Cincinnati, Ohio-based The Procter & Gamble Company (PG) is the world’s largest consumer packaged goods company. With a market cap of $367.7 billion, P&G operates through Beauty, Grooming, Health Care, Fabric & Home Care, and Baby, Feminine & Family Care segments.

Companies worth $200 billion or more are generally described as "mega-cap stocks." P&G fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the household & personal products industry. The company’s extensive operations span over 180 countries and territories across the globe.

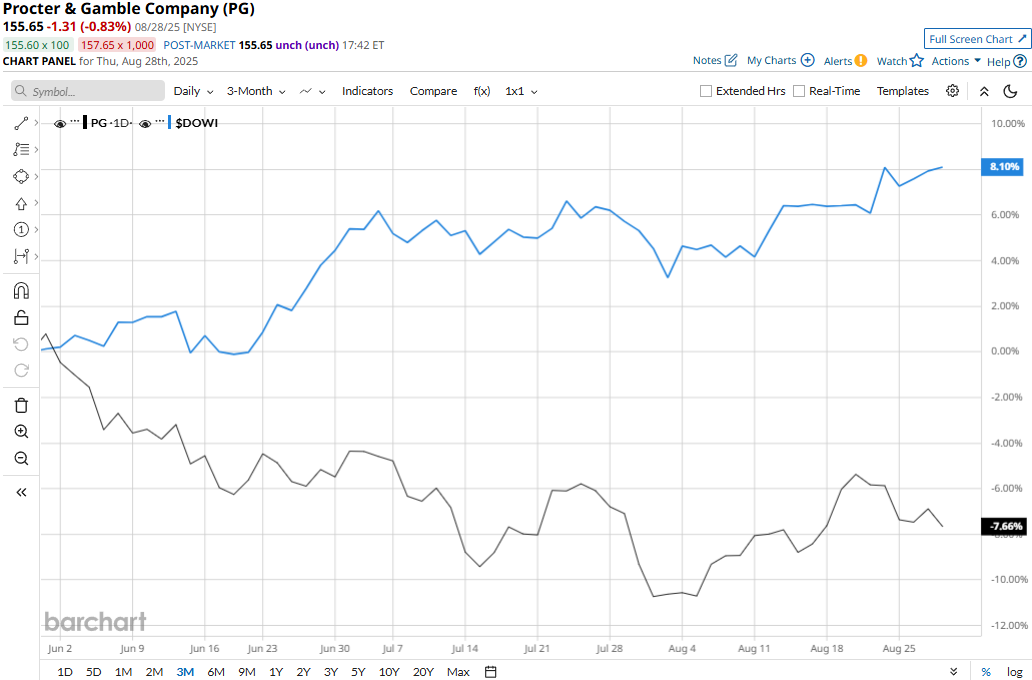

P&G touched its all-time high of $180.43 on Nov. 27 last year and is currently trading 13.7% below that peak. Meanwhile, the stock has plunged 7% over the past three months, notably underperforming the Dow Jones Industrial Average’s ($DOWI) 8.4% surge during the same time frame.

P&G has underperformed the Dow over the long term as well. P&G’s stock prices have declined 7.9% over the past 52 weeks and 7.2% on a YTD basis, lagging behind Dow’s 11.1% surge over the past year and 7.3% gains in 2025.

To confirm the downtrend, P&G has traded mostly below its 200-day moving average since early January and below its 50-day moving average since mid-March, with some fluctuations.

Despite reporting better-than-expected results, Procter & Gamble’s stock prices dropped 1.6% in the trading session following the release of its Q4 results on Jul. 31. The company’s net sales for the quarter inched up 1.7% year-over-year to $20.9 billion, exceeding the Street’s expectations by 1.9%. Meanwhile, the company reduced its SG&A expenses and observed lower impairment charges compared to the year-ago quarter. This led to a 15.2% year-over-year growth in net income to $3.6 billion. Further, its adjusted EPS increased 5.7% year-over-year to $1.48, surpassing the consensus estimates by 3.5%.

Meanwhile, P&G has outperformed its peer, Kimberly-Clark Corporation’s (KMB) 10.5% decline over the past 52 weeks, but underperformed KMB’s 1.8% dip in 2025.

Analysts remain optimistic about the stock’s longer-term prospects. Among the 25 analysts covering the PG stock, the consensus rating is “Moderate Buy.” As of writing, its mean price target of $172 represents a notable 10.5% upside potential.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.