/Dayforce%20Inc%20app-by%20Premio%20Studio%20via%20Shutterstock.jpg)

Dayforce Inc. (DAY), headquartered in Minneapolis, Minnesota, functions as a human capital management (HCM) software company, offering cloud-based solutions that integrate various HR functions. With a market cap of $11 billion, the company provides a platform for talent and workforce management, human resources, benefits, and payroll services that help manage the entire employee lifecycle, from recruiting and onboarding to payroll processing.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and DAY definitely fits that description, with its market cap exceeding this threshold, reflecting its substantial size, influence, and dominance in the software - application industry. DAY's commitment to innovation in products, expanded payroll capabilities, and addressing the growing demand for flexible and remote work solutions with a strategic focus on global expansion and the ability to adapt to market trends has enhanced its competitive edge in the industry.

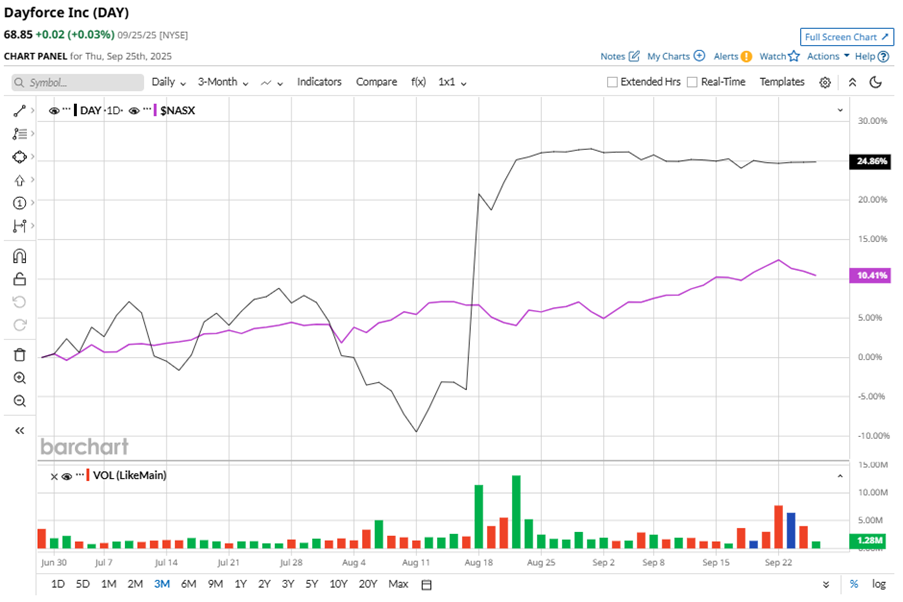

Despite its notable strength, DAY slipped 16.7% from its 52-week high of $82.69, achieved on Nov. 25, 2024. Over the past three months, DAY stock gained 25.2% outperforming the Nasdaq Composite’s ($NASX) 12.1% gains during the same time frame.

In the longer term, shares of DAY dipped 5.2% on a YTD basis but climbed 17.7% over the past 52 weeks, underperforming NASX’s YTD gains of 15.9% and 23.8% returns over the last year.

To confirm the bullish trend, DAY has been trading above its 50-day and 200-day moving averages since mid-August.

On Aug. 6, DAY shares closed up marginally after reporting its Q2 results. Its adjusted EPS of $0.61 topped Wall Street expectations of $0.52. The company’s revenue was $464.7 million, beating Wall Street forecasts of $458.2 million. The company expects full-year revenue in the range of $1.9 billion to $2 billion.

In the competitive arena of software - application, Workday, Inc. (WDAY) has lagged behind DAY, showing resilience with 5.9% losses on a YTD basis and a marginal dip over the past 52 weeks.

Wall Street analysts are cautious on DAY’s prospects. The stock has a consensus “Hold” rating from the 16 analysts covering it, and the mean price target of $70.18 suggests a potential upside of 1.9% from current price levels.