/Super%20Micro%20Computer%20Inc%20logo%20on%20building-by%20Poetra_RH%20via%20Shutterstock.jpg)

With a market cap of $25.5 billion, Super Micro Computer, Inc. (SMCI) is a leading provider of high-performance, energy-efficient server and storage solutions built on modular and open-standard architectures. Supermicro delivers its products and services worldwide through direct sales, distributors, value-added resellers, system integrators, and OEMs.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Super Micro Computer fits this criterion perfectly. The company designs and manufactures a wide range of systems, including AI-optimized servers, blade and multi-node platforms, storage solutions, and edge computing systems, serving industries such as cloud computing, artificial intelligence, 5G, and enterprise data centers.

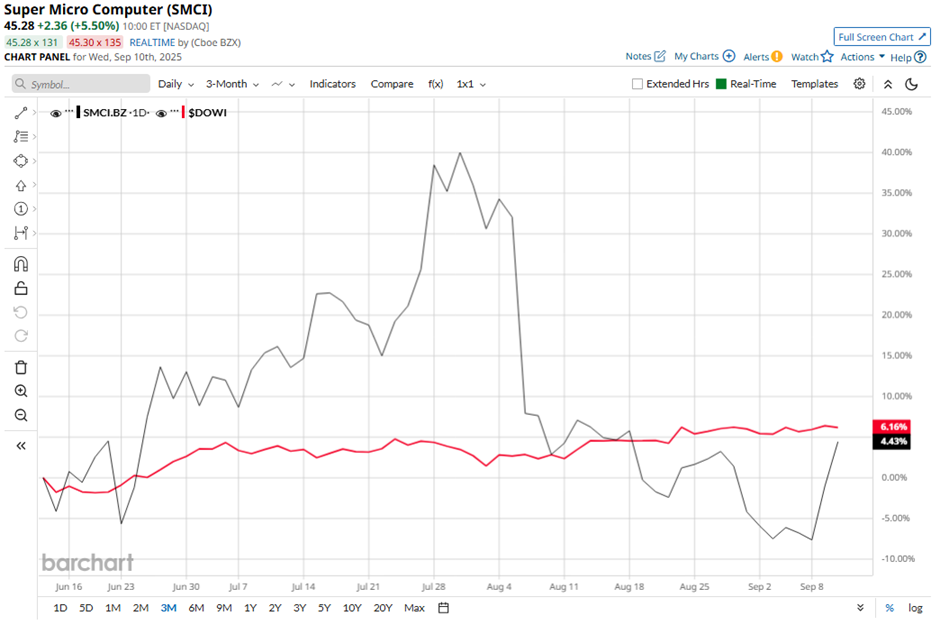

Shares of the San Jose, California-based company have decreased over 34% from its 52-week high of $66.44. Over the past three months, its shares have risen 3.9%, underperforming the broader Dow Jones Industrials Average's ($DOWI) 6.4% gain during the same period.

Longer term, shares of the server technology company have returned nearly 8% over the past 52 weeks, lagging behind DOWI’s nearly 12% increase over the same time frame. However, SMCI stock is up 46.2% on a YTD basis, outperforming DOWI's 7.2% gain.

The stock has fallen below its 50-day moving average since early August.

Super Micro Computer’s shares tumbled 18.3% following its Q4 2025 results on Aug. 5. The company reported adjusted EPS at $0.41 and revenue at $5.76 billion, missed Wall Street expectations. The company also cut its long-term outlook, projecting at least $33 billion in fiscal 2026 revenue, down from its earlier forecast.

In addition, SMCI stock has performed weaker than its rival, Pure Storage, Inc. (PSTG). PSTG stock has climbed nearly 33% YTD and 74.9% over the past 52 weeks.

Due to the stock’s underperformance, analysts remain cautious about its prospects. SMCI stock has a consensus rating of “Hold” from 18 analysts in coverage, and the mean price target of $47.62 is a premium of 5.6% to current levels.