With a market cap of $53.2 billion, Phillips 66 (PSX) is a diversified energy manufacturing and logistics company, with operations spanning the United States, the United Kingdom, Germany, and internationally. The company operates through five key business segments: Midstream, Chemicals, Refining, Marketing & Specialties, and Renewable Fuels, covering the processing, transportation, storage, and marketing of fuels and products worldwide.

Companies valued at $10 billion or more are generally considered “large-cap” stocks, and Phillips 66 fits this criterion perfectly. Through its portfolio of well-known brands such as Phillips 66, Conoco, 76, JET, Kendall, and Red Line, Phillips 66 delivers energy and specialty products that power global economies and support sustainable growth.

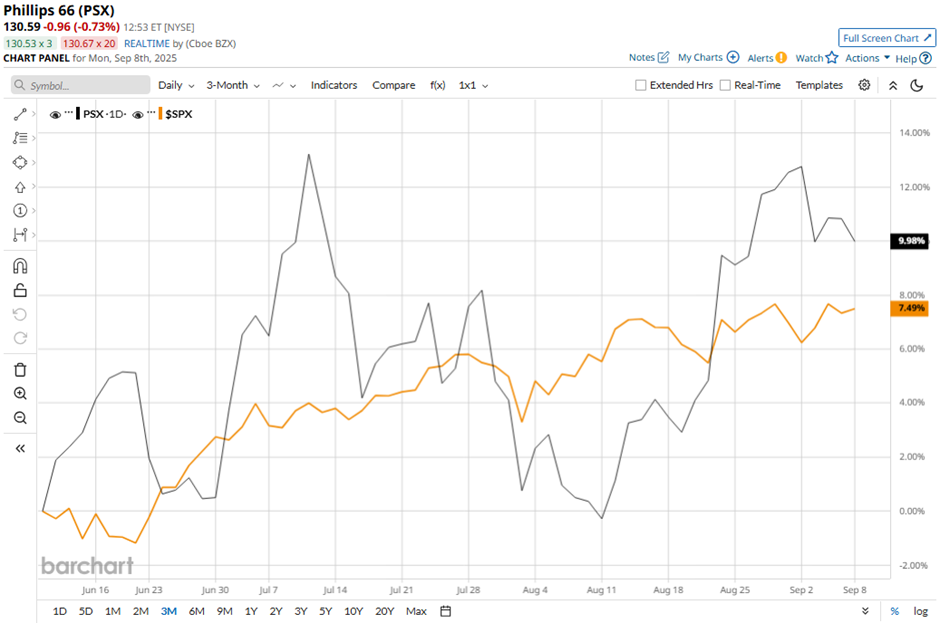

Shares of the Houston, Texas-based company have fallen 7.1% from its 52-week high of $140.60. Phillips 66’s shares have increased 14.3% over the past three months, outperforming the broader S&P 500 Index’s ($SPX) 8.3% gain over the same time frame.

In the longer term, PSX stock is up 14.6% on a YTD basis, outpacing SPX’s 10.4% rise. However, shares of the company have risen 1.9% over the past 52 weeks, lagging behind the 20.1% return of the SPX over the same time frame.

Despite few fluctuations, PSX stock has been trading above its 50-day moving average since May and remained above its 200-day moving average since early June.

Shares of Phillips 66 rose marginally on Jul. 25 after the company posted Q2 2025 results, with adjusted EPS of $2.38 per share, beating the consensus estimate and improving from last year’s $2.31. The beat was driven by higher refining volumes and stronger realized refining margins, which climbed to $11.25 per barrel, with notable strength in the Central Corridor and West Coast. Additionally, Marketing & Specialties earnings surged to $660 million from $415 million, supported by U.S. marketing fuel margins rising to $2.83 per barrel from $1.70, offsetting weakness in Chemicals and Renewable Fuels.

Nevertheless, rival Valero Energy Corporation (VLO) has outpaced PSX stock. VLO stock has gained 27.3% on a YTD basis and 16.3% over the past 52 weeks.

Despite the stock’s underperformance over the past year, analysts remain moderately optimistic on PSX. The stock has a consensus rating of “Moderate Buy” from the 21 analysts in coverage, and the mean price target of $136.15 is a premium of 4.3% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.