/A%20Lucid%20Motors%20vehicle%20parked%20in%20front%20of%20a%20showroom_%20Image%20by%20Michael%20Berlfein%20via%20Shutterstock_.jpg)

The recent discussion about electric vehicles (EVs) centers on industry leader Tesla (TSLA) and how new policies might slow down demand for EVs. President Donald Trump’s bill would cut the $7,500 EV tax credit for the purchase of a new EV as well as the $4,000 credit for buying a used EV after September.

Against this backdrop, can luxury EV maker Lucid Group (LCID) take the spotlight away from some of the big names?

About Lucid Stock

Founded in 2007, Lucid Motors, officially known as Lucid Group, operates as a U.S. luxury EV and technology company. It began its operations by supplying high-performance batteries and powertrain systems but changed its position in 2016 to produce its own EVs. Lucid has a market capitalization of $8.9 billion.

The company’s flagship product, the Lucid Air, was launched in 2021. The EV is popular among consumers for its rapid charging capabilities, long range, and upscale interior design. In late 2024, Lucid started producing its second model, the Gravity SUV. The model combines luxury with long mileage. Lucid is backed by Saudi Arabia’s Public Investment Fund (PIF), which remains its majority investor.

Lucid is also looking at a potential reverse stock split. The company has filed a preliminary proxy statement for a 1-for-10 reverse stock split. While the strategy is popular among firms trying to avoid a delisting by preventing the stock price from falling below the $1 mark, Lucid does not seem to be in danger of delisting.

Lucid recently secured a partnership with ride-hailing giant Uber Technologies (UBER), whereby Uber is set to invest $300 million in Lucid. Uber will also invest in autonomous technology startup Nuro, which is set to equip Lucid vehicles with self-driving capabilities. Uber aims to deploy approximately 20,000 Lucid vehicles equipped with Nuro Driver over a six-year period.

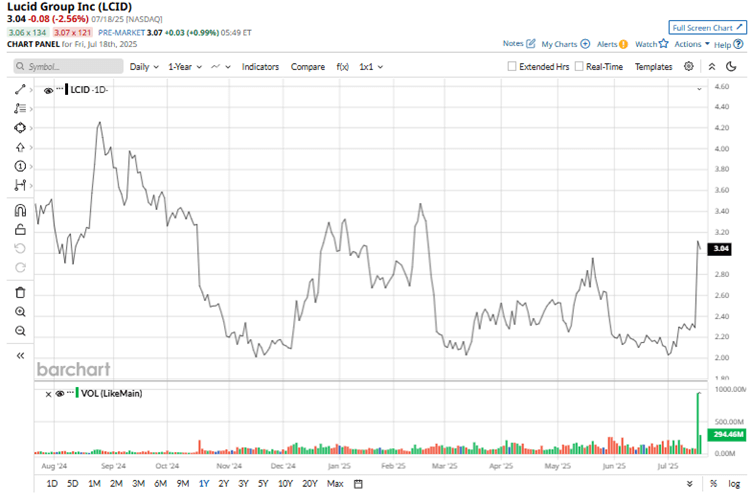

Lucid investors celebrated this multi-year deal, which led to LCID stock surging. Over the past month alone, Lucid shares have gained 36%. However, over the past 52 weeks, the stock is still down by nearly 16%. LCID currently trades 34% lower than its 52-week high of $4.43.

Currently, Lucid trades at an eye-watering valuation. Its price-to-sales ratio sits at 11 times, which is significantly higher compared to the industry average.

Lucid’s Q1 Results Were Lower Than Expected

On May 6, Lucid reported its first-quarter results for 2025. During the quarter, revenue climbed 36% from the prior-year period to $235.05 million. At the heart of this growth was Lucid delivering 3,109 vehicles in Q1, representing a 58.1% year-over-year (YOY) increase. The company produced 2,212 vehicles during the quarter, which excludes over 600 vehicles in transit to Saudi Arabia for factory gating.

While production and deliveries are growing, so are costs. The company continues to post significant losses. In Q1, its net loss per share stood at $0.24. While this was lower than the $0.30 per share net loss in Q1 2024, it was wider than the $0.23 per share net loss that analysts had expected. Lucid ended the quarter with about $5.76 billion in total liquidity.

Lucid is still aiming for a huge expansion in deliveries. At the current rate, it's on track to deliver 12,500 vehicles, which is robustly higher than the number it delivered last year. Even with the fear of tariffs looming large, the company aims to produce approximately 20,000 vehicles this year, which is roughly double what it produced in 2024.

While analysts expect Lucid to continue posting losses, they anticipate that these losses will narrow. In Q2, Lucid is projected to post a loss per share of $0.22, narrowing by 24% YOY. For the current year, the company’s loss per share is expected to be $0.89, reflecting an improvement of 29% YOY.

What Do Analysts Think About Lucid Stock?

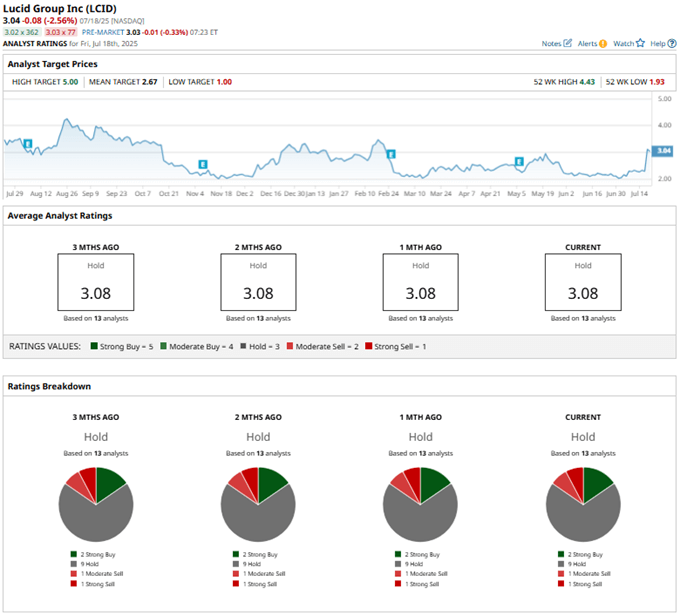

Wall Street analysts are tepid on LCID stock at the moment. Analysts at Cantor Fitzgerald reiterated their “Neutral” rating on LCID with a $3 price target. This was predicated upon Lucid’s Q2 production and delivery numbers falling short of Cantor Fitzgerald’s estimates while showing improvements YOY.

On the other hand, Baird analyst Ben Kallo raised the price target on Lucid Group from $2 to $3 while maintaining a “Neutral” rating. The price target was upgraded after Lucid reaffirmed its intention to launch its midsize platform next year, indicating potential models. Morgan Stanley also sees opportunity in Lucid’s partnership with Uber. Analysts at the firm reiterated their “Equal Weight” rating and $3 price target on the stock.

Wall Street analysts have a mixed view about Lucid, giving it a consensus “Hold” rating overall. Of the 13 analysts rating the stock, two analysts rate it a “Strong Buy,” a majority of nine analysts play it safe with a “Hold” rating, one analyst provides a “Moderate Sell” rating, and one analyst recommends “Strong Sell.” The consensus price target of $2.86 represents 2% downside potential from current levels.

Key Takeaways

While the multi-year partnership with Uber creates a chance of generating a revenue stream for the foreseeable future, the effects of the absence of tax credits on this luxury EV maker and a reverse stock split must also be taken into account. Hence, it might be wise to observe LCID stock from the sidelines for now.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.