/Elevance%20Health%20Inc%20billboard-by%20monticello%20via%20Shutterstock.jpg)

Indianapolis, Indiana-based Elevance Health, Inc. (ELV) operates as a health benefits company providing health insurance and related services. Valued at $71.8 billion by market cap, the company offers health, dental, vision, and pharmacy benefits, as well as life insurance, and disability insurance benefits dedicated to addressing healthcare disparities.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and ELV perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the healthcare plans industry. Elevance Health leads the market as the largest provider of Blue Cross Blue Shield coverage, leveraging its strong brand reputation, credibility, and loyal customer base of 47 million members to maintain its competitive edge.

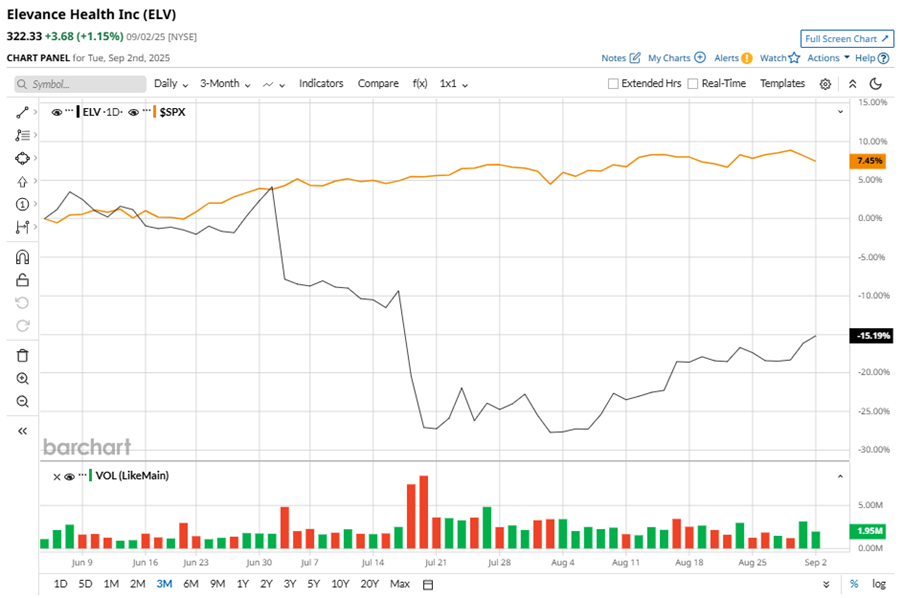

Despite its notable strength, ELV slipped 43.2% from its 52-week high of $567.26, achieved on Sep. 3, 2024. Over the past three months, ELV stock declined 14.5% underperforming the S&P 500 Index’s ($SPX) 8.1% gains during the same time frame.

In the longer term, ELV shares dipped 12.6% on a YTD basis and fell 42.1% over the past 52 weeks, considerably underperforming the SPX’s 9.1% surge in 2025 and 13.6% returns over the past year.

To confirm the bearish trend, ELV has been trading below its 200-day moving average since late September 2024. The stock has been trading below its 50-day moving average since early May.

Elevance Health's underperformance is attributed to rising medical costs, a decline in Medicaid membership, and unfavorable regulatory changes, resulting in a higher benefit expense ratio of 88.9%. The company expects these pressures to persist through 2025 and potentially into 2026.

On Jul. 17, ELV shares closed down more than 12% after reporting its Q2 results. Its adjusted EPS came in at $8.84, down 14.2% year-over-year. The company’s revenue increased 14.3% from the year-ago quarter to $49.4 billion.

ELV’s rival, UnitedHealth Group Incorporated (UNH) shares lagged behind the stock, plummeting 39% on a YTD basis and 47.7% over the past 52 weeks.

Wall Street analysts are reasonably bullish on ELV’s prospects. The stock has a consensus “Moderate Buy” rating from the 21 analysts covering it, and the mean price target of $357.06 suggests a potential upside of 10.8% from current price levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.