/Dell%20Technologies%20by%20Poetra_RH%20via%20Shutterstock.jpg)

Dell Technologies (DELL) will release its second-quarter fiscal 2026 financial results on Thursday, Aug. 28. The tech giant, known for its personal computers, servers, networking equipment, data storage devices, and other IT solutions, is benefiting from a solid demand for its AI-optimized servers, and Q2 could be no different.

Thanks to the solid demand and improved product mix, Dell’s bottom-line growth rate was more than three times higher than its revenue in Q1. For instance, in the first quarter of fiscal 2026, Dell delivered $23.4 billion in revenue, up 5% year-over-year. At the same time, its earnings per share (EPS) rose 17% to $1.55. Notably, this growth came despite significant weakness in consumer revenue and cautious spending on IT.

Strong earnings growth is enabling the company to return significant cash to its shareholders. Dell reported $2.8 billion in cash flow from operations in Q1 and returned $2.4 billion to its shareholders.

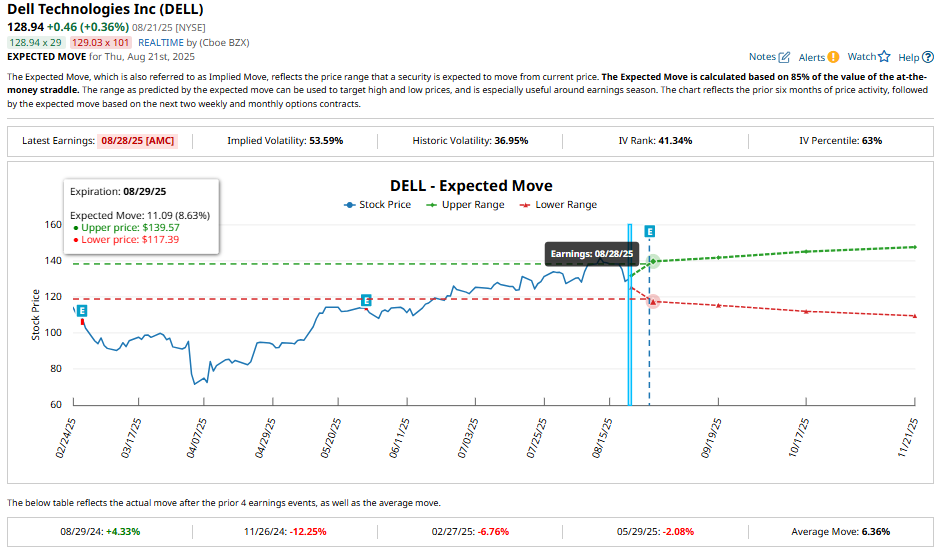

This momentum in its business will likely sustain in Q2. However, will the strong earnings growth be enough to push Dell stock higher? Despite the operational strength, Dell shares have declined following three of the last four quarterly reports. The options market appears to be anticipating a sharp move once again, pricing in an 8.63% swing in either direction after results, which is above the company’s average post-earnings move of 6.36% over the past year.

AI-Driven Demand to Drive Dell’s Financials

Dell Technologies is well-positioned to deliver strong growth in the second quarter, led by surging demand for AI-optimized servers. The company has guided for revenue in the range of $28.5 billion to $29.5 billion, implying a 16% increase at the midpoint. That marks a notable acceleration in sequential growth and reflects the growing contribution of AI in its overall revenue mix.

Dell’s Infrastructure Solutions Group (ISG) is expected to deliver solid growth, where management anticipates shipping roughly $7 billion worth of AI servers tied to large enterprise deals. The appetite for these servers has been growing, creating a solid growth avenue for Dell. For instance, in the first quarter, Dell booked $12.1 billion in orders, shipped $1.8 billion, and ended with a backlog of $14.4 billion. That backlog, which is expected to climb further, provides a powerful revenue cushion for upcoming quarters. Adding to the tailwind, Dell’s sales pipeline is broadening across enterprise verticals, spanning cloud service providers to public institutions.

To capture this growth, Dell has been scaling its AI strategy on multiple fronts. Its AI Factory initiative now stretches across PCs, edge computing, and data center infrastructure. The company has rolled out a lineup of Copilot+ capable AI PCs and unveiled new notebooks and desktops powered by Nvidia’s (NVDA) RTX PRO Blackwell GPUs. On the server side, Dell continues to refine its portfolio with systems that pack more GPUs per rack and advanced cooling technologies to handle the increasing density of AI workloads. All these initiatives augur well for growth.

Broader macroeconomic dynamics are still pressuring IT spending, and the consumer revenue market remains weak, which could weigh on Dell’s Client Solutions Group (CSG). Even so, the strength of AI-driven infrastructure sales is likely to keep overall growth on an upward trajectory.

For the quarter, management expects adjusted earnings per share of $2.25, a 15% increase from last year. Analysts are more cautious, with a consensus estimate of $2.08. However, this still represents 10% growth year-over-year.

Historically, Dell has topped Wall Street’s earnings forecasts in three of the last four quarters, though it missed expectations in its most recent report by about 6%.

Is Dell Stock a Buy, Sell, or Hold?

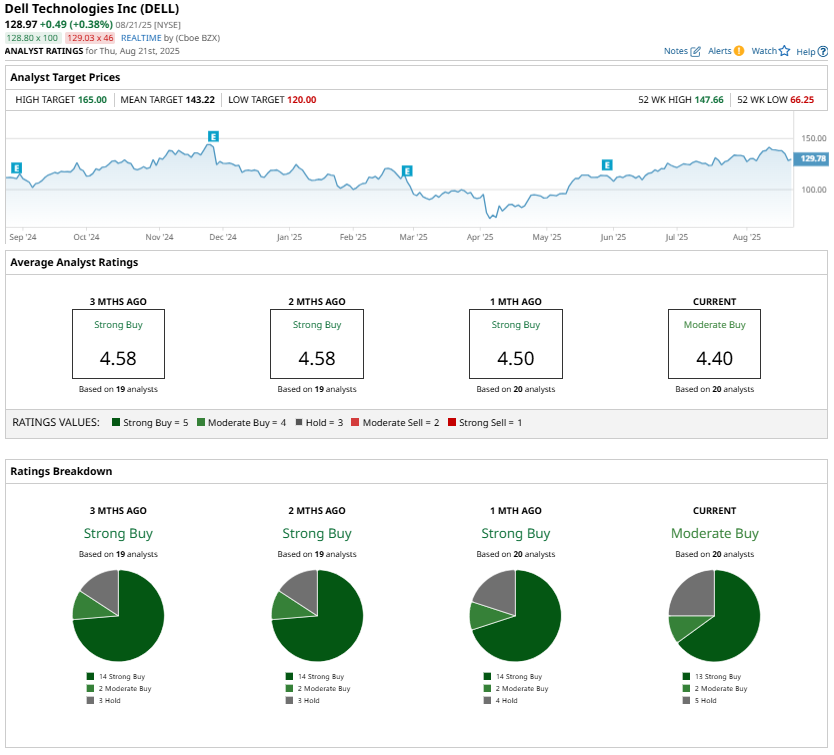

Dell heads into its Q2 earnings with strong momentum in AI-driven infrastructure sales and a healthy order backlog that should support growth. However, analysts are cautiously optimistic about Dell stock ahead of earnings and maintain a “Moderate Buy” consensus rating.

While AI will drive demand, ongoing weakness in the consumer market and broader IT spending remain a drag. Given the macro uncertainty and the stock’s recent track record of post-earnings declines, caution is warranted ahead of earnings.