/Howmet%20Aerospace%20Inc%20logoon%20phone-by%20T_Schneider%20via%20Shutterstock.jpg)

Howmet Aerospace Inc. (HWM), headquartered in Pittsburgh, Pennsylvania, provides advanced engineered solutions for the aerospace and transportation industries. Valued at $74.1 billion by market cap, the company offers engines, fasteners, and structures, as well as forged wheels.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and HWM perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the aerospace & defense industry. HWM's specialization in lightweight metals engineering and manufacturing has solidified its position as a key supplier for aircraft engines and turbines. Through cutting-edge products, such as advanced airfoils and specialized fasteners, HWM meets the rigorous standards of the aerospace industry, resulting in improved performance and efficiency.

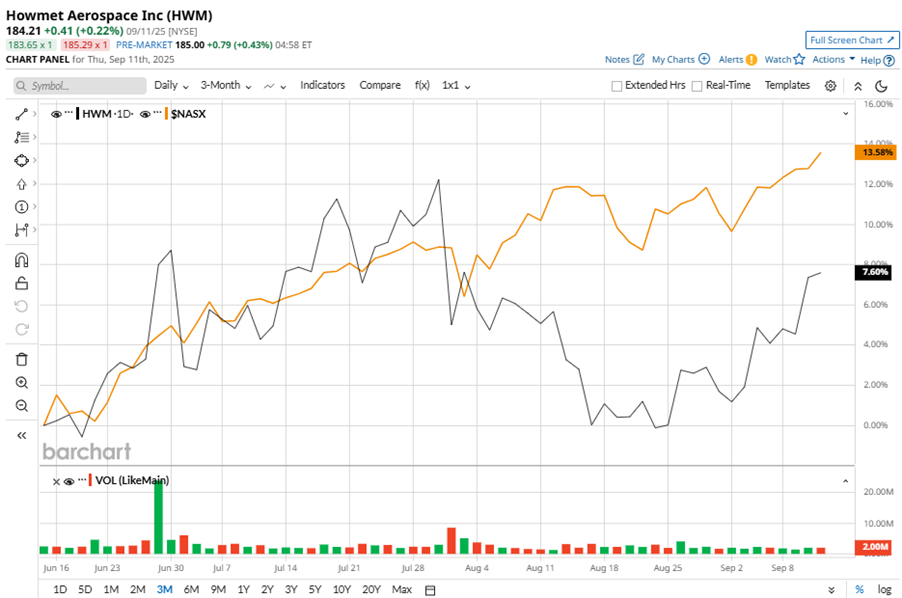

Despite its notable strength, HWM slipped 4.7% from its 52-week high of $193.26, achieved on Jul. 30. Over the past three months, HWM stock has gained 7.9%, underperforming the Nasdaq Composite’s ($NASX) 12.4% gains during the same time frame.

In the longer term, shares of HWM rose 68.4% on a YTD basis and climbed 95.8% over the past 52 weeks, considerably outperforming NASX’s YTD gains of 14.2% and 26.7% returns over the last year.

To confirm the bullish trend, HWM has been trading above its 50-day and 200-day moving averages over the past year, experiencing some fluctuations.

Howmet's strong performance is driven by the commercial aerospace market, with a 52% business share, fueled by increased demand for wide-body aircraft and fuel-efficient models. The defense sector also contributes, supported by robust government spending and strong demand for F-35 engine spares. Upcoming defense budget allocations are expected to boost Howmet's business further.

On Jul. 31, HWM shares closed down more than 6% after reporting its Q2 results. Its adjusted EPS of $0.91 exceeded Wall Street expectations of $0.87. The company’s revenue was $2.1 billion, surpassing Wall Street forecasts of $2 billion. HWM expects full-year adjusted EPS in the range of $3.56 to $3.64, and expects revenue ranging from $8.1 billion to $8.2 billion.

HWM’s rival, TransDigm Group Incorporated (TDG) shares significantly lagged behind the stock, with a 2.1% uptick on a YTD basis and 2.6% losses over the past 52 weeks.

Wall Street analysts are bullish on HWM’s prospects. The stock has a consensus “Strong Buy” rating from the 23 analysts covering it, and the mean price target of $197.75 suggests a potential upside of 7.4% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.