In an August 8, 2025, Barchart article on gold, I concluded with the following:

Time will tell if gold continues to reach further record highs in the coming quarters. At over $3,440 in August, the leading precious metal that is a commodity and a currency reserve asset will now set a course for achieving the ninth consecutive quarterly record high in Q4 2025.

Gold continues to reach new highs in October, with the December COMEX futures price hitting a high of $3,923.30 per ounce. Gold’s bullish trend since the low in 1999 continues, and the sky appears to be the limit for the leading precious metal. Meanwhile, the higher gold rises, the odds of a correction increase.

Gold’s parabolic price action continues

Gold just completed its eighth consecutive quarter during which the leading precious metal reached a new record high. The active month December COMEX futures contract traded above $3,920, reaching a ninth consecutive quarterly high in early October 2025.

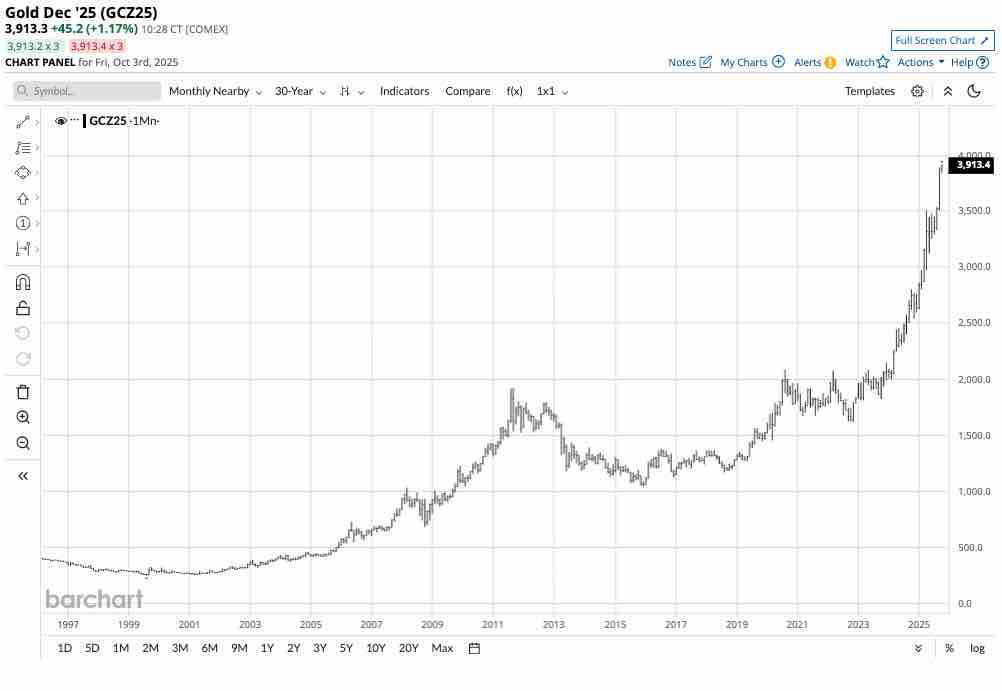

The thirty-year monthly continuous COMEX futures chart highlights gold’s ascent, which took off on the upside from another in a long series of higher lows in October 2023. Gold has not experienced any substantial pullbacks since the October 2023 low.

The second-leading reserve currency

A reserve currency is a foreign exchange instrument that central banks, governments, monetary authorities, and supranational institutions hold as a reserve asset. In 2025, gold surpassed the euro as the world’s second-leading reserve currency, second only to the U.S. dollar, which has held the leadership position for over a decade.

Meanwhile, according to the latest statistics, the United States holds the largest gold reserves.

The chart shows that the U.S. owns 8,133 metric tons, translating to nearly 261.5 million ounces. At $3,870 per ounce at the end of September, the value is just over $1 trillion.

While China and Russia are the fifth and sixth-largest gold-holding countries, with 2,330 and 2,299 metric tons, respectively, their holdings are likely understated, as the two countries consider strategic stockpiles to be matters of national security or state secrets.

China and Russia were the top two gold-producing countries in 2024, with output of 380 and 310 metric tons, respectively. China and Russia have been steadily acquiring gold and expanding their reserves over the past years, and have likely absorbed a significant portion of their domestic gold output. Therefore, their gold holdings are likely far higher than are stated in statistics.

Uncharted territory

Gold’s parabolic rally has pushed the price into uncharted territory.

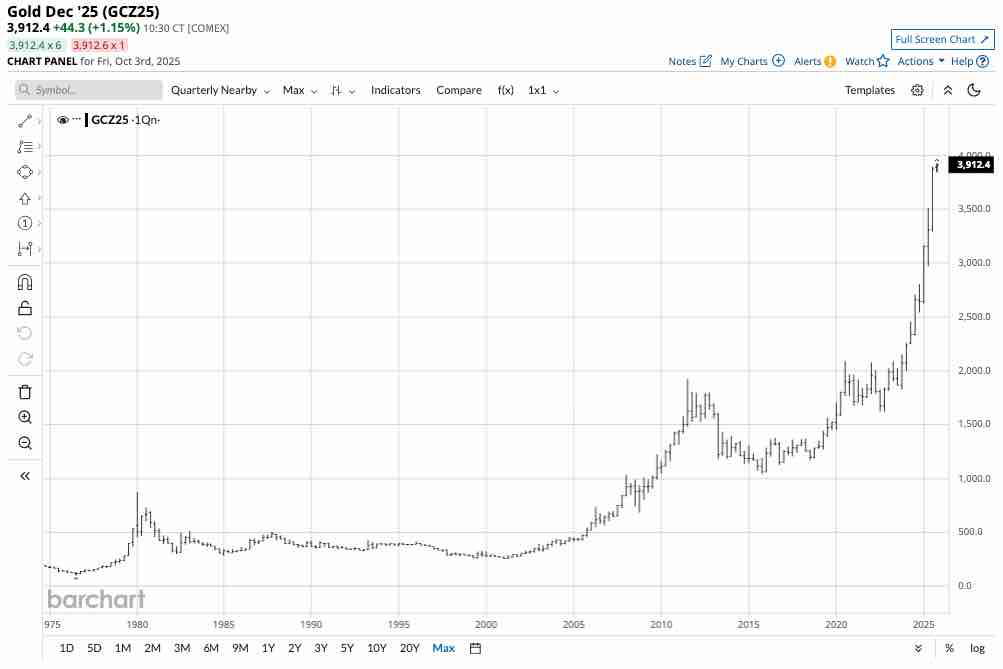

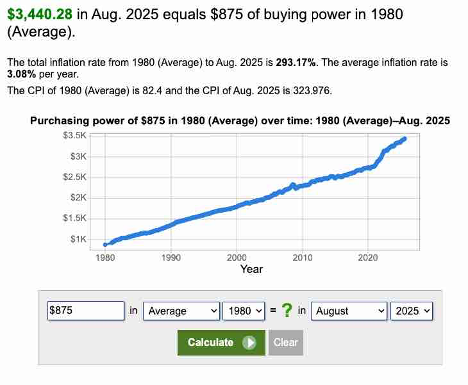

The quarterly chart illustrates the price action since the mid-1970s, when the gold standard was abandoned. Meanwhile, adjusted for inflation, the 1980 peak of $875 per ounce is still below the current price.

As the chart shows, gold has surpassed the 1980 inflation-adjusted peak, placing it in uncharted territory by all measures. Upside targets are nothing more than a mere guessing game in early October 2025. While many analysts are calling for gold to reach $4,000 or higher, the odds of a correction increase as the price rises.

The factors that could lead to a correction

Several factors could lead to a significant gold correction, with the first concrete technical support level located over 35% below the current price, at the November 2024 low of $2,541.50 per ounce. Only a move below the October 2023 low of $1,823.50 would jeopardize the bullish trend that has been firmly in place since the 1999 low.

The following factors could push gold prices lower:

- A rising U.S. dollar and elevated interest rates tend to weigh on gold and other metal prices as they increase the cost of carrying inventories and increase gold prices in other currency terms.

- A shift in central bank policy that results in gold liquidation could weigh on the metal’s price.

- Even the most aggressive bull markets rarely move in straight lines for prolonged periods. Gold’s price action could be overdue for a correction.

- The cure for high prices tends to be those higher prices in most commodities, as they create an environment where production increases, inventories rise, demand declines, and prices reach their peaks, leading to corrections.

The bottom line is that parabolic rallies in most markets tend to be followed by substantial corrections to the downside.

Picking a top is always dangerous

Gold’s ascent has been nothing short of a parabolic freight train, and it is not a typical asset. Gold has industrial applications and is highly valued worldwide as an ornamental product, supporting demand for fabricated or jewelry products. Moreover, gold has been a hard currency and a store of value for thousands of years. Therefore, picking a top is a dangerous approach in the current environment.

When it comes to trading or investing in gold, the trend is always our best friend, and it remains bullish in early October 2025, with the precious metal already reaching a ninth consecutive quarterly new record high. Gold will reach a price where it runs out of bullish steam, but there is no sign that level is on the immediate horizon in October 2025.