3M Company (MMM) in St. Paul, Minn., is a diversified global manufacturer, technology innovator, and marketer of various products and services. While the company’s current 4.06% dividend yield looks attractive amid current, volatile market conditions, the stock has been underperforming the broader market over the past three years on investors’ disappointment around its weak financials and lower management guidance.

On April 25, 2022, MMM announced the acquisition of the technology assets of LeanTec, a provider of digital inventory management solutions for the automotive aftermarket segment in the United States and Canada. MMM’s Automotive Aftermarket Division’s President Dave Gunderson said, “This acquisition adds new levels of data integration and insights that will allow body shops greater visibility of their business operations, operational efficiency, and a better customer experience.”

Moreover, as part of the industrial sector, supply chain disruptions and input cost inflation are impacting MMM. An expected decline in light vehicle production is another concern for MMM, because automotive equipment is a primary end market for the company. MMM stock has declined 24.7% in price over the past nine months and 27.4% over the past year to close the last trading session at $146.96. The stock is currently trading 28.9% below its 52-week high of $206.81, which it hit on June 7, 2021.

Here is what could influence MMM’s performance in the upcoming months:

Poor Financials

The company’s revenue has grown at the disappointing rate of 3% over the past three years, and its EBITDA has grown only at a 1.4% CAGR over this period. Also, Moreover, the company’s levered free cash flow has declined at a 4.8% CAGR over the past three years. Though management has undertaken several restructuring measures to revive the company’s financials, investors have yet to see improvements in the company’s financials.

MMM’s net sales declined 0.2% year-over-year to $8.82 billion for the first quarter ended March 31, 2022. The company’s net income attributable decreased 20% year-over-year to $1.29 billion. Also, its adjusted EPS came in at $2.65, representing a decrease of 10.1% year-over-year. In addition, its adjusted EBITDA declined 9.2% year-over-year to $2.35 billion.

Stretched Valuation

In terms of forward non-GAAP PEG, MMM’s 2.29x is 72.6% higher than the 1.32x industry average. Also, its 2.76x forward EV/S is 74.4% higher than the 1.58x industry average. And the stock’s 2.33x forward P/S is 86.4% higher than the 1.25x industry average.

Higher-than-industry Profitability

In terms of trailing-12-month gross profit margin, MMM’s 46.33% is 58.1% higher than the 29.29% industry average. And its 26.77% trailing-12-month EBITDA margin is 101.5% higher than the 13.28% industry average. Furthermore, the stock’s 21.35% trailing-12-month EBIT margin is higher than the 9.61% industry average.

Favorable Analyst Estimates

Analysts expect MMM’s EPS for the quarter ending Sept. 30, 2022, to increase 13.9% year-over-year to $2.79. Its revenue for its fiscal year 2023 is expected to increase 3.3% year-over-year to $37.07 billion. It surpassed the Street’s EPS estimates in each of the trailing four quarters. Its EPS is expected to increase 6.5% per annum over the next five years.

POWR Ratings Reflect Uncertainty

MMM has an overall C rating, which equates to a Neutral in our POWR Ratings system. The POWR Ratings are calculated by considering 118 distinct factors, with each factor weighted to an optimal degree.

Our proprietary rating system also evaluates each stock based on eight distinct categories. MMM has a C grade for Value, which is in sync with its 5.20x forward P/B, which is 105.5% higher than the 2.53x industry average.

MMM is ranked #48 out of 78 stocks in the B-rated Industrial - Machinery industry. Click here to access MMM’s Growth, Momentum, Stability, Sentiment, and quality ratings.

Click here to check out our Industrial Sector Report for 2022

Bottom Line

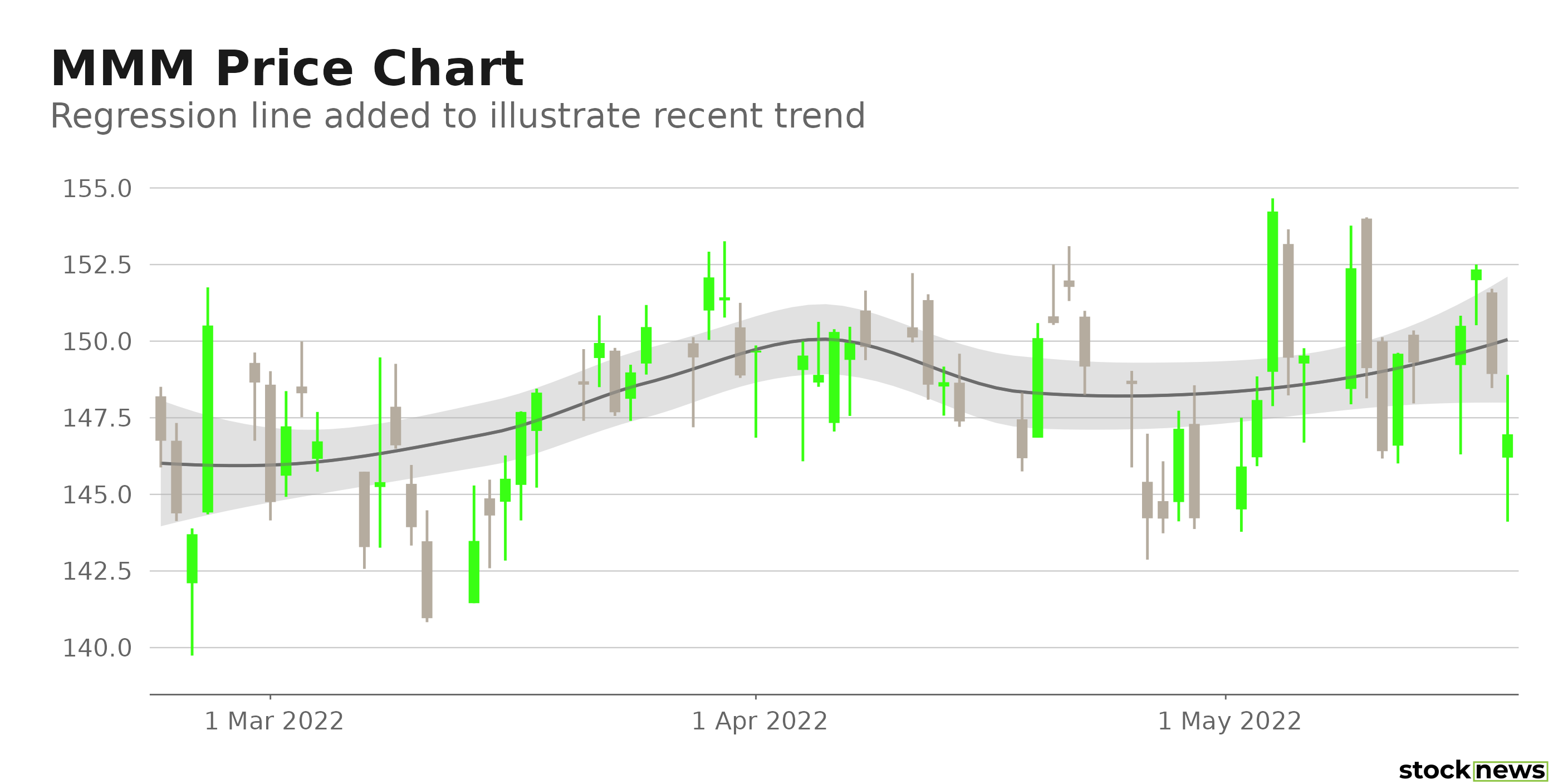

MMM is currently trading below its 50-day and 200-day moving averages of $148.47 and $169.68, respectively, indicating a downtrend. Furthermore, the stock looks overvalued at the current price level. Thus, it could be wise to wait for a better entry point in the stock.

How Does 3M Company (MMM) Stack Up Against its Peers?

While MMM has an overall POWR Rating of C, one might want to consider investing in the following Industrial - Machinery stocks with an A (Strong Buy) and B (Buy) rating: Amada Co., Ltd. (AMDLY), Donaldson Company, Inc. (DCI), and Tennant Company (TNC).

MMM shares rose $1.59 (+1.08%) in premarket trading Friday. Year-to-date, MMM has declined -14.71%, versus a -16.82% rise in the benchmark S&P 500 index during the same period.

About the Author: Dipanjan Banchur

Since he was in grade school, Dipanjan was interested in the stock market. This led to him obtaining a master’s degree in Finance and Accounting. Currently, as an investment analyst and financial journalist, Dipanjan has a strong interest in reading and analyzing emerging trends in financial markets.

Is Now a Good Time to Buy Shares of 3M Company? StockNews.com