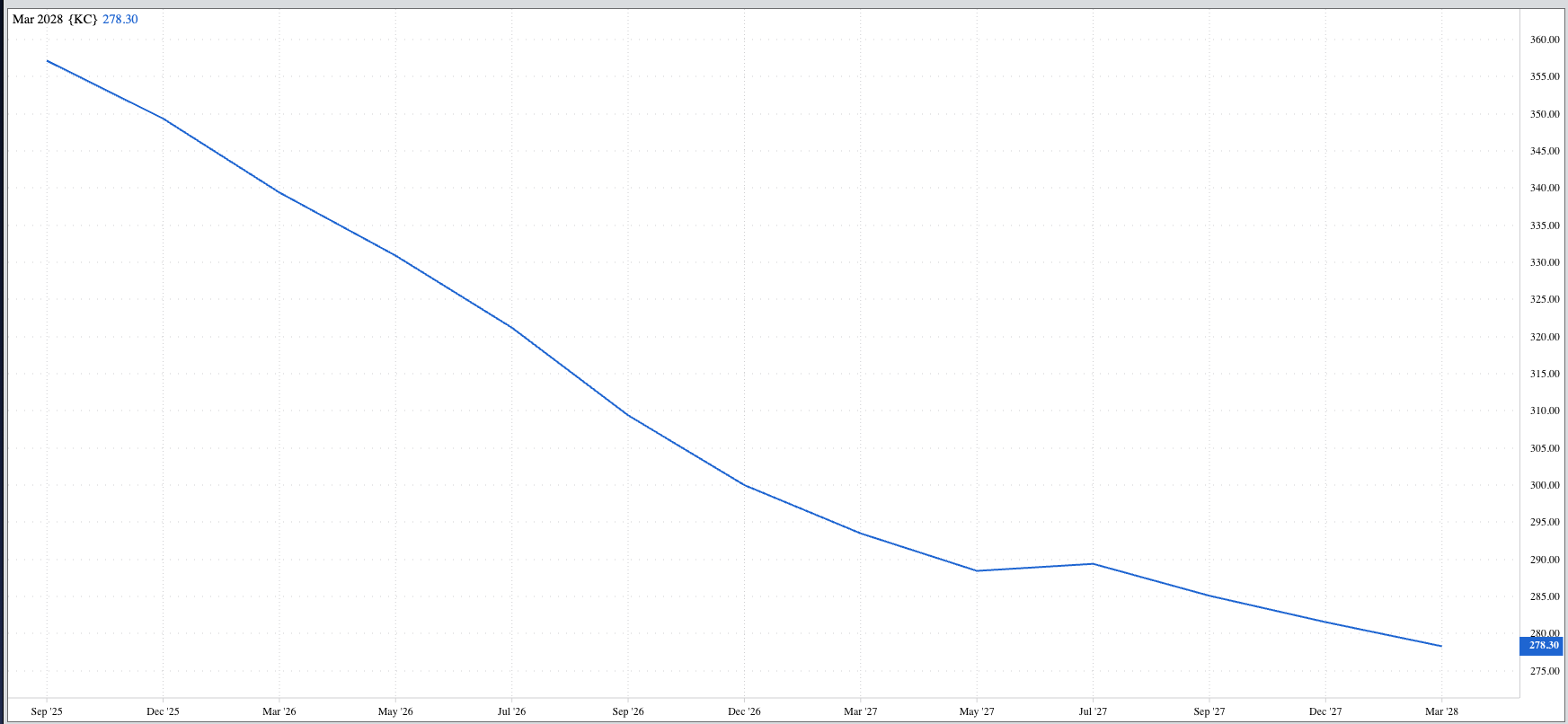

The structure of the coffee futures market makes it a Type 9 market, the most bullish type.

-

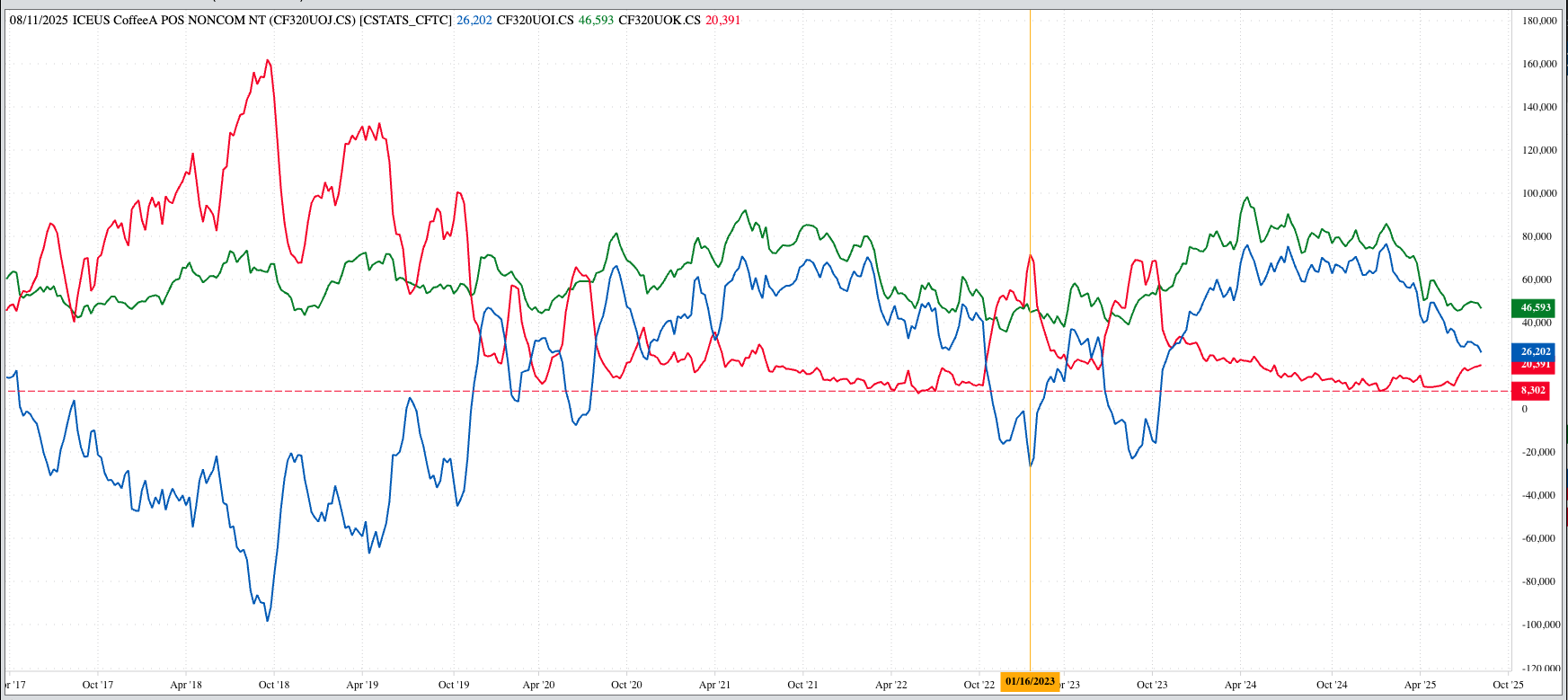

Still, the noncommercial side has been slow to follow the commercial side into sharply bullish territory.

Don’t Miss a Day: From crude oil to coffee, sign up free for Barchart’s best-in-class commodity analysis. Given its structure, coffee is in position to be the next cattle market.

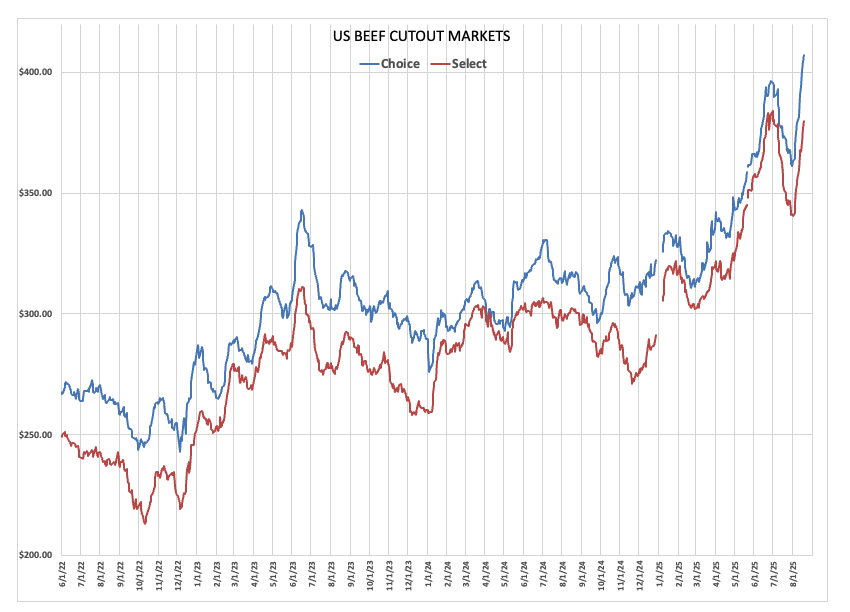

You’ve likely noticed I occasionally refer to the movie City Slickers, particularly over the past few years when both live and feeder cattle markets have moved into the spotlight. Tuesday morning was another of those days after I made note of Monday afternoon’s boxed beef reported prices[i]. Choice had climbed to a new all-time high of $404.24, up $3.67 to start the week. Select actually made the more impressive jump, adding $6.38 to hit $377.14, but was still off its all-time high of $384.10 from June 30. (Both markets extended their strength Tuesday afternoon with Choice up $2.96 and select adding $2.62.) Why the City Slickers reference? In the movie, Billy Crystal’s character mentions that even though they were participating on a cattle drive, they could still be civilized, so he fires up his coffee grinder. Naturally, it spooks the cattle into a stampede. The chaos is only settled moments later by Jack Palance’s character, the crusty old cowboy Curly.

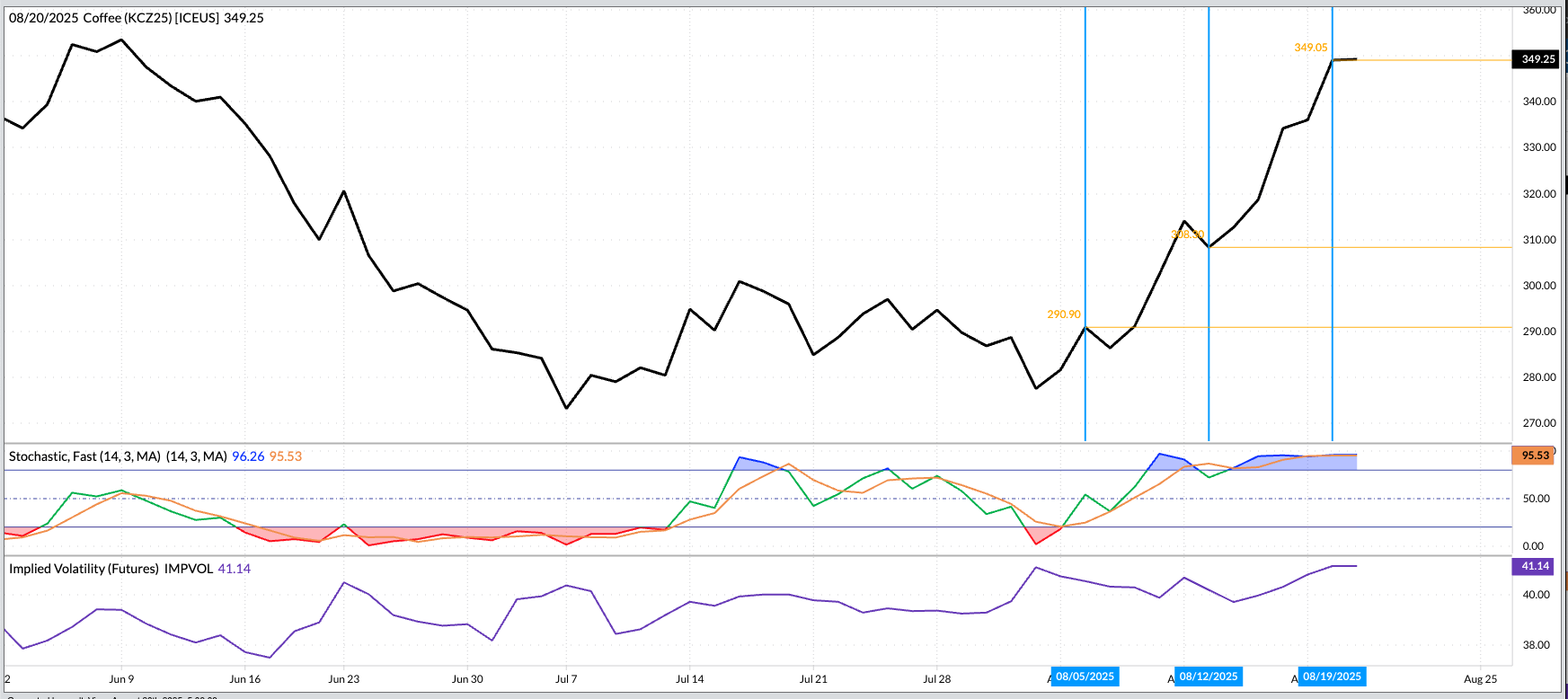

All this talk of cattle market got me thinking about the coffee market, and not because coffee crusted steak is delicious. The December coffee contract (KCZ25) is bullish from both a fundamental and technical point of view, creating a Type 9 market, the most bullish type.

Fundamentally

- Coffee’s forward curve remains inverted telling us global supplies remain tight in relation to demand.

- A quick search of the subject shows 3 reasons

- Adverse weather in both Brazil and Vietnam

- The US president’s single word trade policy of tariffs, raising costs for the US to import coffee

- Increased demand

- A quick search of the subject shows 3 reasons

Technically

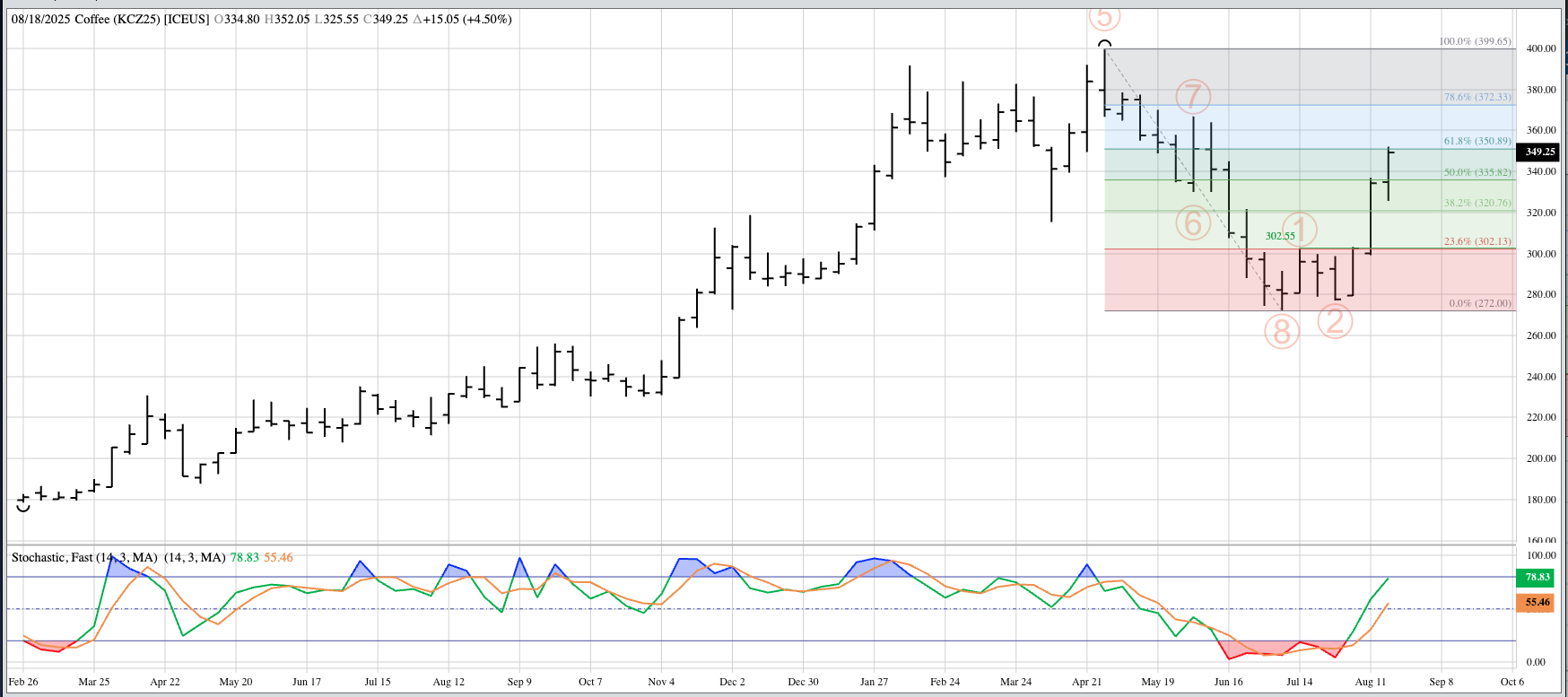

- Dec coffee’s intermediate-term weekly chart shows a number of technical patterns at play

- The previous secondary downtrend came to an end with the low of 272.00 the week of July 7 (point 8)

- After some choppiness over the next few weeks, resulting in Waves 1 and 2 of a new 5-wave uptrend pattern (Elliott Wave Theory), Dec25 posted a bullish breakout with a new 4-week high beyond 302.55 the week of August 4

- Confirming the new secondary uptrend indicated by a bullish crossover by weekly stochastics below the oversold level of 20% at the close of the week of July 21

- Dec25 has extended Wave 3 to a high of 352.05 this week, just beyond the next upside target of 350.89 in sight

- This target is the 61.8% retracement level (Fibonacci) of the previous secondary downtrend

- Setting the stage for a possible Wave 4 selloff in the not-too-distant future

- Given Dec25 is sharply overbought short-term (see below)

Watson

- It’s interesting to note Watson has been slow to get in line with coffee’s bullish forward curve. The latest CFTC Commitments of Traders report (legacy, futures only), for the week ending Tuesday, August 12, showed a noncommercial net-long futures position of 26,202 contracts a decrease of 3,056 from the previous week.

- From Tuesday-to-Tuesday, the December contract closed 40.75 higher indicating strong buy by Watson to go along with commercial support

- However, Dec25 closed last Tuesday with a gain of 17.40 from the previous Tuesday, yet the noncommercial net-long position decreased

The Bottom Line: If funds start buying, and fundamentals remain bullish, coffee could be the next cattle market.

[i] Yes, reported by USDA, so the prices come with an automatic asterisk.

On the date of publication, Darin Newsom did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.