/Seagate%20Technology%20Holdings%20Plc%20logo%20on%20phone-by%20rafapress%20via%20Shutterstock.jpg)

Seagate Technology (STX) is a global leader in data storage solutions, renowned for its innovative hard disk drives, solid-state drives, and advanced storage systems. Seagate is known for setting industry benchmarks in storage systems while empowering businesses and individuals with their growing need for data access through cloud, edge, and endpoint devices. With over four decades of expertise, the company serves diverse sectors, including healthcare, telecommunications, media, and security.

Founded in 1978, Seagate maintains a strong global presence with its headquarters in Dublin, Ireland.

About STX Stock

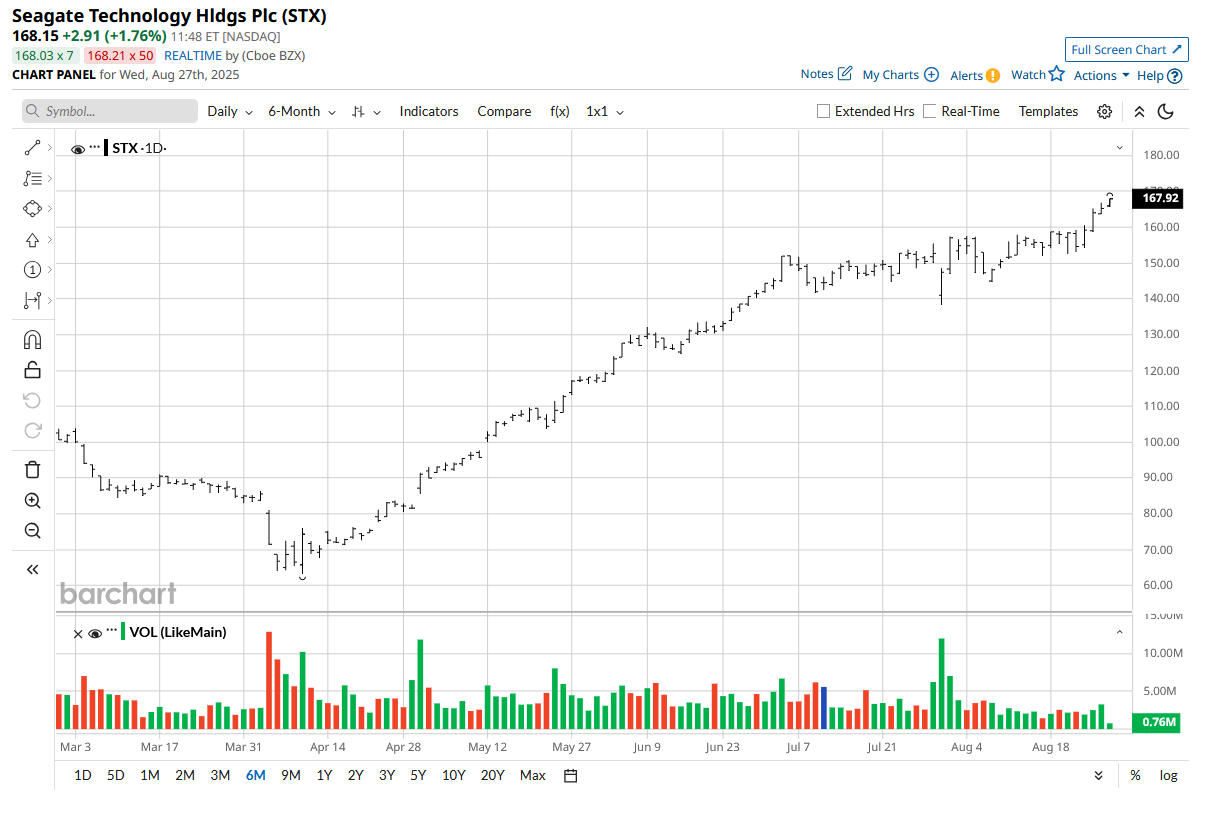

STX stock has delivered a stellar performance in 2025, up approximately 90% year-to-date (YTD) and over 60% for the 52-week period, far outperforming benchmarks like the S&P 500 ($SPX), which claims a 9.7% rise YTD and 16% in 52-weeks time.

Seagate Touches New Highs

Seagate’s exceptional run this year sees STX stock cross the $164 mark for the first time, taking its market cap over $35 billion. This surge follows a dramatic rebound from the $60s in early April, as the market recovered from tariff-driven selloffs. Strong quarterly results further underpin this performance.

Seeking Alpha analyst Narek Hovhannisyan highlighted Seagate's impressive 30% revenue growth and record profit margins, driven by its increasing market share in high-capacity hard disk drives within the cloud and enterprise sectors. He noted that the hard drive market is dominated by a duopoly consisting of Seagate and Western Digital (WDC), with Toshiba (TSHTY) holding a smaller share.

Over recent years, these companies have shifted from aggressive price competition to a more strategic approach of reducing output, which has helped maintain strong profit margins across the industry.

Additionally, during Seagate's fourth-quarter earnings call last month, CEO William David Mosley noted that the typical highs and lows caused by seasonality in the data storage industry are diminishing. He remarked, "For most of our business, seasonality is no longer a significant factor," indicating a shift toward more consistent demand throughout the year in Seagate’s operations.

Seagate’s Q4 Results

Seagate reported fiscal fourth-quarter 2025 earnings of $2.59 per share, surpassing analyst estimates of $2.46. Revenue totaled $2.44 billion, beating projections of $2.41 billion and marking a 30% year-over-year (YoY) increase. The company’s strong performance was fueled by momentum in cloud demand, AI workloads, and edge computing, driving growth in scalable storage solutions.

The company shipped 162.5 exabytes of HDD storage, a 42% increase YoY, with nearline cloud sales accounting for 91% of mass capacity shipments. Non-GAAP gross margin reached a record 37.9%, supported by product mix and pricing improvements. Operating expenses were $286 million, while adjusted EBITDA grew 73% to $697 million.

For the fiscal first quarter 2026, Seagate expects revenue between $2.35 billion and $2.65 billion and EPS ranging from $2.10 to $2.50. Guidance is supported by strong cloud demand and continued deployment of its Heat-Assisted Magnetic Recording (HAMR) technology. Management remains optimistic about sustaining growth despite a dynamic market landscape.

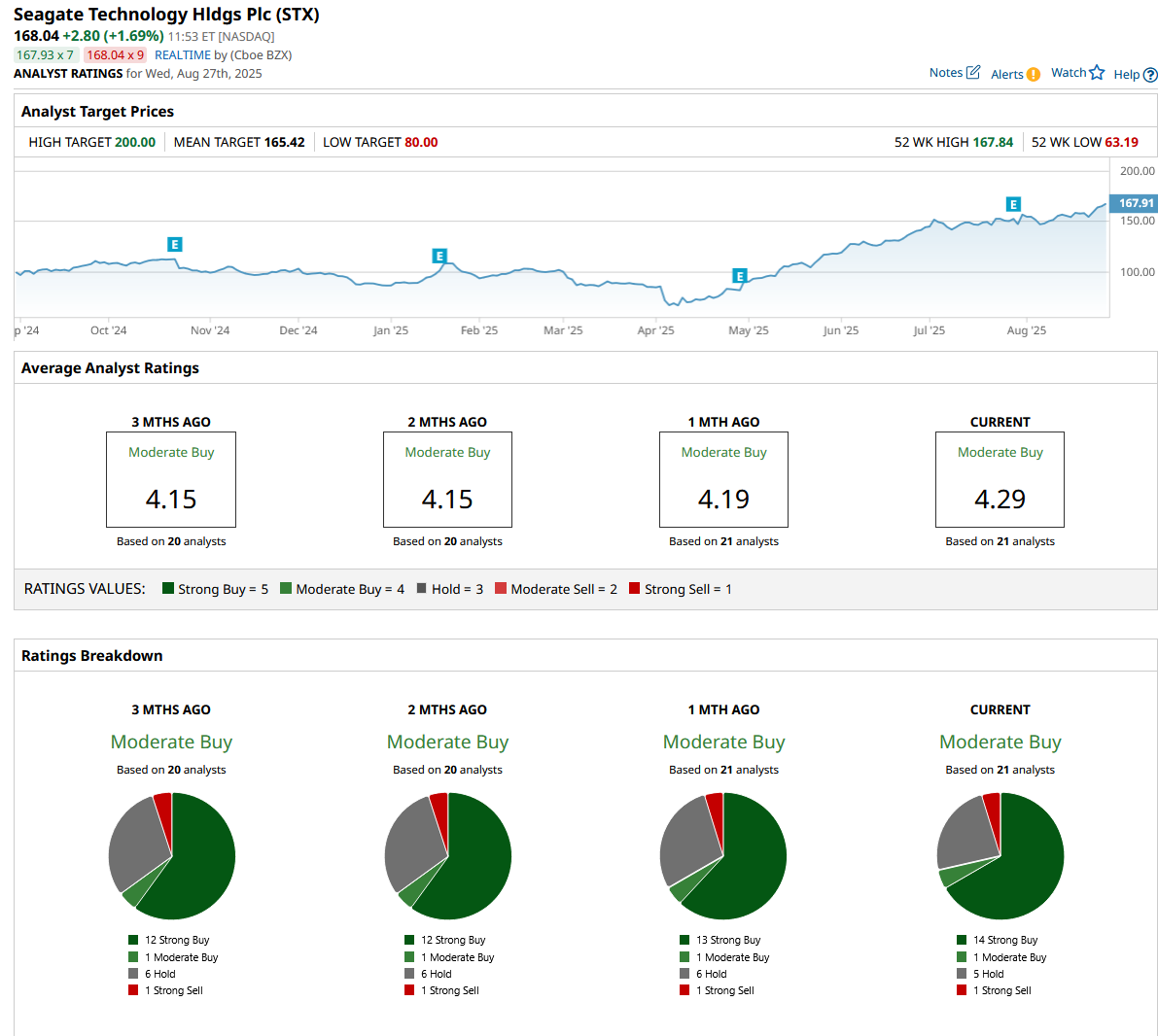

Analyst Rating on Seagate

Analysts have a positive report on Seagate with a consensus “Moderate Buy” rating and a mean price target of $165.42, which is at par with the stock’s trading price. STX stock has been reviewed by 21 analysts while receiving 14 “Strong Buy” ratings, one “Moderate Buy” rating, five “Hold” ratings, and one “Strong Sell” rating.