/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Late last year, custom chips were all the buzz, and chipmakers like Broadcom (AVGO) and Marvell Technology (MRVL) were cashing in on the need for high-performance chips tailored to specific uses, such as large language models (LLM) training. This caused the stock to reach high valuations, which weren't sustainable. As we approach the end of 2025, custom chips are about to make a comeback.

OpenAI announced a deal with Broadcom for 10 gigawatts of custom AI accelerators. The ChatGPT maker will design the systems, and Broadcom will use its custom chips, networking, and connectivity expertise to deploy those systems. In other words, OpenAI is making its own chips, and it chose Broadcom for that purpose.

To understand why the partnership was necessary, it is important to know what a custom chip is. Referred to as an application-specific integrated circuit (ASIC), these chips are built to serve a single purpose: run OpenAI’s foundation models. General-purpose GPUs like the ones from Nvidia (NVDA) may well be the best in the world, but when the task is as repetitive and intensive as AI model training and inference, companies like OpenAI prefer to remove the bottlenecks of general-purpose GPUs and replace them with bespoke ones that can perform the same tasks repeatedly at a high pace and with the right amount of memory capabilities.

OpenAI has been signing a lot of deals recently, and this one was just a matter of time. The question for investors now is whether there is still value in buying Broadcom, or is last year’s story repeating itself with hype around custom chips?

About Broadcom Stock

Broadcom is the designer and developer of different types of semiconductor equipment as well as connectivity and networking solutions. The company is headquartered in San Jose, California. As a designer of semiconductor chips, it is at the forefront of the ongoing AI revolution.

AVGO stock is up over 49% year-to-date (YTD), comfortably outpacing the Nasdaq Composite’s ($NASX) 17.58% returns. It hit an all-time high of $374.23 just last month, and the current momentum from the OpenAI partnership could well carry it past that level.

When it comes to valuation, Broadcom looks overvalued at first sight. It has a forward price-to-earnings (P/E) multiple of 65x and a forward price-to-sales (P/S) multiple of 32.2x. Both these multiples are well above the five-year averages of 46.6x and 10.8x. However, the P/E ratio is still below peers like Advanced Micro Devices (AMD) (104.7x) and ARM Holdings (ARM) (195.17x). Broadcom also enjoys better net margins than both these peers and still commands a lower multiple. AMD recently announced a partnership with OpenAI, and ARM is actually a part of the OpenAI-AVGO deal. It is clear that OpenAI-led AI initiatives are driving multiples higher across the board, and investors would do well if they identified stocks that will perform despite the high valuations. Broadcom could very well fall in this category.

A 42% payout ratio and a 0.67% forward dividend yield also help soothe investor worries to an extent. Dividends are rare in this industry, so a 0.67% yield stands out. Broadcom also boasts 14 consecutive years of dividend growth.

Broadcom Beats Q3 EPS and Revenue Estimates

Broadcom announced its Q3 results on Sept. 4 and posted an EPS of $1.69 against the consensus estimate of $1.67 on a revenue of $15.95 billion against the consensus estimate of $15.84 billion. Q4 revenue is expected to come in at $17.4 billion against Wall Street expectations of $17.1 billion, driven in part by 15% year-over-year (YoY) growth in the software segment.

None of the above was enough to impress the investors, though, as the stock dipped after the earnings announcement. This could be explained by the lack of demand in the non-AI part of the chips business, margin pressure due to product mix, and high valuation. Some were expecting a higher growth in AI as well. Even if those concerns were valid, the OpenAI deal should make up for all that. In fact, the stock has already started inching upwards.

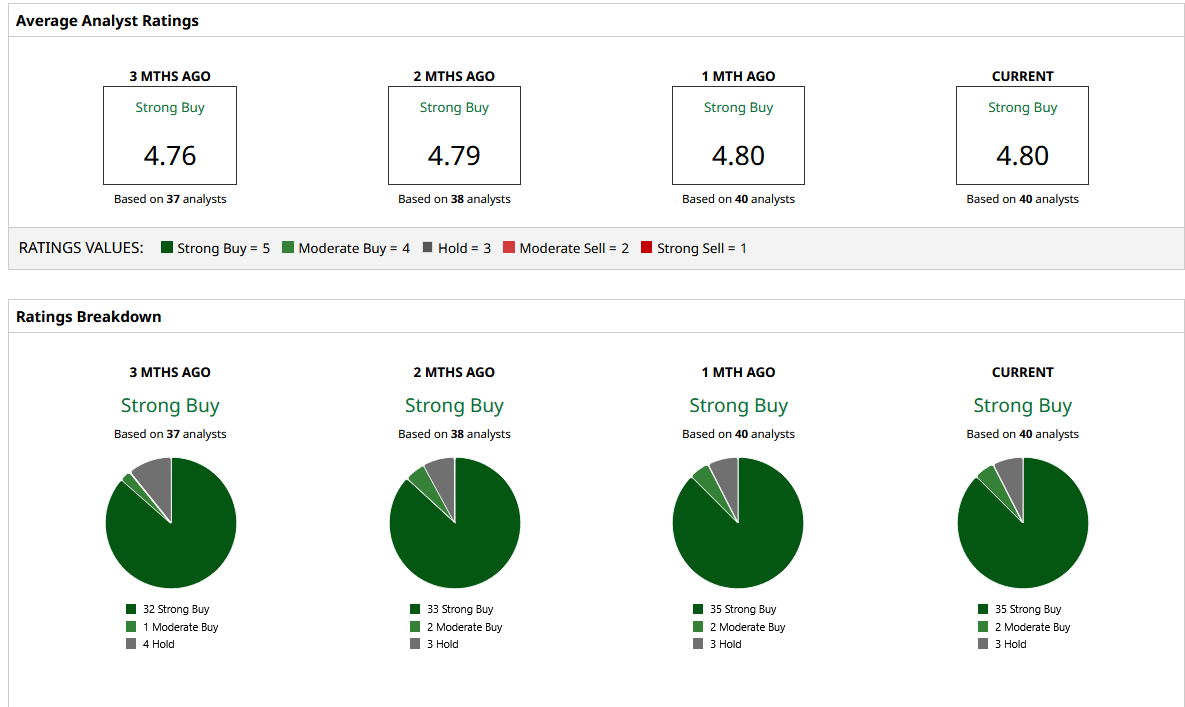

What Do Analysts Expect for AVGO Stock?

Broadcom is covered by 40 Wall Street analysts, and 35 of them have a “Strong Buy” rating on AVGO stock. Two give it a “Moderate Buy,” and three say “Hold.” No analyst has a “Sell” rating on Broadcom, which goes to show the analysts are not particularly concerned about the high valuation.

The mean analyst price target of $396.64 offers 14% upside, with the lowest price target at $300, a level the stock was trading at just before the Q3 earnings. One can expect upside revisions to these estimates as the scope of the OpenAI deal becomes clear. For now, analyst estimates, peer valuation, and AI prospects mitigate the high valuation concerns.