/NXP%20Semiconductors%20NV%20logo%20on%20website-by%20Robert%20Way%20via%20Shutterstock.jpg)

With a market cap of $57.5 billion, NXP Semiconductors N.V. (NXPI) is a Dutch chipmaker headquartered in the Netherlands. It’s a global leader in automotive semiconductors, with additional focus on industrial IoT, mobile security/NFC, and communication infrastructure.

Companies worth $10 billion or more are generally described as "large-cap stocks." NXPI fits right into that category, with its market cap exceeding this threshold, reflecting its substantial size and influence in the semiconductor industry. NXP is among the top global automotive chip suppliers, positioned strongly in secure connectivity, AI, and software-defined vehicles.

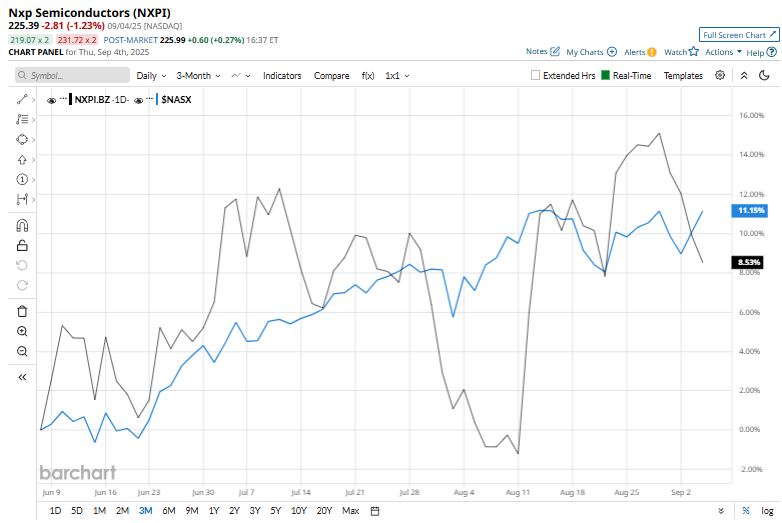

However, it is not all sunshine and rainbows for NXPI as the stock is down 12.2% from its 52-week high of $256.62, achieved on Oct. 29 last year. Shares of NXPI have soared 7.3% over the three months, underperforming the broader Nasdaq Composite’s ($NASX) 11.6% rise over the same time frame.

Over the long term, NXPI is up 8.4% on a YTD basis, and the shares are down 5.6% over the past 52 weeks. By contrast, $NASX has gained 12.4% in 2025 and 27.1% over the past year.

NXPI has been trading over both its 50-day and 200-day moving averages since the start of August, indicating an uptrend.

On Jul. 21, NXPI shares climbed over 1% after reporting its Q2 results. Its adjusted EPS of $2.72 surpassed Wall Street's expectations of $2.66. The company’s revenue was $2.93 billion, beating Wall Street forecasts of $2.90 billion. For Q3, NXPI expects its adjusted EPS to be in the range of $2.89 to $3.30, and its revenue to be in the range of $3.1 billion to $3.3 billion.

In the semiconductor arena, its rival, Microchip Technology Incorporated (MCHP), has outperformed the stock on a YTD basis, with its shares surging 12.4%. However, MCHP has lagged behind the stock over the past year, with its shares declining 16.2%.

Analysts remain highly optimistic about its prospects. The stock has a consensus rating of “Strong Buy” from the 30 analysts in coverage, and the mean price target of $257.69 suggests a premium of 14.3% to its current levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.