/Factset%20Research%20Systems%20Inc_%20logo%20on%20keyboard-by%20rafapress%20via%20Shutterstock.jpg)

FactSet Research Systems Inc. (FDS), headquartered in Norwalk, Connecticut, has long been a cornerstone for the investment community, offering a digital platform and enterprise solutions that cater to portfolio analytics, data management, and reporting workflows.

With a market capitalization hovering around $10.9 billion, the company comfortably resides in the “large-cap” category, a tier reserved for the heavyweights valued at $10 billion or more. Its suite of services spans configurable desktop and mobile platforms, data feeds, cloud-based digital solutions, and application programming interfaces, creating an ecosystem that investors and institutions have relied upon for years.

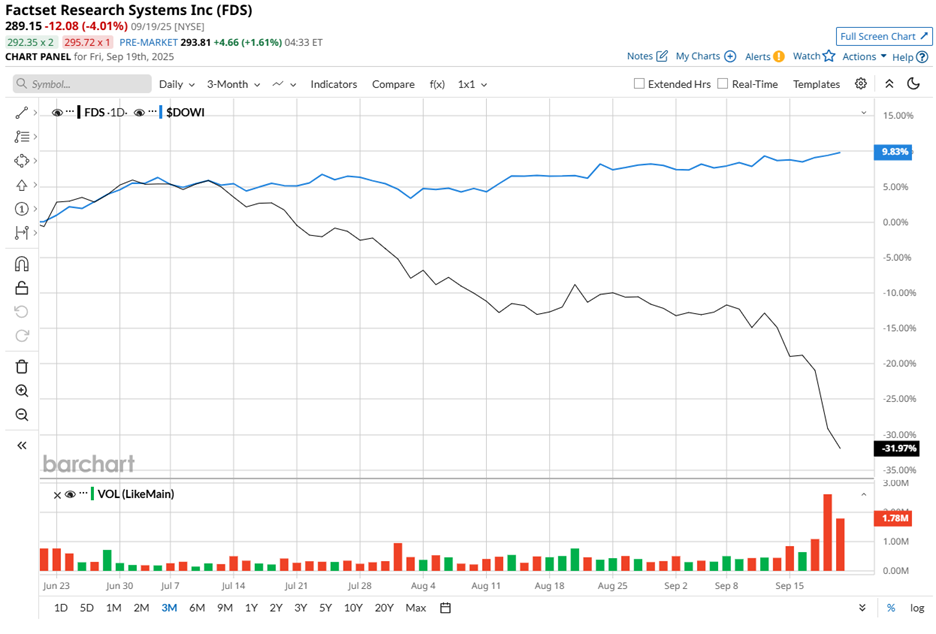

Despite its stature, the market has not been kind. Shares of FactSet Research have tumbled 42.2% from its 52-week high of $499.87 in November 2024. FDS stock has fallen 32% over the past three months. In sharp contrast, the Dow Jones Industrial Average ($DOWI) rose 9.8% during the same period, highlighting the stark divergence between broader market gains and the stock’s sharp retreat.

The challenges stretch further back. Over the past 52 weeks, FDS plummeted 38.4%, and in 2025 alone, it declined by 39.8%, while DOWI rose 10.2% across the 52-week span and 8.9% year-to-date (YTD).

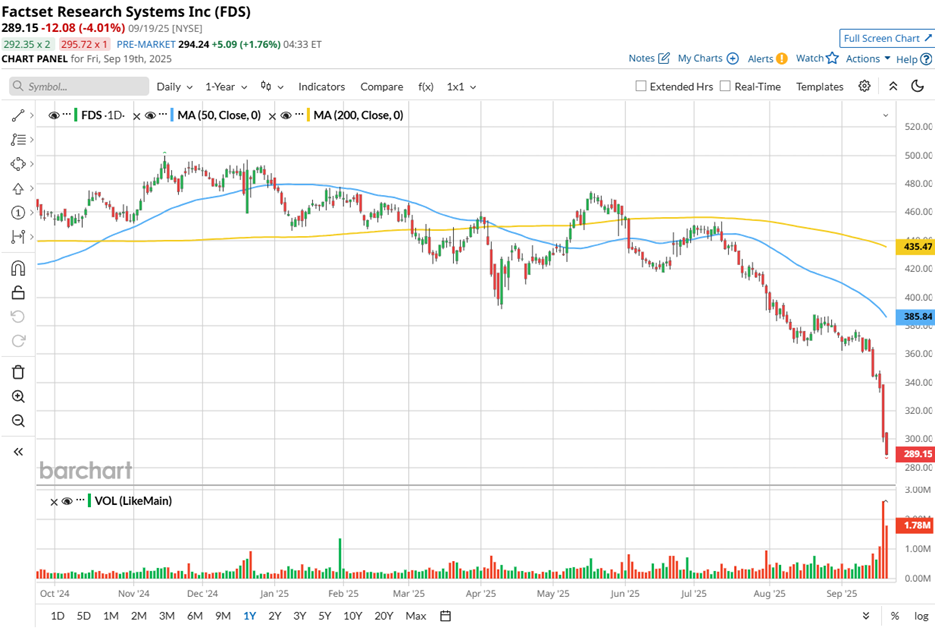

FDS has been in freefall, locked in a bearish channel. Trading below its 50-day moving average since January and the 200-day line since March – rising briefly above those levels in May – momentum screams prolonged weakness.

The downturn deepened further following the release of Q4 2025 earnings results. On Sept. 18, FDS stock saw an intra-day drop of 10.4%, followed by another 4% decline the next day.

Revenue rose 6.2% year over year (YoY) to $596.9 million, exceeding the consensus forecast of $592.8 million. Organic revenue climbed 4.5% annually to $587.3 million, driven by institutional buy-side and wealth management clients. EPS rose 8.3% from the previous year’s quarter to $4.05. However, it fell short of analyst expectations of $4.13.

Full-year earnings guidance also lagged expectations, fueling further market unease. For fiscal 2026, management expects adjusted EPS between $16.90 and $17.60, below the consensus estimate of $18.27. Also, the management expects revenue to be between $2.42 billion and $2.45 billion while organic ASV growth is projected between $100 million and $150 million.

By comparison, its rival S&P Global Inc. (SPGI) has seen only a 2% decline over the past year and a 3% YTD gain, highlighting FDS stocks relative underperformance in the sector.

Analysts remain cautious on the stock’s long-term trajectory. Among 19 covering analysts, the consensus rating is a “Hold,” an upgrade from the “Moderate Sell” rating three months back. Plus, FDS has a mean price target of $403.43, reflecting a premium of 39.5% to current levels but tempered by skepticism over sustained growth.