After reaching a 52-week low in April of this year, Canadian cannabis products manufacturer Canopy Growth (CGC) has been experiencing a resurgence lately due to the possibility of favorable regulations. With that in mind, at this point, should you buy, sell, or hold CGC stock? Let's take a closer look.

About Canopy Growth Stock

Based in Smiths Falls, Ontario, Canopy Growth is a well-established name in the cannabis sector. The company is known for producing and distributing a wide selection of cannabis products for both therapeutic and recreational use. Its offerings include items like dried flower, cannabis oils, edibles, infused beverages, vaporizers, and softgel capsules.

Canopy runs its business across multiple areas, including its domestic operations in Canada and international cannabis markets. It manages a variety of popular labels, including Tweed, Doja, 7ACRES, and Spectrum Therapeutics, helping it maintain a strong footprint in Canada and abroad. Canopy also operates a vaporizer technology unit through its Storz & Bickel brand. The company has a market capitalization of $431 million.

CGC stock has not performed well over the past 52 weeks, down 66% during this period, and down 34% year-to-date (YTD). The stock had also dropped to a 52-week low of $0.77 in April, but is up 134% from this low.

That said, cannabis stocks have been having a good time on Wall Street more recently after President Donald Trump announced that he is considering reclassifying marijuana. Right now, it is classified as a Schedule I drug alongside heroin and cocaine. The reclassification would allow cannabis companies to fall under a different and more conducive tax bracket.

As a result, the AdvisorShares Pure US Cannabis ETF (MSOS) has gained 67% over the past month. CGC shares are also up by 50% over the same period.

CGC stock is currently trading at a low price. Its price sits at 1.91 times sales, which is lower than the industry average.

Canopy Growth Reported Topline Growth For Q1

On Aug. 8, Canopy Growth reported its first-quarter results for fiscal 2026. Revenue increased 17.1% year-over-year (YOY) to CAD 88.75 million ($64.4 million), while net revenue increased 9% annually to CAD 72.13 million ($52.3 million).

This increase was driven by increased adult-use cannabis and medical cannabis in Canada, as well as an increase in international markets. However, the effect was offset by lower Storz & Bickel net revenue.

While the company still noted losses for the quarter, its loss per share reduced from CAD 1.60 in Q1 2025 to CAD 0.22 in Q1 2026. Cash and short-term investments increased to CAD 144 million ($104.4 million) as of June 30 from CAD 131 million ($95 million) as of March 31.

The company announced that it is undertaking multiple actions aimed at improving cannabis gross margins in the second half of the current fiscal year. These actions include the “deployment of automation technology” and “increased PRJ production capacity,” as well as the continued pursuit of margin-accretive bulk cannabis sales in Europe and Canada.

Wall Street analysts are optimistic about Canopy’s ability to reduce its losses. They expect the company’s loss per share to narrow by 88.4% YOY to $0.11 for Q2 2026. For the current fiscal year, loss per share is projected to decrease by 83.2% annually to $0.50, followed by a 78% improvement to a $0.11 loss per share in the next fiscal year.

What Do Analysts Think About Canopy Growth Stock?

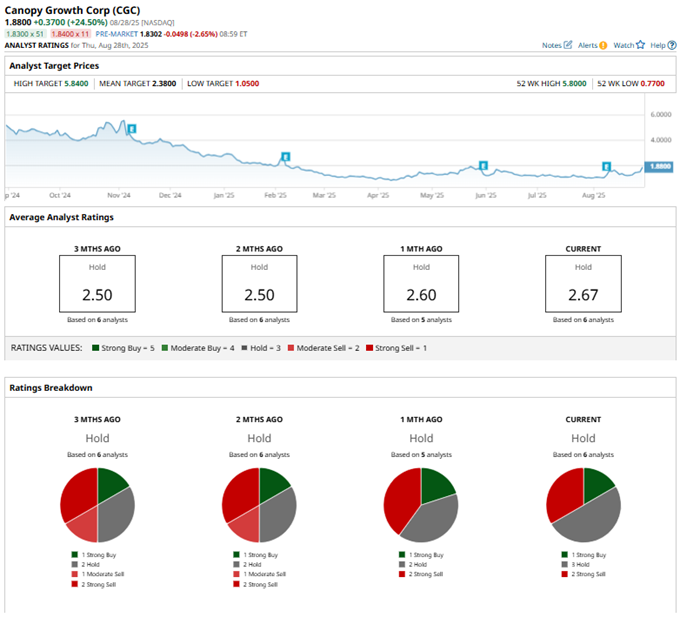

Analysts seem to be recommending caution when it comes to Canopy Growth stock. Pablo Zuanic from Zuanic & Associates initiated coverage on the stock earlier this year with an overall “Neutral” rating. Last year, Piper Sandler analyst Michael Lavery maintained an “Underweight” rating on the stock, while cutting the price target from $3 to $2.

Wall Street analysts are cautious about CGC stock, giving it a consensus “Hold” rating overall. Of the six analysts rating the stock, one analyst gives it a “Strong Buy” rating, three are cautious with a “Hold” rating, and two have a “Strong Sell” rating. The consensus price target of $2.38 represents 32% potential upside from current levels. The Street-high price target of $5.84 indicates 224% potential upside from here.

Key Takeaways

While the regulatory environment for cannabis in the U.S. may improve, Canopy Growth appears to have a long way to go before achieving profitability. Therefore, it might be wise to observe CGC stock for now, in hopes for the reclassification of cannabis.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.