/Stanley%20Black%20%26%20Decker%20Inc%20sign-by%20BalkansCat%20via%20Shutterstock.jpg)

New Britain, Connecticut-based Stanley Black & Decker, Inc. (SWK) provides hand tools, power tools, outdoor products and accessories, engineered fastening systems, and several other items and services. With a market cap of $11.6 billion, SWK employs over 50,000 people and its operations span the Americas, Europe, and Asia.

Companies worth $10 billion or more are generally described as "large-cap stocks." Stanley Black & Decker fits right into that category, with its market cap exceeding this threshold, reflecting its notable size and influence in the tools & accessories industry.

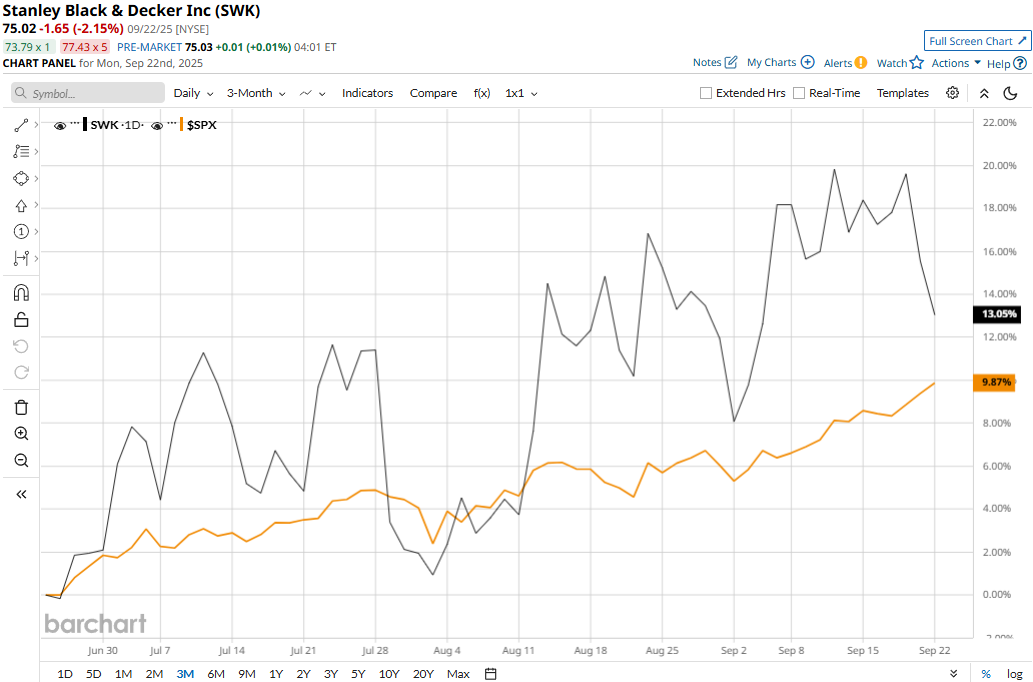

Despite its notable strengths, SWK stock has plummeted 32.3% from its three-year high of $110.88 touched on Sep. 27, 2024. However, the stock has soared 16.2% over the past three months, notably outpacing the S&P 500 Index’s ($SPX) 12.2% gains during the same time frame.

Meanwhile, the stock’s performance has remained grim over the longer term. SWK has declined 6.6% in 2025 and tanked 29.8% over the past 52 weeks, underperforming SPX’s 13.8% gains in 2025 and 17.4% surge over the past year.

The stock has traded below its 200-day moving average between November 2024 and August 2025, and above its 50-day moving average for the past few months, underscoring its longer-term downtrend and recent upsurge.

Stanley Black & Decker’s stock prices plummeted 7.2% in a single trading session following the release of its mixed Q2 results on Jul. 29. The company’s sales have remained under constant pressure during recent quarters. In Q2, SWK’s topline came in at $3.9 billion, down nearly 2% year-over-year and 1.1% below the Street’s expectations. Further, its operating cash flows plummeted 62.6% year-over-year to $214.3 million. However, the company’s non-GAAP EPS dipped by a modest 92 bps year-over-year to $1.08 and surpassed the consensus estimates of 38 cents by a large margin.

When compared to its peer, SWK has significantly underperformed Snap-on Incorporated’s (SNA) marginal 58 bps dip in 2025 and 19.2% surge over the past 52 weeks.

Among the 16 analysts covering the SWK stock, the consensus rating is a “Moderate Buy.” Its mean price target of $84.25 suggests a 12.3% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.