/Drone%20flying%20by%20Pexels%20via%20Pixabay.jpg)

Valued at a market cap of $8.4 billion, Kratos Defense & Security Solutions (KTOS) is a technology company providing defense and security solutions globally. It operates through two segments: Kratos Government Solutions and Unmanned Systems.

Kratos offers satellite ground systems, unmanned aerial drones, hypersonic vehicles, propulsion systems, command and control systems, microwave electronics, counter-drone systems, and virtual reality training. Kratos primarily serves defense agencies and international customers.

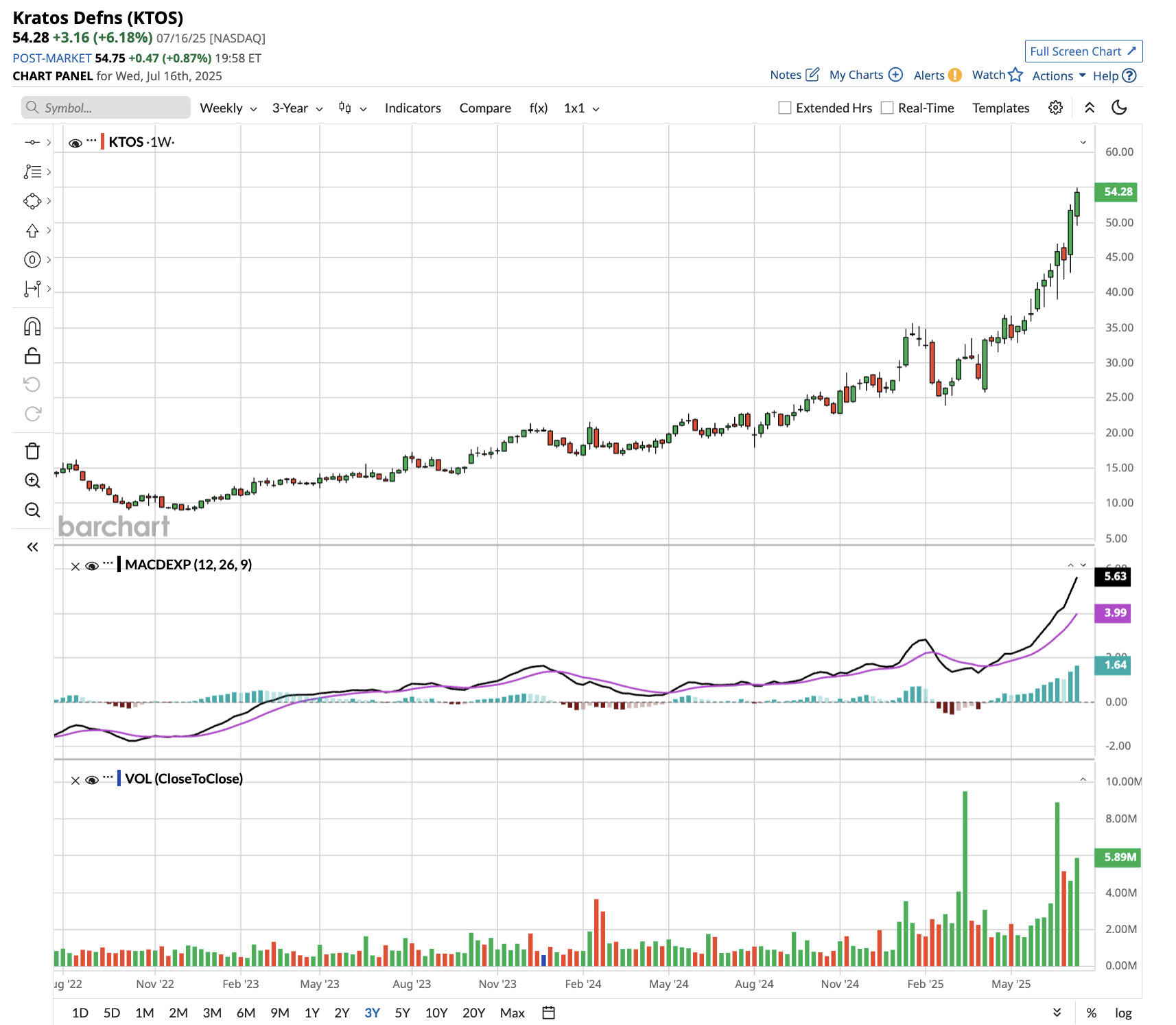

Kratos stock has more than doubled in the last 12 months and is up almost 300% in the last three years. Let’s see if Kratos Defense is still a good stock to own right now.

The Bull Case for Kratos Defense Stock

Kratos Defense stock surged after Defense Secretary Pete Hegseth announced aggressive support for domestic drone production, marking a significant milestone for the unmanned systems specialist.

The Pentagon’s renewed focus on drone capabilities represents a tailwind for Kratos. Hegseth’s July 11 memorandum rescinding restrictive policies that previously hindered drone production removes critical barriers that have constrained the industry. His acknowledgment that “drones are the biggest battlefield innovation in a generation” validates Kratos’ strategic positioning in the unmanned aerial systems market.

The accelerated timeline for drone development is encouraging. The Defense Department showcased 18 American-made prototypes that moved from concept to development in just 18 months, a dramatic improvement from the typical six-year process. This rapid innovation cycle favors agile companies like Kratos that specialize in cost-effective, off-the-shelf solutions.

President Donald Trump’s executive order in June to streamline drone production approval processes further supports the investment thesis. The administration’s three-pronged approach, which includes prioritizing American-made drones, arming units with low-cost systems, and expanding training programs, aligns with Kratos’ capabilities in unmanned systems and defense technology.

The U.S. military aims to rapidly scale domestic production of drones. Kratos’ established expertise in jet-powered unmanned systems, combined with supportive policy changes and streamlined regulations, creates a compelling growth opportunity for investors willing to capitalize on the United States' drone modernization initiative.

A Strong Performance in Q1 2025

In Q1 of 2025, Kratos reported revenue of $302.6 million, above its midpoint estimate of $290 million. The defense technology manufacturer experienced robust organic growth across all segments. Adjusted EBITDA of $26.7 million also surpassed expectations of $22 million.

The drone maker’s fundamentals appear strong with a 1.2 to 1 book-bill ratio for both the quarter and trailing 12 months, while maintaining an all-time high opportunity pipeline of $12.6 billion.

Management expressed confidence in achieving 10% organic revenue growth for 2025 and 13%-15% for 2026, supported by favorable defense spending trends.

Kratos has 70 rocket motors on order and multiple hypersonic systems in development, positioning it as a leader in this critical defense technology. The tactical drone business, particularly the Valkyrie program, continues advancing with 24 units in serial production ahead of contract awards. Multiple variants, including those equipped with landing gear, are progressing toward flight testing this year.

With 68% revenues from federal government contracts, a predominantly U.S.-sourced supply chain, and leadership positions in hypersonics, microwave electronics, and unmanned systems, Kratos appears well-positioned to capitalize on escalating defense priorities and budget increases.

Is KTOS Stock Still Undervalued?

Analysts tracking KTOS stock expect revenue to increase from $1.13 billion in 2024 to $2.20 billion in 2029. Comparatively, adjusted earnings are forecast to expand from $0.49 per share to $1.48 per share in this period.

Today, KTOS stock is priced at 110x forward earnings, which is quite steep. If this multiple “normalizes” to 50x, the stock could trade at $72 in early 2029, indicating upside potential of 27% from current levels.

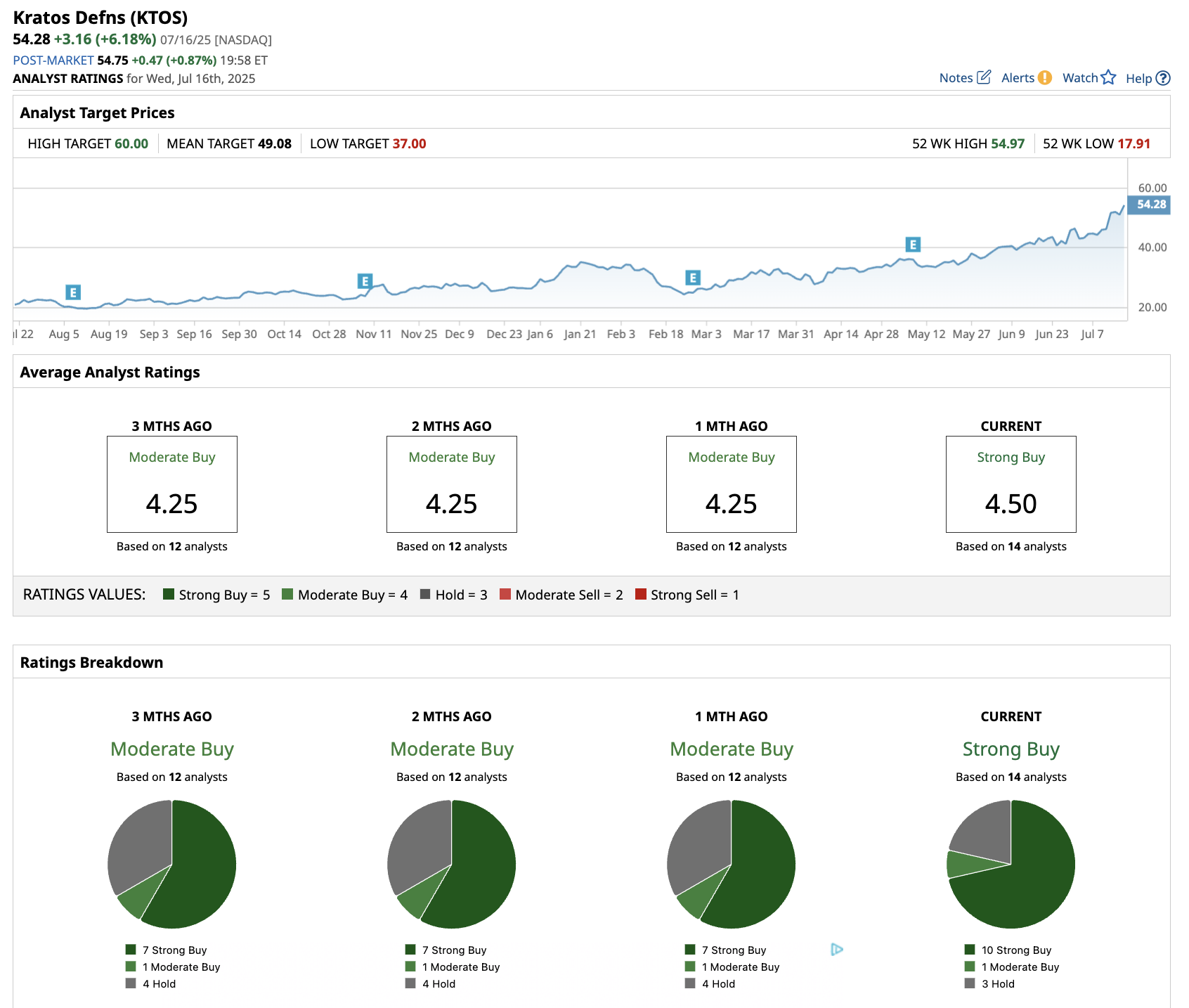

Out of the 14 analysts covering KTOS stock, 10 recommend “Strong Buy,” one recommends “Moderate Buy,” and three recommend “Hold.” The average target price for Kratos stock is $49, below the current trading price.