/Norfolk%20Southern%20Corp_%20logo%20and%20site-by%20T_Schneider%20via%20Shutterstock.jpg)

Atlanta, Georgia-headquartered Norfolk Southern Corporation (NSC) is a prominent rail transportation service provider. Valued at $62.4 billion by market cap, Norfolk specializes in the transportation of raw materials, intermediate goods, and finished products, serving key players across the agricultural, consumer, and industrial sectors. In addition to its domestic operations, it also facilitates overseas freight transportation through a network of Atlantic and Gulf Coast ports.

Companies worth $10 billion or more are generally described as "large-cap stocks." NSC fits right into that category with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the rail transportation industry.

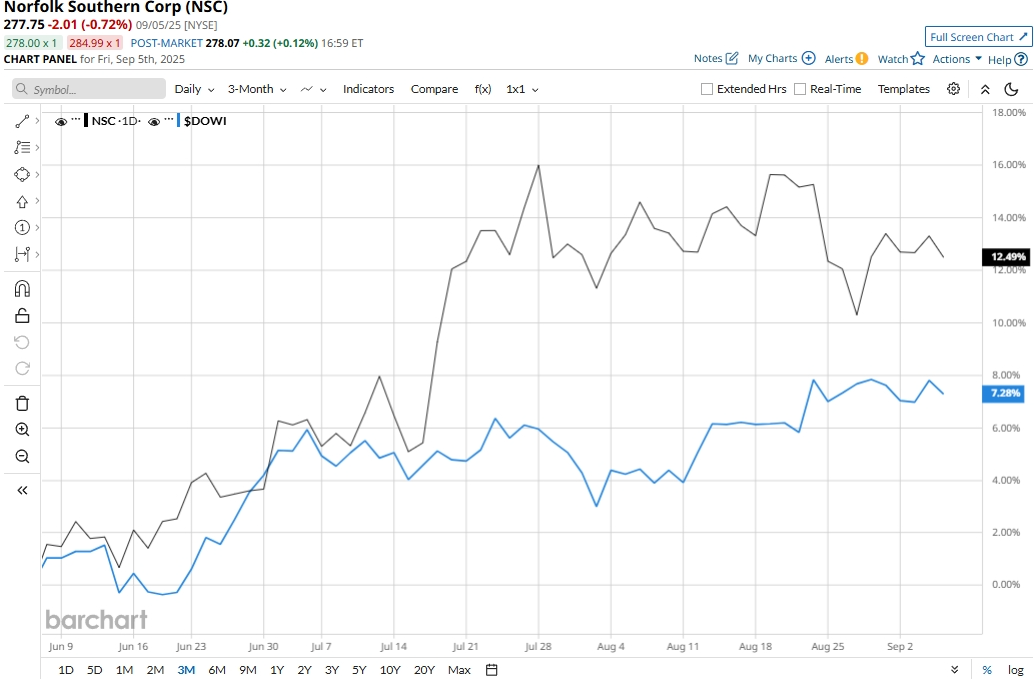

NSC touched its three-year high of $291.69 on Aug. 22 and is currently trading 4.8% below that peak. Meanwhile, NSC stock prices have soared 12.5% over the past three months, notably outperforming the Dow Jones Industrial Average’s ($DOWI) 7.3% gains during the same time frame.

Over the longer term, NSC’s performance has remained mixed. NSC stock has soared 18.3% on a YTD basis and gained 9.9% over the past 52 weeks, outperforming Dow’s 6.7% gains in 2025, but lagging behind Dow’s 11.4% uptick over the past year.

To confirm the recent uptrend, NSC stock has traded consistently above its 50-day moving average since mid-May and above its 200-day moving average since early June.

Norfolk Southern’s stock prices declined nearly 3% in the trading session following the release of its mixed Q2 results on Jul. 29. Driven by 3% growth in volumes, the company’s topline for the quarter increased by $66 million from the year-ago quarter to $3.1 billion, but missed the Street’s expectations by 76 bps. On the positive note, Norfolk showcased notable expense discipline during the quarter. The company’s adjusted EPS increased by a solid 7.5% year-over-year to $3.29, surpassing the consensus estimates by a modest 61 bps.

When compared to its peer, Union Pacific Corporation (UNP), Norfolk’s performance looks even more impressive. Norfolk has significantly outperformed UNP’s 3.4% decline on a YTD basis and 12.4% plunge over the past 52 weeks.

Among the 22 analysts covering the NSC stock, the consensus rating is a “Moderate Buy.” As of writing, its mean price target of $294.50 represents a 6% premium to current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.