Shares of financial services firm SoFi Technologies (SOFI) reached their highest point since going public in 2021 following a special purpose acquisition company (SPAC) merger. SoFi reached an all-time high of $28.58 on Sept. 18, as macroeconomic conditions show signs that could be conducive to the financial backdrop.

With this momentum in mind, should you consider buying SOFI stock now?

About SoFi Technologies Stock

SoFi Technologies is a leading U.S. financial technology company focused on providing a broad range of digital financial services. It primarily operates as an online bank, serving customers through a user-friendly digital platform. SoFi’s offerings include lending, investment, banking, and personal finance tools designed to simplify money management for its members.

The company integrates technology-driven solutions to support personal loans, mortgages, credit cards, investment accounts, and financial planning. With its primary operations based in San Francisco, SoFi continues to innovate in the fintech sector, aiming to help people reach financial independence and achieve their financial goals. SoFi has a market capitalization of $32.5 billion.

Over the past 52 weeks, SOFI stock has gained 247%, while it is up 83% year-to-date (YTD). The stock reached its highest level of $28.58 on Sept. 18. SOFI first started trading on the Nasdaq on June 1, 2021 following a merger with blank-check company Social Capital Hedosophia Corp V. Currently, SOFI stock is down only 1.6% from its recent high.

The reason for the surge in shares? Optimism is spreading in anticipation of the Federal Reserve potentially cutting interest rates this month. In addition, the company recently launched an artificial intelligence (AI) exchange-traded fund (ETF). The SoFi Agentic AI ETF (AGIQ) launched on Sept. 3, tracking the BITA US Agentic AI Index, which follows companies that generate at least 30% of their overall revenue from agentic AI and autonomous decision-making technologies.

Sofi currently trades at an eye-watering valuation. Its price sits at 86 times forward earnings, which is significantly stretched compared to the industry average.

SoFi Technologies Reported Solid Q2 Results

On July 29, SoFi reported solid results for the second quarter of fiscal 2025, exceeding the expectations of Wall Street analysts. Total net revenue increased by 43% year-over-year (YOY) to $854.94 million, while adjusted net revenue jumped 44% annually to $858.23 million. This was predicated upon SoFi adding record numbers of new members.

The company added a record 850,000 new members in Q2, representing a 34% increase from the prior year’s period to 11.7 million. Additionally, the company introduced a record 1.26 million new products, also representing a 34% increase from the previous year, to a total of 17.1 million products.

SoFi is diversifying its revenue stream. Underscoring this fact, its fee-based revenue reached a record of $377.50 million, up 72% YOY. This was due to strong performance from the company’s Loan Platform Business (LPB), as well as revenues from origination fees, referral fees, and interchange and brokerage fees.

SoFi’s profitability is also rising significantly. In Q2, EPS was $0.08 — 700% higher than the year-ago value of $0.01. The figure also came in higher than the $0.06 EPS that Wall Street analysts were expecting.

Based on these robust results, the company raised its full-year guidance. SoFi now expects to generate adjusted net revenue of approximately $3.375 billion, which is higher than the prior guidance range of $3.235 billion to $3.31 billion. This updated figure also reflects roughly 30% annual growth, higher than the previous growth range of 24% to 27%.

Wall Street analysts are optimistic about SoFi’s future earnings. They expect EPS to climb 60% YOY to $0.08 for the current quarter. For the current fiscal year, EPS is projected to surge 113% annually to $0.32, followed by an 81% growth to $0.58 in the next fiscal year.

What Do Analysts Think About SoFi Technologies Stock?

Wall Street analysts show a mixed view about SoFi’s future prospects. This month, analysts at Needham reiterated their “Buy” rating on the stock while raising the price target from $25 to $29. This upgrade followed the publication of Volume 5 of its digital lending funding tracker, which indicated that the funding environment is poised to improve.

On the other hand, analysts at JPMorgan kept a “Neutral” rating on SoFi while raising the price target to $24. Analyst Reginald Smith believes that SoFi’s balance sheet growth trajectory and recent convertible issuance are concerning, but there are reasons to be optimistic about the company’s prospects.

Analysts at Keefe Bruyette raised the price target from $13 to $14. However, they also maintain an “Underperform” rating on SOFI stock.

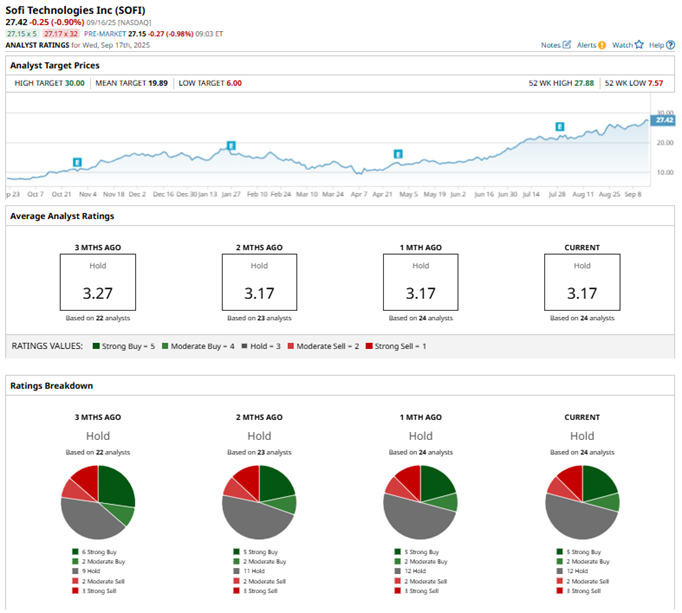

Wall Street analysts are taking a cautious stance on SoFi Technologies, with a consensus “Hold” rating overall. Of the 24 analysts rating the stock, five analysts rate it a “Strong Buy,” two analysts suggest a “Moderate Buy,” 12 analysts have a “Hold” rating, two analysts give a “Moderate Sell” rating, and three analysts have a “Strong Sell” rating. The consensus price target of $19.89 represents 30% potential downside from current levels.

Key Takeaways

Despite SOFI stock reaching a record high and the company experiencing robust financial growth, the mixed outlook from Wall Street analysts may give investors pause for a moment. Moreover, SoFi's stretched valuation might cause a short-term selloff, as Wall Street analysts are also forecasting a downside risk.