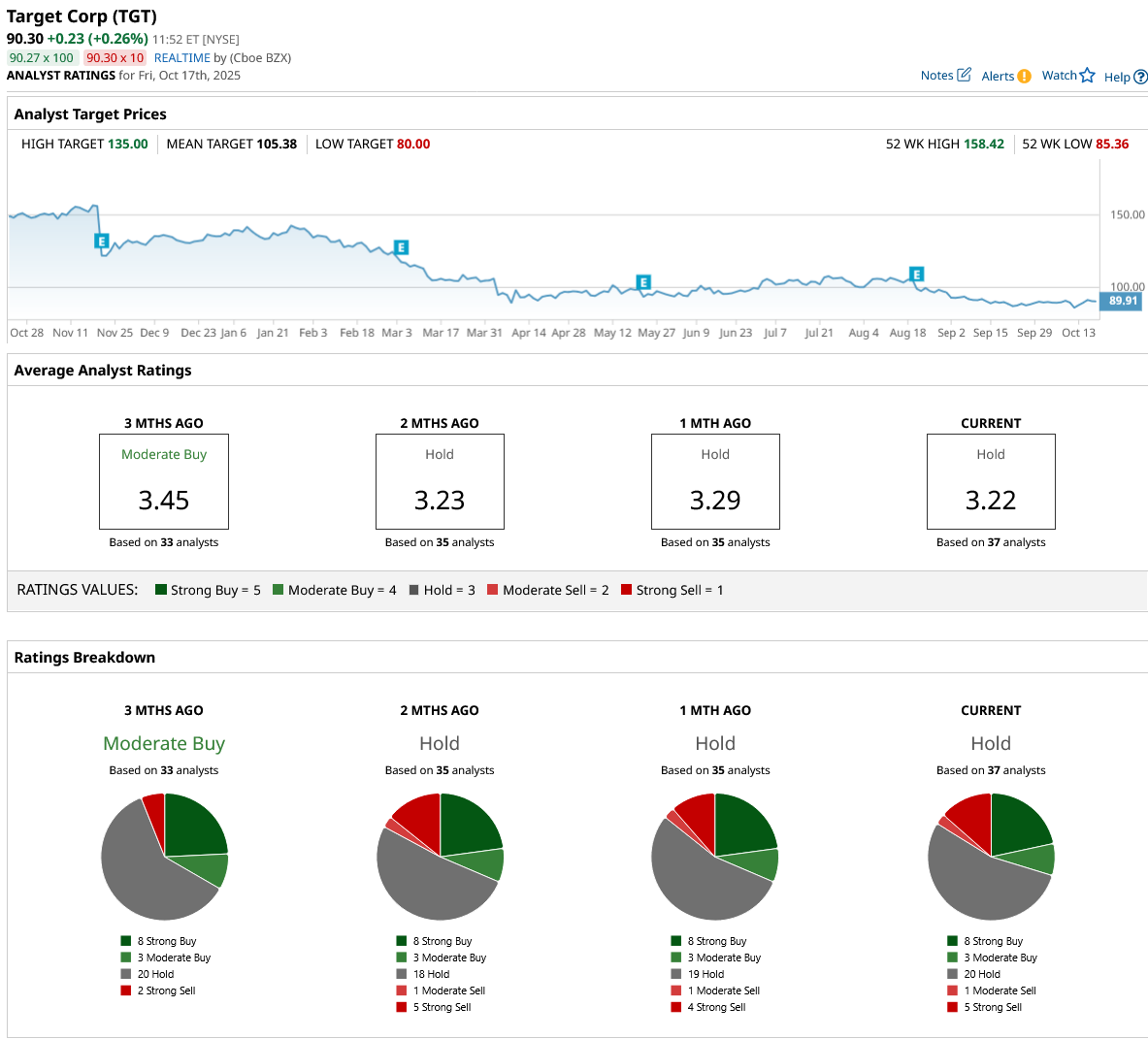

Analyst sentiment remains notably balanced. The 37 analysts surveyed maintain a consensus “Hold” rating on TGT stock, indicating neither conviction to sell nor confidence to upgrade. The average price target of $105.28 suggests a 16.6% upside from the current share price.

Conclusion

So, is Target really going private? Probably not immediately, but the idea isn’t without weight. A $40 billion buyout would be complex, yet its discounted valuation and stable cash flow make the prospect enticing. Going private could give the company breathing room to restructure operations, streamline costs, and drive long‑term profit without quarterly market scrutiny. While a deal remains uncertain, Target’s current setup keeps the door slightly open. Whether through a takeover or a turnaround, Target’s next chapter looks set to be one worth watching.