/Fidelity%20National%20Information%20Services%2C%20Inc_%20logo%20outside%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Jacksonville, Florida-based Fidelity National Information Services, Inc. (FIS) provides financial services technology solutions to financial institutions, businesses, and developers. Valued at a market cap of $35.9 billion, the company offers a wide range of services, including payment processing, banking software, capital markets technology, and merchant solutions.

Companies worth $10 billion or more are typically classified as “large-cap stocks,” and FIS fits the label perfectly. With its strong focus on innovation, cloud-based platforms, and real-time payments, FIS is uniquely positioned to support financial institutions and businesses in driving growth and enhancing customer experiences worldwide.

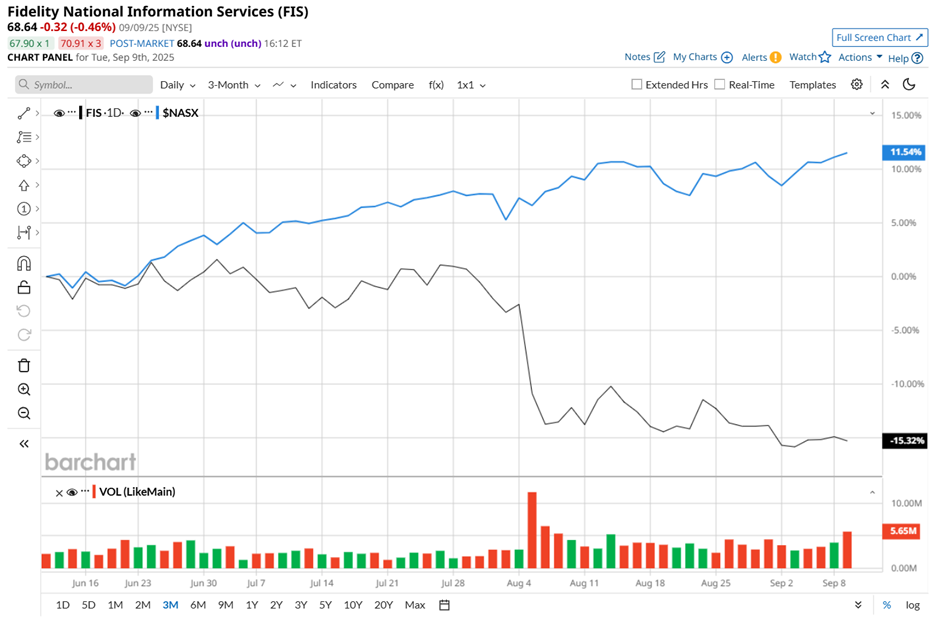

Despite its notable strength, this financial services provider has dipped 25.4% from its 52-week high of $91.98. Moreover, shares of FIS have declined 16% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 11.7% surge during the same time frame.

In the longer term, FIS stock has declined 16.7% over the past 52 weeks, significantly lagging behind NASX's 29.6% uptick over the same time period. Moreover, on a YTD basis, shares of FIS are down 15%, compared to NASX’s 13.3% return.

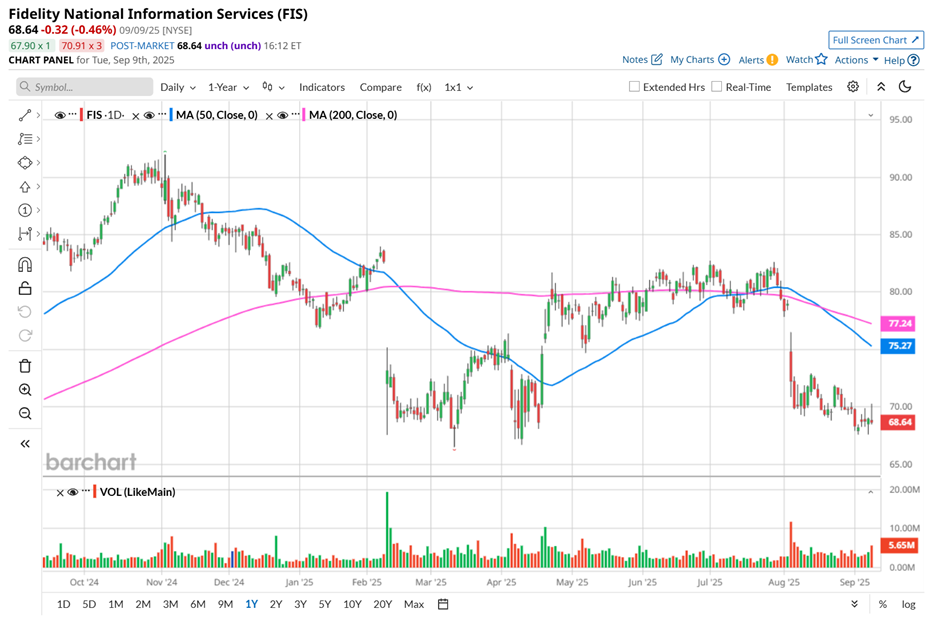

To confirm its bearish trend, FIS stock has been trading below its 200-day and 50-day moving averages since late July.

On Aug. 5, FIS released its Q2 2025 earnings results. The company’s revenue of $2.6 billion advanced 5.1% from the year-ago quarter and came in 1.6% ahead of the consensus estimates. Growth across both of its key reportable segments aided its top-line. Meanwhile, its adjusted EPS improved 1.5% year-over-year to $1.36, meeting analyst expectations. Additionally, FIS raised its fiscal 2025 guidance, now expecting revenue in the range of $10.5 billion to $10.6 billion, and adjusted EPS to be between $5.72 and $5.80.

However, despite these positives, its share price tumbled 8.5% after the earnings release as a notable 42.1% annual decline in its free cash flow might have made investors jittery.

Although FIS has lagged behind the broader market, it has outpaced its rival, Fiserv, Inc. (FI), which declined 20.9% over the past 52 weeks and 33.6% on a YTD basis.

Despite FIS’ recent underperformance, analysts remain moderately optimistic about its prospects. The stock has a consensus rating of "Moderate Buy” from the 27 analysts covering it, and the mean price target of $87 suggests a 26.7% premium to its current price levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.