/Fifth%20Third%20Bancorp%20ban%20location%20by-Joe%20Hendrickson%20via%20iStock.jpg)

With a market cap of $30 billion, Fifth Third Bancorp (FITB) is a diversified financial services company and the holding company for Fifth Third Bank, National Association. The company provides a wide range of banking and financial solutions through three core segments: Commercial Banking, Consumer and Small Business Banking, and Wealth & Asset Management.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and Fifth Third Bancorp fits this criterion perfectly. Its offerings span lending, deposits, mortgage and consumer finance, investment management, insurance, and advisory services for individuals, businesses, and institutions across the United States.

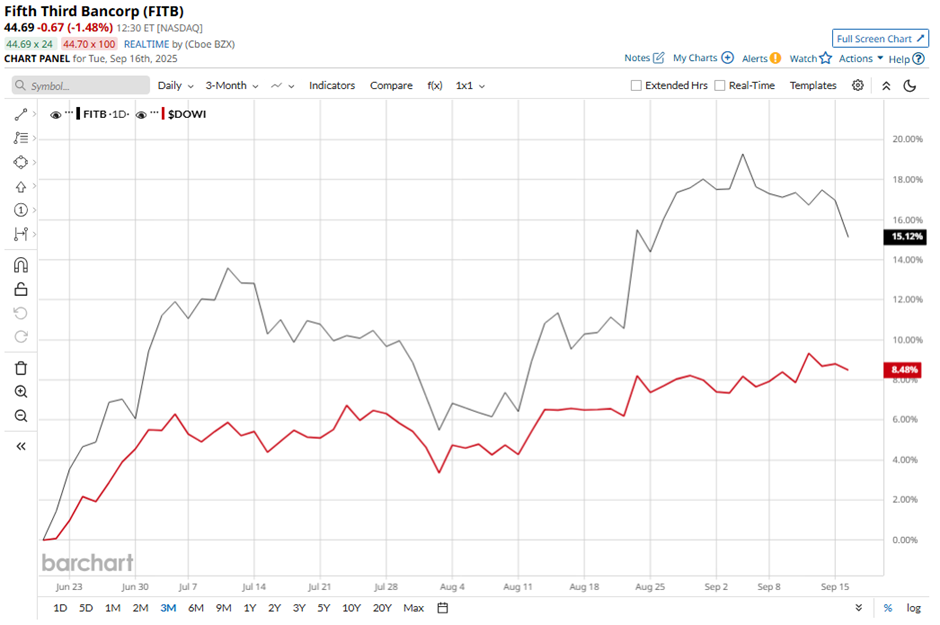

Shares of the Cincinnati, Ohio-based company have declined 9.1% from its 52-week high of $49.07. Over the past three months, its shares have returned 16.4%, outperforming the broader Dow Jones Industrials Average's ($DOWI) 7.6% gain during the same period.

Longer term, FITB stock is up 5.5% on a YTD basis, lagging behind DOWI's 7.6% return. Moreover, shares of the company have risen 5.2% over the past 52 weeks, compared to DOWI’s 9.9% increase over the same time frame.

Yet, the stock has climbed above its 50-day moving average since early May.

Shares of Fifth Third Bancorp fell over 1% on Jul. 17 after the company reported Q2 2025 results, as investors focused on weakening credit quality and rising provisions. The company’s provision for credit losses surged 78% year-over-year to $173 million, while non-performing loans jumped 37.8% to $886 million. Additionally, net income available to common shareholders declined 5.3% year-over-year to $591 million, reflecting pressure from higher expenses of $1.26 billion, which overshadowed revenue growth.

In comparison, rival M&T Bank Corporation (MTB) has performed weaker than FITB stock on a YTD basis, gaining over 3%. However, MTB stock has soared nearly 12% over the past 52 weeks, outpacing FITB’s performance during the same period .

Despite the stock’s underperformance, analysts remain moderately optimistic about its prospects. FITB stock has a consensus rating of “Moderate Buy” from 25 analysts in coverage, and the mean price target of $48.57 is a premium of 8.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.