/L3Harris%20Technologies%20Inc%20logo%20and%20cash-by%20Ascannio%20via%20Shutterstock.jpg)

Valued at a market cap of $50.6 billion, L3Harris Technologies, Inc. (LHX) is an aerospace and defense technology company specializing in mission-critical solutions. The Melbourne, Florida-based company provides advanced communication systems, space technologies, electronic warfare, avionics, and defense modernization services to government, military, and commercial customers.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and LHX fits the label perfectly. The company is recognized for its innovation, speed of execution, and ability to deliver integrated solutions that enhance security and performance across air, land, sea, space, and cyber domains.

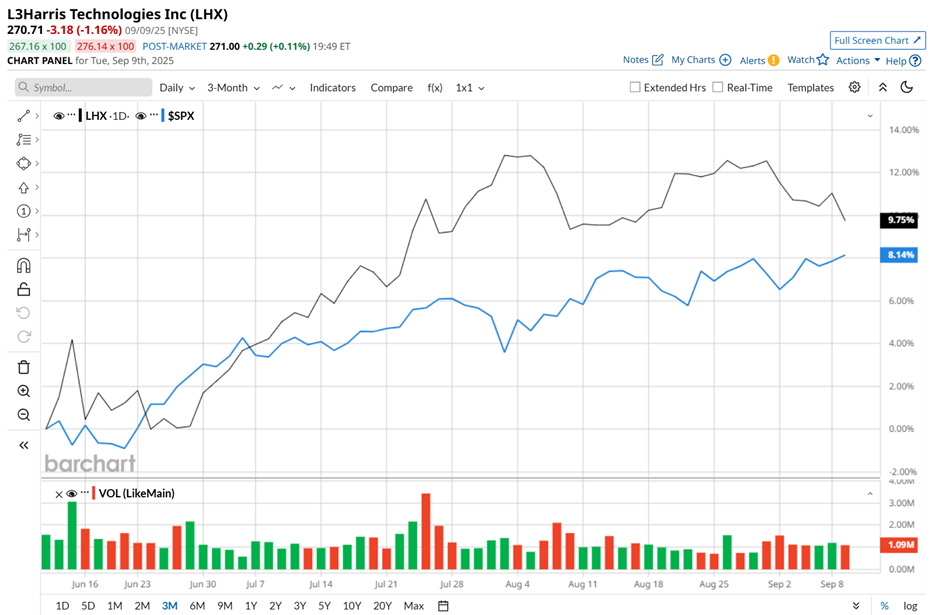

Shares of the aerospace and defense leader have declined 3.5% from its 52-week high of $280.52, reached on Aug. 5. LHX stock has soared 10.3% over the past three months, outpacing the S&P 500 Index’s ($SPX) 8.4% return during the same time frame.

Moreover, on a YTD basis, shares of LHX are up 28.7%, outperforming SPX’s 10.7% rise. However, in the longer term, LHX stock has gained 18.1% over the past 52 weeks, slightly underperforming SPX's 19% uptick over the same time period.

LHX stock has been trading above its 200-day moving average since mid-May and has remained above its 50-day moving average since early March, with slight fluctuations.

On Jul. 24, shares of LHX rose 1.3% after delivering better-than-expected Q2 2025 earnings results. The company’s revenue grew 2.4% year-over-year to $5.4 billion, surpassing consensus estimates by 2.5%. Moreover, its adjusted EPS came in at $2.78, up 15.8% from the year-ago quarter and 12.1% ahead of analyst expectations. Its strong Q2 performance was driven by a record book-to-bill ratio of 1.5x, healthy organic growth, and the company’s seventh consecutive quarter of year-over-year adjusted segment operating margin expansion.

LHX stock has considerably outperformed its rival, Lockheed Martin Corporation (LMT), which declined 20.7% over the past 52 weeks and 5.9% on a YTD basis.

Despite LHX’s outperformance relative to the SPX on a YTD basis, analysts remain cautiously optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 20 analysts covering it, and the mean price target of $301.85 is a premium of 11.5% to current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.