/Oracle%20Corp_%20logo%20on%20phone-by%20WonderPix%20via%20Shutterstock.jpg)

Around since the 70s, and after operating for almost half a century, Oracle (ORCL) finds itself under some serious spotlight, thankfully for the right reasons. Following a blockbuster guidance that elevated founder Larry Ellison briefly to the status of the world's richest person, it is now in the news for a management revamp that is seldom seen among corporations.

Will Two Be Better Than One?

Through a press release on Sept. 22, the cloud computing major announced that Clay Magouyrk and Mike Sicilia would be appointed as co-CEOs of the company, with current CEO Safra Katz set to serve as executive vice chair of the Oracle board of directors.

Magouyrk joined Oracle in 2014 and most recently served as president of Oracle Cloud Infrastructure (OCI). He played a pivotal role as one of the original architects of Oracle’s cloud engineering group, guiding the creation, rollout, and commercial success of OCI’s second generation, a platform designed to support both large-scale public cloud operations and massive AI training data centers measured in gigawatts.

Sicilia, on the other hand, offers extensive experience in industry-specific software and applied AI. Under his leadership, engineering groups introduced intent-driven application generation, reducing reliance on conventional coding for Oracle’s application development. They also embedded advanced AI agents across Oracle’s vertical application suites—spanning healthcare, financial services, communications, utilities, hospitality, and retail. Notably, he joined the company in 2008, following Oracle's acquisition of Primavera Systems, where he served as CTO.

Commenting on the development, Chairman of the Board Larry Ellison said:

“Clay's years of experience leading Oracle's large, fast-growing Cloud Infrastructure business has demonstrated his readiness for a CEO role. Mike has spent the last several years modernizing Oracle's Industry applications businesses—including Oracle Health—by completely rebuilding those applications using the latest AI technologies. A few years ago, Clay and Mike committed Oracle's Infrastructure and Applications businesses to AI—it's paying off. They are both proven leaders, and I am looking forward to spending the coming years working side-by-side with them. Oracle's future is bright.”

Meanwhile, the latest appointments of Magouyrk and Sicilia make it clear where Oracle's strategic focus lies—cloud and AI, specifically agentic AI. While Magouyrk's deep cloud expertise and prior stint at Amazon Web Services (AWS) are expected to push Oracle to challenge the hegemony of AWS, Microsoft's (MSFT) Azure, and Google Cloud in the cloud market, Sicilia's proven track record in the realm of applied AI fits in well with the company's aim of becoming an agentic AI powerhouse.

So, what does this management change mean for the ORCL stock as an investment? Already up a mammoth 86% on a year-to-date (YTD) basis, does the $877.1 billion market cap company have enough legs for another upmove? Let's analyze.

Decent Financials But Overhyped

The most recent trigger for the Oracle share price was the company's guidance that it expects its revenues from the cloud business to grow by a significant 77% in this fiscal year to $77 billion. However, a deeper dive would reveal that its numbers were nothing extraordinary. In fact, it was rather muted, with both revenue and earnings missing estimates.

For its fiscal Q1 results, Oracle revealed that the revenues increased by 12.2% from the previous year to $14.9 billion. The largest revenue segment of cloud saw quarterly revenues of $7.2 billion, up 27.8% on a year-over-year (YOY) basis, as all other segments witnessed growth as well, except for software ($5.7 billion, -1% YOY).

Earnings saw a modest yearly growth of 5.8% to come in at $1.47 per share, missing the consensus estimate of $1.48 by a whisker. Notably, over the last nine quarters, Oracle's earnings have had a mixed showing with four misses and five beats.

Over a much longer period of 10 years, however, Oracle's performance has been disappointing, with revenue and earnings growing at CAGRs of just 4.48% and 2.73%, respectively. A transition from up-front license sales to a cloud/subscription revenue recognition model and a late thrust towards AI and cloud infrastructure are to blame.

Coming back to the latest results, what can be seen as a prominent cause of optimism around Oracle for the coming years and which can increase its rate of revenue growth, which has been evidently abysmal, is its remaining performance obligations, or RPO figure. The company informed investors that in the quarter, Oracle saw its RPO jump by a scarcely believable 359% to $455 billion. This is significant, as RPO represents the total value of signed contracts for goods or services that Oracle is obligated to deliver in the future. Thus, this bodes well for the company, as a large RPO means Oracle has a pipeline of committed income that will hit the books over time.

Net cash from operating activities for the quarter rose to $8.14 billion from $7.43 billion in the same period a year ago. Overall, Oracle closed the quarter with a cash balance of $10.44 billion. Although this may seem significant, the company's short-term debt is close to that figure at $9.08 billion.

Looking Into The Oracle

So, Oracle's has been almost a lost decade, as can be seen above. Yet, within that period, the stock has shot up by nine times, as the shift in the revenue recognition model mentioned earlier may have hurt sales growth in the initial years, but it has created a base for strong and predictable cash flows in the future. Moreover, significant share buybacks have also played a part in the appreciation of the stock price.

And if Oracle plays its strategy correctly, the company’s outlook appears promising, supported by its growing leadership in AI infrastructure, significant multi-billion-dollar contracts, unique multi-cloud partnerships, and rapid expansion in GPU capacity and innovation, though challenges remain in the form of intense competition and valuation scrutiny.

A central pillar of this growth trajectory is Oracle’s confirmed multi-year cloud agreement with OpenAI, valued at over $300 billion and set to commence in the coming years. OpenAI’s selection of Oracle was influenced not only by the company’s substantial computing capacity but also by its cost efficiency and execution speed.

Notably, Oracle has also become an early adopter of Nvidia’s (NVDA) Blackwell GPUs, integrating Nvidia’s full CUDA ecosystem into Oracle Cloud Infrastructure, while simultaneously scaling up with thousands of AMD (AMD) MI300X chips to provide customers with enhanced flexibility and competitive cost advantages.

Beyond OpenAI, Oracle is reportedly in advanced discussions with Meta (META) regarding a potential $20 billion cloud arrangement to supply AI training capabilities, further challenging traditional hyperscalers. The company’s approach to multi-cloud integration has also evolved strategically. Oracle is now enabling Oracle Database@Azure and connecting with both Amazon Web Services and Google Cloud, allowing enterprises to deploy Oracle tools seamlessly across multiple platforms. This strategy has yielded tangible results, with revenues from these collaborations increasing sixteenfold in the first quarter.

Innovation continues to be a key focus, exemplified by the launch of Database 23c “AI,” which incorporates native vector search to enhance machine learning efficiency. In parallel, Oracle’s AI Agent Studio allows enterprises to develop LLM-powered agents using technologies like Meta’s Llama or Cohere, streamlining operations across HR, finance, and other functions.

Oracle also finds itself at the intersection of geopolitics and social media through Project Texas and its involvement with TikTok. With U.S. regulators pressing ByteDance to divest TikTok’s U.S. operations, Oracle already hosts and secures over 100 million U.S. user accounts on its cloud infrastructure, positioning the company as a strategic participant in any potential acquisition. Larry Ellison’s political connections further reinforce Oracle’s potential role in a forced sale scenario. Acquisition of TikTok could elevate Oracle into a major consumer social media player, tapping into over 115 million U.S. monthly active users and unlocking opportunities for data monetization, advertising revenue, and cultural influence.

Finally, Ellison emphasizes AI inference over training as a primary driver of future growth, alongside cloud expansion. Oracle’s technical advantages, including lower latency, higher throughput, and cost efficiency, support this focus, reinforcing its strategic positioning in the rapidly evolving AI landscape.

However, much larger and deep-pocketed hyperscalers such as Microsoft, Alphabet (GOOG) (GOOGL), and Amazon (AMZN) will certainly not leave the ground so easily for Oracle. Moreover, despite being around for decades, Oracle is still not the first choice when it comes to cloud for enterprises as much as AWS, Azure, or Google Cloud is.

Then there is the issue of valuation. Oracle's searing rally has come at the cost of its valuations reaching uncomfortable levels. Currently, the ORCL stock is trading at a forward P/E, P/S, and P/CF of 62.99, 13.08, and 35.45, much higher than the sector medians of 33.14, 3.51, and 19.17, respectively. Even with an upbeat growth outlook, the stock is trading at a much higher PEG of 2.97, where the sector median is 1.87.

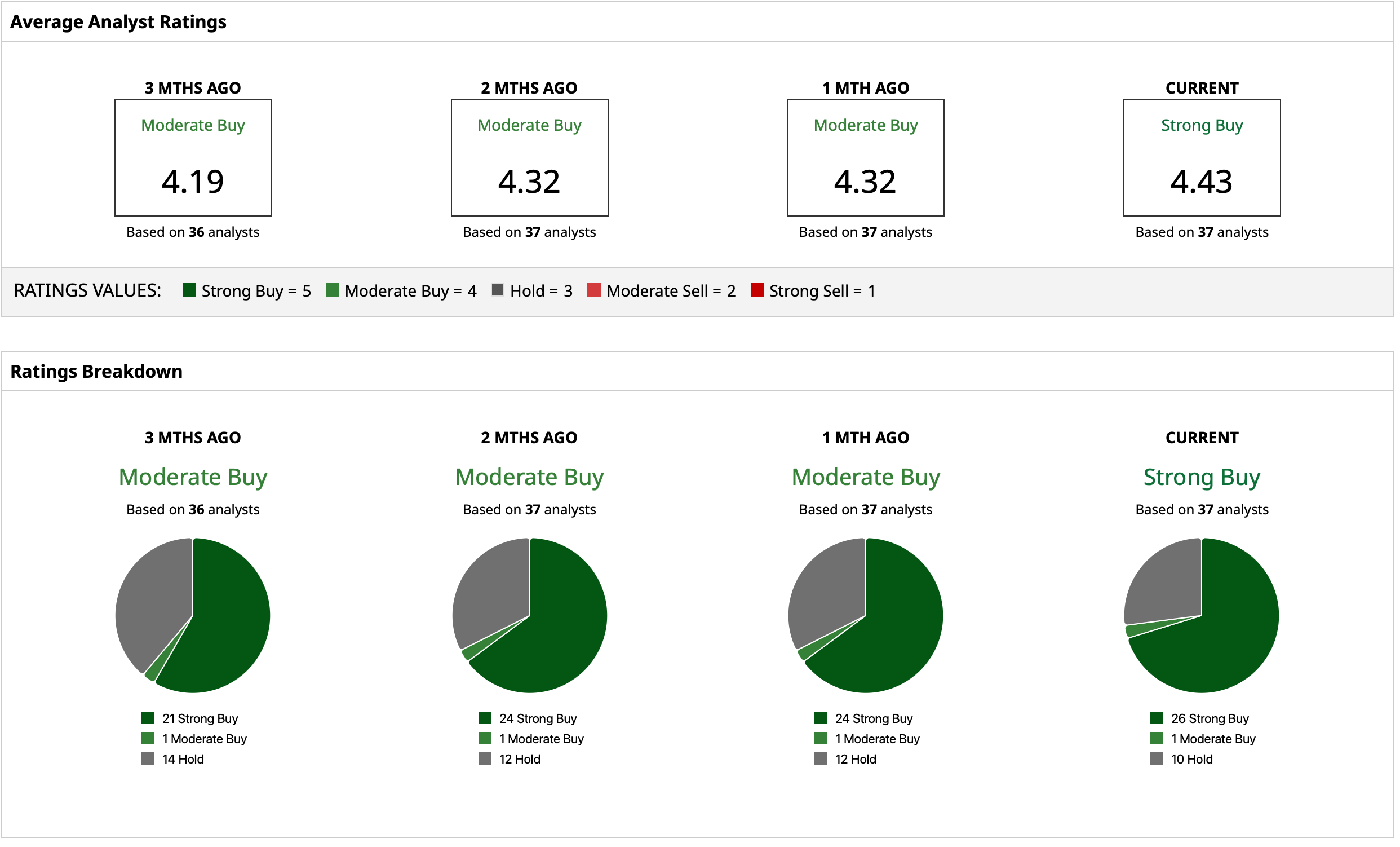

Analyst Opinion on ORCL Stock

Overall, analysts are bullish about the ORCL stock, with a “Strong Buy” rating earmarked. The price target of $334.57 denotes an upside potential of about 2% from current levels. Out of 37 analysts covering the stock, 26 have a “Strong Buy” rating, one has a “Moderate Buy” rating, and 10 have a “Hold” rating.