/Delta%20Air%20Lines%2C%20Inc_%20passanger%20plane-by%20viper-zero%20via%20iStock.jpg)

With a market cap of $43.8 billion, Delta Air Lines, Inc. (DAL) is one of the largest U.S. airlines, providing passenger and cargo air transportation across a broad global network spanning hundreds of destinations on six continents. Headquartered in Atlanta, Georgia, Delta operates multiple hubs and employs roughly 100,000 people.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and Delta Air Lines fits this criterion perfectly. In addition to commercial flights, the company offers cargo services, aircraft maintenance and engineering, and a major loyalty program, making it a significant player in international aviation and logistics.

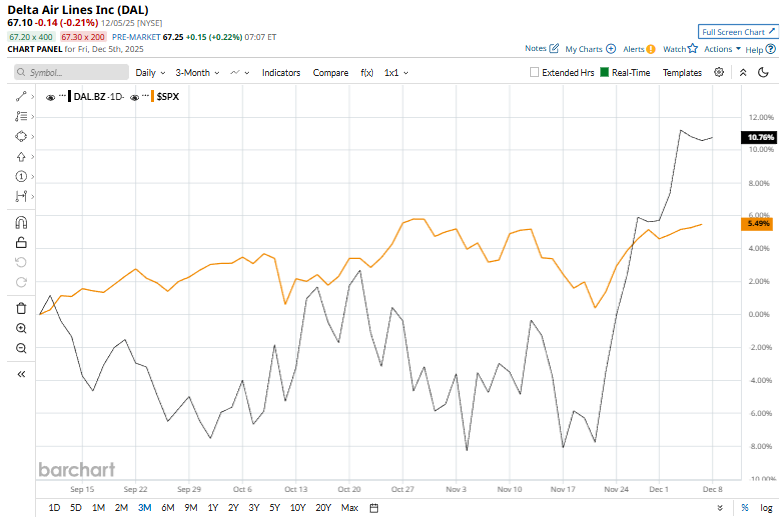

Shares of the airline company have decreased 4.1% from its 52-week high of $69.98. Delta Air Lines’ shares have increased 9.7% over the past three months, outperforming the S&P 500 Index ($SPX) 6% surge over the same time frame.

In the longer term, DAL stock is up 10.9% on a YTD basis, compared to $SPX’s 16.8% return. Moreover, shares of the airline have soared 2% over the past 52 weeks, lagging behind the index’s 13.1% return over the same time frame.

Yet, the stock has been trading above its 50-day moving average recently. Also, it has remained above its 200-day moving average since early August.

On Oct. 9, DAL shares rose over 4% after reporting its Q3 results. Its revenue of $16.7 billion beat the consensus estimates by 3.8%. The company’s EPS was $2.17, surpassing the consensus estimates by 39.8%. Strong demand, particularly in premium and corporate travel, along with effective cost management, helped drive profitability.

Its key rival, United Airlines Holdings, Inc.’s (UAL) shares have surged 8.1% on a YTD basis and nearly 2.5% over the past 52 weeks, following a similar trend as DAL.

Despite the stock’s underperformance over the past year, analysts remain highly optimistic about its prospects. DAL stock has a consensus rating of “Strong Buy” from 20 analysts in coverage, and the mean price target of $73.64 is a premium of nearly 9.7% to current levels.