/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

The semiconductor pioneer Nvidia (NVDA) navigated a turbulent geopolitical backdrop to deliver second-quarter results that modestly outpaced expectations last week. The earnings came just two weeks after the company agreed to remit 15% of H20 chip sales to China to the U.S. government, reflecting ongoing trade sensitivities.

Earlier, Nvidia had warned of an $8 billion second-quarter loss after President Donald Trump announced an April ban on chip sales to China, a restriction later rescinded. The company sold no H20 chips to Chinese customers yet booked $180 million by releasing inventory to a customer outside China.

Even with the positive earnings surprise, shares slipped the day after the report was released as investors weighed the nuances. Data center sales, which form the backbone of Nvidia’s revenue, rose sharply but fell slightly short of Wall Street forecasts.

CFO Colette Kress said H20 could contribute $2 billion to $5 billion of third-quarter revenue if political issues ease. After touching a new 52-week high of $184.48 last month, Nvidia shares have mostly traded sideways. Over the past five trading days, the stock has declined 7%, leaving the market evaluating its next move carefully.

About NVDA Stock

Headquartered in Santa Clara, California, Nvidia has cemented itself as the global pioneer in visual computing technologies and the inventor of the graphic processing unit (GPU). With a market cap of nearly $4.1 trillion, the company has transitioned from PC graphics to advanced artificial intelligence (AI) solutions, powering high-performance computing, gaming, and virtual reality platforms.

In the past 52 weeks, NVDA shares have surged 56.6%, while year-to-date (YTD) gains stand at 26%. In the last three months, the stock climbed 19.8%, though it experienced a 2.6% pullback over the past month owing to the recent mixed narrative around the stock.

NVDA trades at 38.12 times forward adjusted earnings, above the industry average yet below its five-year historical range, suggesting an attractive relative valuation amid strong fundamental performance.

Nvidia Surpasses Q2 Earnings

On Aug. 26, Nvidia unveiled its fiscal 2026 second-quarter results, which surpassed Wall Street expectations. Revenue rose 55.6% year-over-year (YoY) to $46.74 billion, which edged past analysts’ $46.06 billion projection.

Data center sales, the powerhouse of Nvidia’s operations, surged 56.4% to a record $41.1 billion, just shy of the $41.34 billion Street estimate. The gaming division contributed $4.3 billion, climbing 48.9% from the year-ago period, reflecting Nvidia’s continued adaptation of its GPUs to support select OpenAI models on personal computers.

Meanwhile, the robotics segment, a management-highlighted growth avenue, recorded $586 million in sales, up 69% annually, yet still represents a modest slice of total revenue.

Adjusted net income jumped 52.1% to $25.8 billion, while adjusted EPS increased 54.4% to $1.05, surpassing the $1.01 Street forecast. Profits received a $180 million boost from the release of H20 inventory to a customer outside China, following the export ban enforced earlier by the Trump administration.

Looking forward, management anticipates Q3 2026 revenue of $54 billion, plus or minus 2%. On the other hand, analysts estimate Q3 fiscal 2026 EPS growth of 43.6% year over year to $1.12, a full-year rise of 40.6% to $4.12, and fiscal 2027 bottom line growing 35.9% from the prior year to $5.60.

What Do Analysts Expect for NVDA Stock?

Following the earnings release, analyst sentiment for NVDA has strengthened. Morgan Stanley’s Joseph Moore raised his price target from $206 to $210. J.P. Morgan analyst Harlan Sur raised his price target from $170 to $215. Also, KeyBanc analyst John Vinh adjusted his estimate from $215 to $230, keeping an “Overweight” stance.

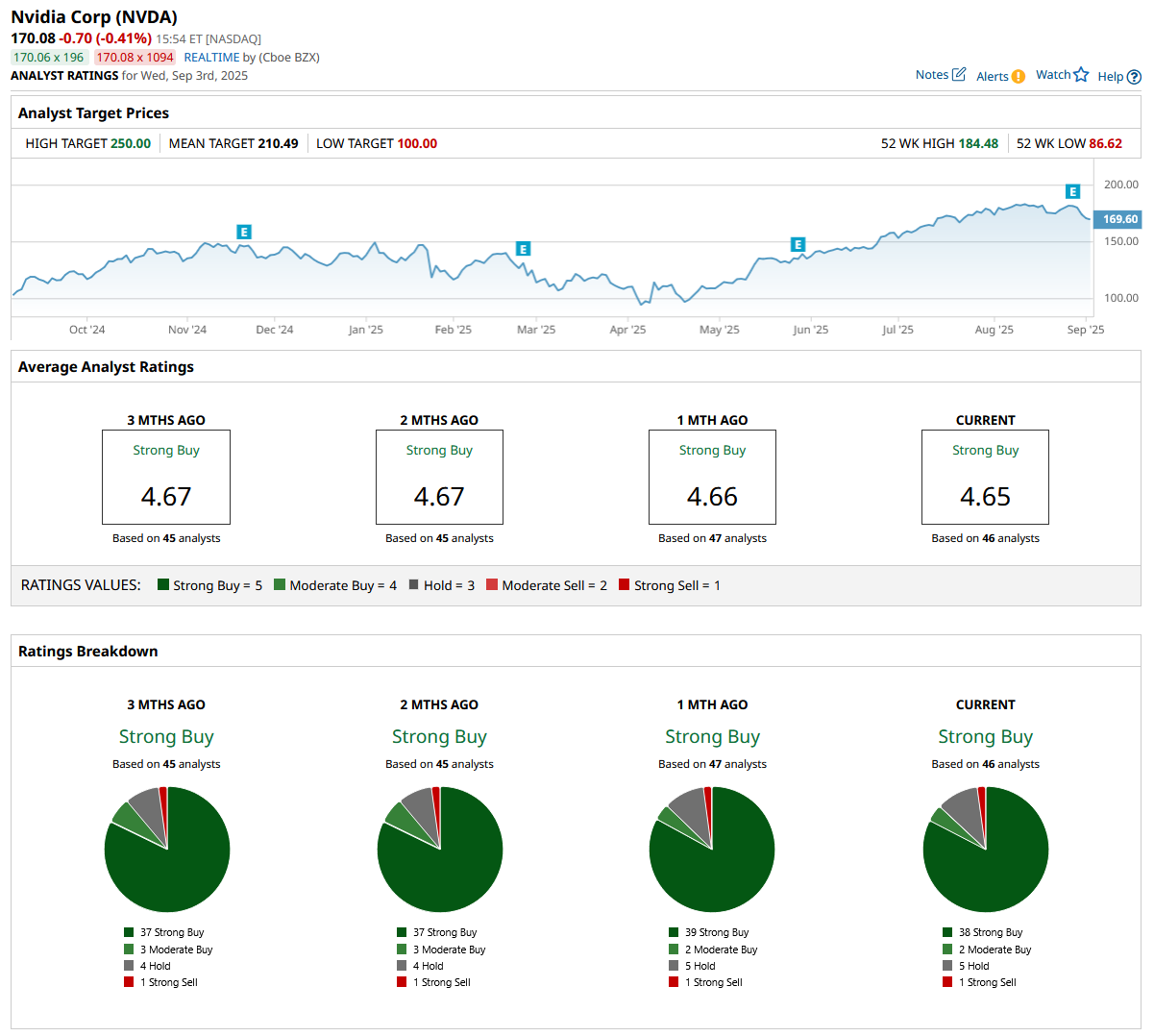

In a similar vein, Wolfe Research also lifted its price target from $220 to $230 while maintaining an Outperform rating. Among 46 analysts covering NVDA, the consensus remains “Strong Buy,” with 38 recommending “Strong Buy,” two “Moderate Buy,” five “Hold,” and one advising a “Strong Sell.”

NVDA’s average price target of $210.49 represents potential upside of 23%, while the Street-high target of $250 reflects a 46% potential gain from current levels.