/Moody)

Valued at a market cap of $89.3 billion, Moody's Corporation (MCO) is a leading integrated risk assessment firm. Based in New York, it is best known for providing credit ratings, research, and risk analysis, helping governments, financial institutions, and corporations make better-informed decisions.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and Moody's fits the label perfectly. By leveraging advanced data, technology, and decades of market experience, the company plays a vital role in enhancing transparency and efficiency across global capital markets.

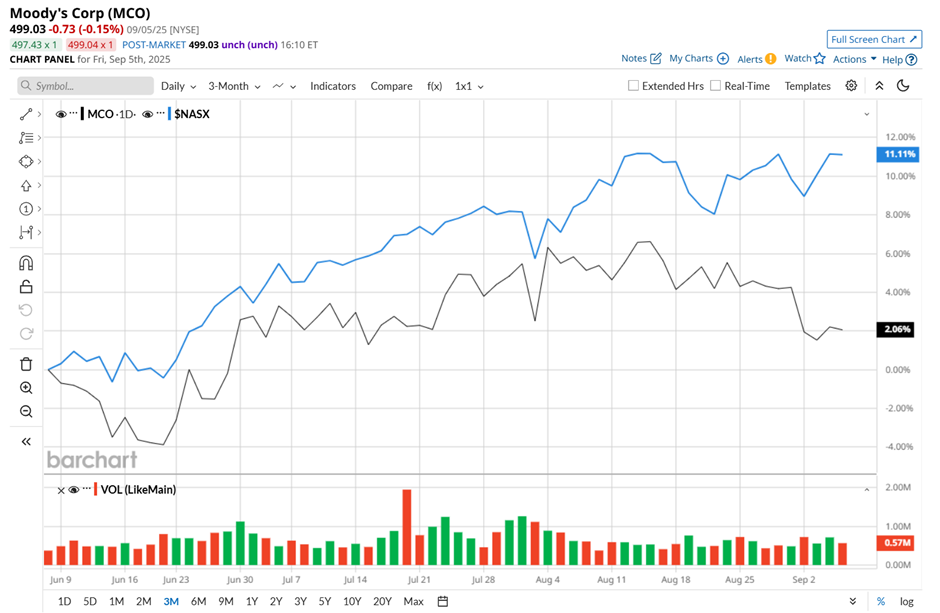

This risk assessment giant stock has slipped 6.2% from its 52-week high of $531.93, reached on Feb. 14. Shares of MCO have gained 2.4% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 12.5% return during the same time frame.

In the longer term, MCO stock has risen 3.1% over the past 52 weeks, lagging behind NASX's 26.7% uptick over the same time period. Moreover, on a YTD basis, shares of Moody are up 5.4%, compared to NASX’s 12.4% return.

The stock has been trading above its 50-day and 200-day moving averages since May. However, it has fallen below its 50-day moving average since September.

Moody’s shares rose 1.8% on Jul. 23 after it delivered its Q2 2025 earnings results. Due to strong growth in its analytics segment, its overall revenue advanced 4.5% year-over-year to $1.9 billion. This, combined with robust expansion in adjusted operating margins across both of its reportable segments, helped lift adjusted EPS by 8.5% from the year-ago quarter to $3.56.

Nevertheless, MCO stock has lagged behind its rival, S&P Global Inc. (SPGI). SPGI stock has increased 4.1% over the past 52 weeks and 8% on a YTD basis.

Despite MCO’s underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 24 analysts covering it, and the mean price target of $544.35 suggests a 9.1% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.