Five years ago, the spot-month WTI crude oil contract fell to a low of (-$40.32) at expiration, busting the myth that commodity markets had a $0 floor.

-

One of the more bearish commodity market structures I've seen in quite some time belongs to HRW wheat.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. Could it be the next market to test $0 with the 2025 harvest drawing nearer on the horizon?

My Wednesday morning analysis again focused on HRW wheat, a market I’ve written a great deal about over the last number of months. What is my obsession with HRW? It could be tied to a number of things starting with the fact I grew up on a wheat farm in south-central Kansas, worked in the local elevator where my summers were filled with dumping wheat trucks at harvest (while listening to the Kansas City Royals baseball games on am radio[i]), before moving on to the role of grain merchandiser at an elevator in the center of the Wheat State. There is also the possibility that as I grew into the role of market analyst over the last number of decades, I gained a reputation for always being bearish. While I don’t think this is true, I am fascinated by what makes a market as overwhelmingly bearish as what we see with HRW these days.

Let’s take a look at the HRW market from a structural point of view. Recall every commodity market has two sides: Commercial and noncommercial. Commercials are those interests actively involved in trading the underlying cash commodity. Noncommercial traders are large investment interests, funds, speculators, etc., a group I’ve titled Watson given most are driven by algorithms.

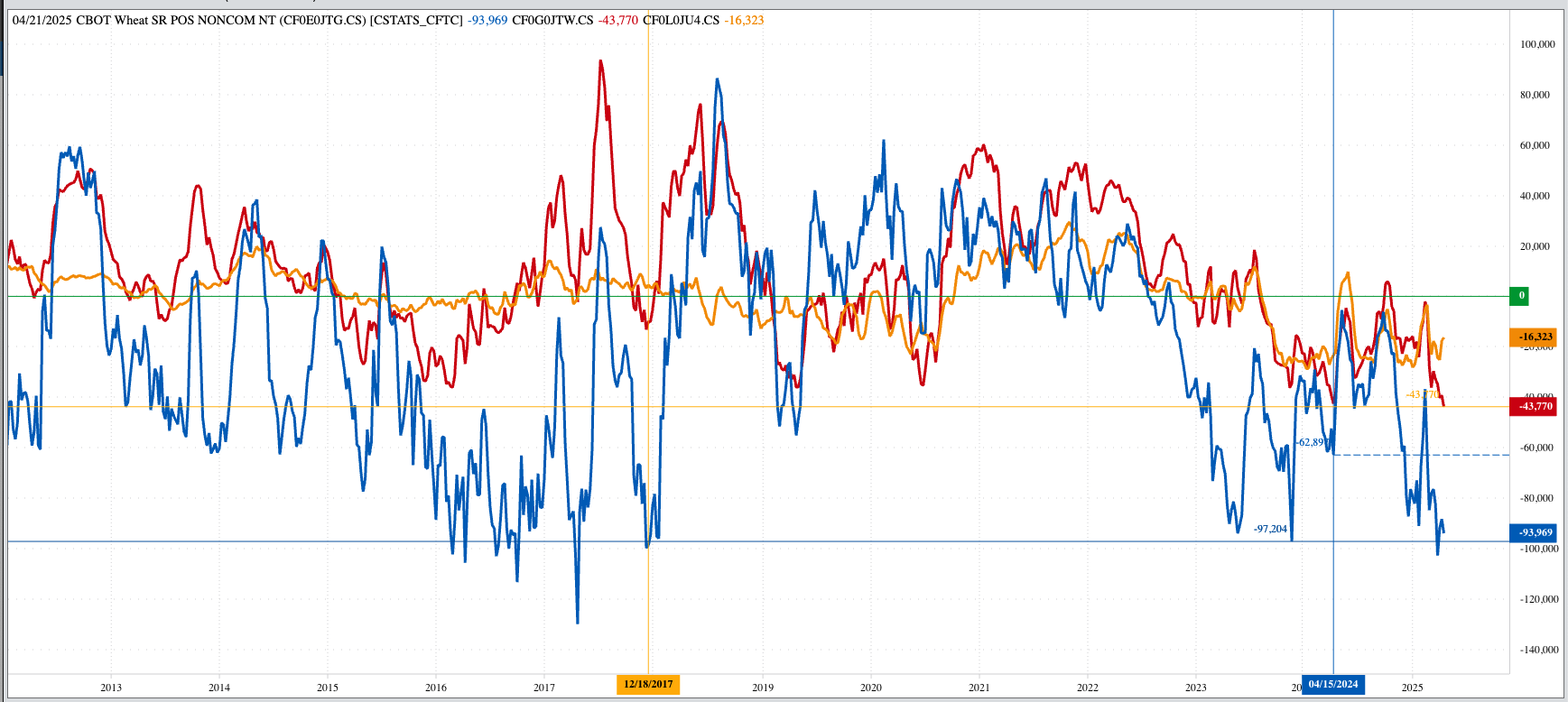

The latest CFTC Commitments of Traders report (legacy, futures only) showed Watson held a net-short futures position of 43,770 contracts as of Tuesday, April 22, an increase of 4,481 contracts from the previous week. This change included a decrease in long futures by 1,470 contracts and an increase in short futures of 3,011 contracts. A couple things stand out to me with all this:

- The weekly change can be viewed as more bearish given it was driven by new selling interest

- The noncommercial net-short futures position was record large

The fact Watson held a record large net-short futures position in HRW wheat opened the door to a potential round of short-covering. However this past week, from Tuesday-to-Tuesday, the July issue closed 27.25 cents lower indicating the noncommercial short futures position likely moved to record large levels as well. Why? The continued pressure from Watson? Newsom’s Rule #6: Fundamentals win in the end.

From previous discussions we know HRW wheat is one of, if not the most fundamentally bearish market in the commodity complex. At Tuesday’s close the hybrid May-July futures spread closed covering 100% calculated full commercial carry while both the July-September and September-December covered 99%. Additionally, the HRW market will see its official storage rate increase to $0.00265/bushel/day on May 19, something that usually doesn’t happen to a fundamentally bullish market. If we want to pile on this growing heap, the National HRW Wheat Index ($CRWI), the market’s national average cash price and intrinsic value, was calculated Tuesday evening at $4.5225. What does this tell us about real supply and demand?

- Heading into the last day of the month, HRW wheat’s available stocks-to-use came in at 46.6%[ii]. This would be both the lowest monthly settlement by the Index since August 2020 and the largest April available stocks-to-use figure since 2019.

- National average basis was calculated at 78.75 cents under July futures as compared to the previous 5-year low weekly close for this week of 56.5 cents under July.

From a structural point of view, then, HRW wheat would be considered the most bearish type of market, one where both commercial and noncommercial interests are bearish. This raised the question of how low can the market go? Back in the day, the standard answer would be something along the line of, “Well, we know it can’t go below $0”, but WTI crude oil proved this wrong back in April 2020. For those who might’ve blanked out that day, the spot-month contract fell to (-$40.32) as it expired.

Do I think HRW will suffer this same fate? No, but it is a possibility. If we apply the Wheat Reality that tells us, “One bushel of wheat left over is too many”, and bring back into the discussion the National Index puts available stocks-to-use at 46.6%, then we know the US will have more than one bushel of HRW left over by the time new bushels from the 2025 harvest start rolling in.

Let’s see how all this plays out.

[i] Some of you may be young enough to have to look up what I mean by “am radio”.

[ii] Based on the economic Law of Supply and Demand that tells us market price is the intersection of the supply and demand curves.