President Donald Trump’s signing of the GENIUS Act into law creates a clear regulatory framework for stablecoins, positioning Coinbase (COIN) as a primary beneficiary alongside Circle (CRCL) in the evolving crypto landscape.

One Seeking Alpha analyst identified Coinbase and Circle as “the biggest immediate winners in the public markets” from the landmark legislation. The Act establishes full reserve backing, real-time redemption, and transparency standards for U.S. dollar-pegged tokens, effectively launching what analysts refer to as the “Web3 economy.”

The GENIUS Act should also benefit platforms like Coinbase that integrate stablecoin functionality with decentralized finance (DeFi) applications.

With regulatory uncertainty removed and Coinbase positioned as a key infrastructure provider for the emerging stablecoin economy, the stock offers strong upside potential as institutions embrace compliant digital dollar applications.

Is Coinbase Stock a Good Buy Right Now?

Beyond the regularity wins, there are three other key catalysts for investors to watch here.

First, the ETF success story continues to drive institutional adoption, with over $120 billion in assets gathered across crypto ETFs. Coinbase serves as custodian for the vast majority of these products, generating steady revenue while validating crypto’s mainstream acceptance. CFO Alesia Haas noted that institutional buyers have been net purchasers of Bitcoin (BTCUSD), with corporations and even countries adding cryptocurrency to their balance sheets.

Second, the $2.9 billion Deribit acquisition represents Coinbase’s largest deal to date, adding the world’s leading crypto options platform, which holds a 75% market share and $30 billion in open interest. This plugs a critical gap in Coinbase’s derivative offerings, targeting the 75% of crypto trading volume that occurs in derivatives markets.

Lastly, the company’s crypto as a service offering serves over 200 financial institutions, positioning Coinbase as the infrastructure provider as traditional finance increasingly adopts cryptocurrency.

With regulatory clarity emerging, institutional adoption accelerating, and utility-driven use cases maturing, Coinbase appears well-positioned to benefit from crypto’s ongoing mainstream evolution.

What Is the Target Price for COIN Stock?

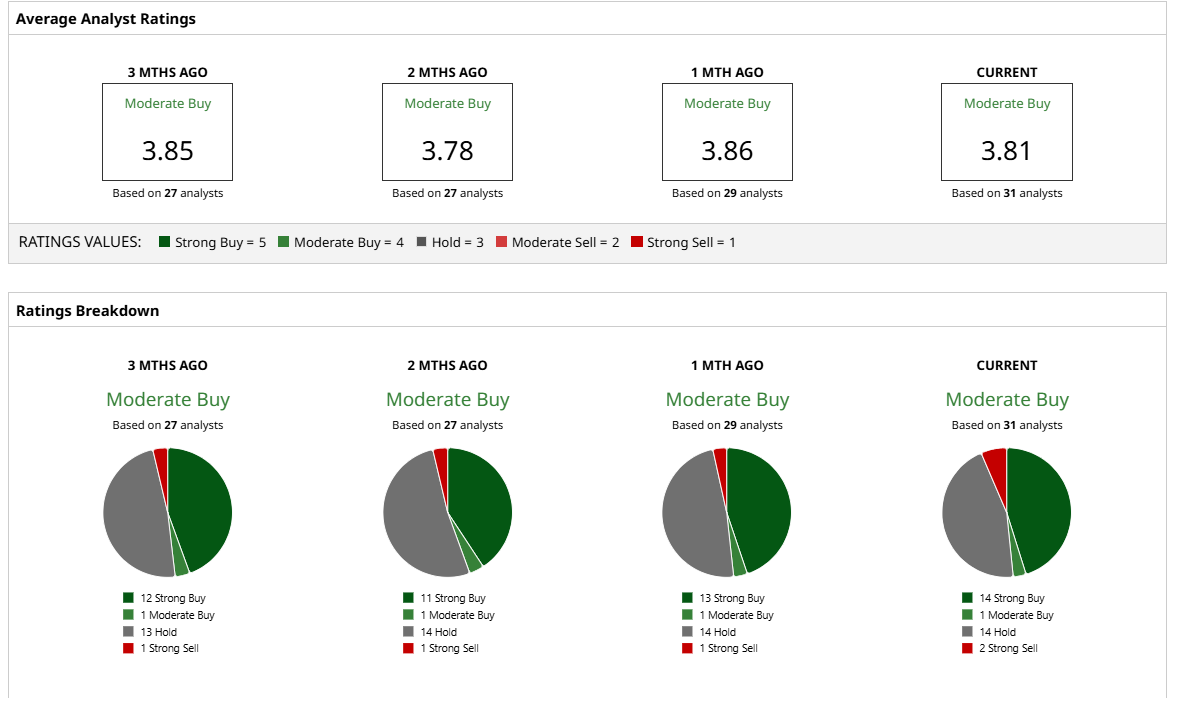

Out of the 31 analysts covering COIN stock, 14 recommend “Strong Buy,” one recommends “Moderate Buy,” 14 recommend “Hold,” and two recommend “Strong Sell.” The average COIN stock price target is $341, 14% below the current trading price.