The J. M. Smucker Company (SJM), headquartered in Orrville, Ohio, is a leading American manufacturer of branded food and beverage products. With a market cap of $11.5 billion, the company has evolved from its origins in apple butter production to encompass a diverse portfolio of consumer goods. Smucker operates through four primary segments: U.S. Retail Coffee, U.S. Retail Frozen Handheld and Spreads, U.S. Retail Pet Foods, and Sweet Baked Snacks.

Companies with a market value of $10 billion or more are classified as “large-cap stocks,” and SJM is a prominent member of this category. It stands out in the consumer-packaged goods sector due to its robust portfolio of iconic brands, including Folgers, Jif, and Meow Mix, which provide a strong market presence and consumer loyalty. The company's strategic acquisitions, such as Hostess Brands, have diversified its product offerings and expanded its reach.

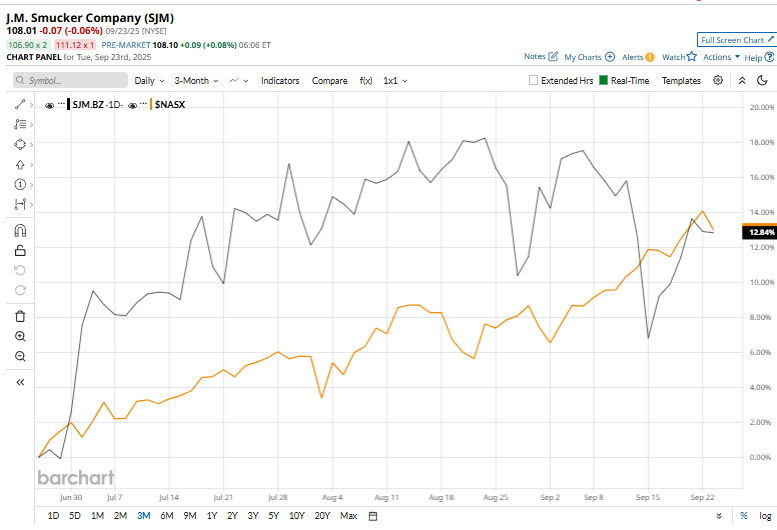

However, SJM has been trading 13.9% below its 52-week high of $125.42, met on Nov. 26, last year. However, the stock has surged 11% over the three months, underperforming the broader Nasdaq Composite’s ($NASX) 15% rise over the same time frame.

On a YTD basis, SJM has declined 1.9%, compared to $NASX's 16.9% rise. Over the past year, SJM has declined 9.2%, trailing $NASX’s 25.6% rise over the same period.

The stock has dipped below its 50-day and 200-day moving averages since mid-September, reinforcing a downtrend.

On Aug. 27, The J.M. Smucker released its fiscal 2026 first-quarter earnings, and its shares dipped 4.4%. It reported net sales of $2.11 billion, a marginal decrease from the same quarter of the previous year. Its adjusted EPS was $1.90, down 22% year over year due to higher commodity costs, unfavorable volume/mix, and derivative losses. Both the topline and bottom line failed to surpass the market’s expectations. Additionally, cash flow weakened, with operating activities resulting in a $10.6 million outflow compared to a $172.9 million inflow in the prior year. Free cash flow was negative at $94.9 million, a significant decline from the $49.2 million generated in the same quarter last year.

Its peer, Hormel Foods Corporation (HRL), has dropped 22.1% in 2025 and 22.4% over the past 52 weeks, underperforming SJM.

SJM has a consensus rating of “Moderate Buy” from 18 analysts covering it. Its mean price target of $118.88 indicates a modest 10.1% upside potential from the current market price.