/Boeing%20Co_%20plane-by%20Wirestock%20via%20iStock.jpg)

Boeing (BA) has spent much of the last six years fighting headwinds of its own making, including two 737 MAX disasters and the regulatory shadow they cast, quality lapses throughout the supply chain, a stained reputation, cash burn, and leadership turnover. This year, the picture has become constructive as well as complex. Deliveries have sped up, cash burn has eased dramatically, and new leadership is attempting to ingrain discipline into the production system. Yet the tragic June crash of Air India Flight 171, a Boeing 787-8, has reminded investors that the story around Boeing can change at any instant.

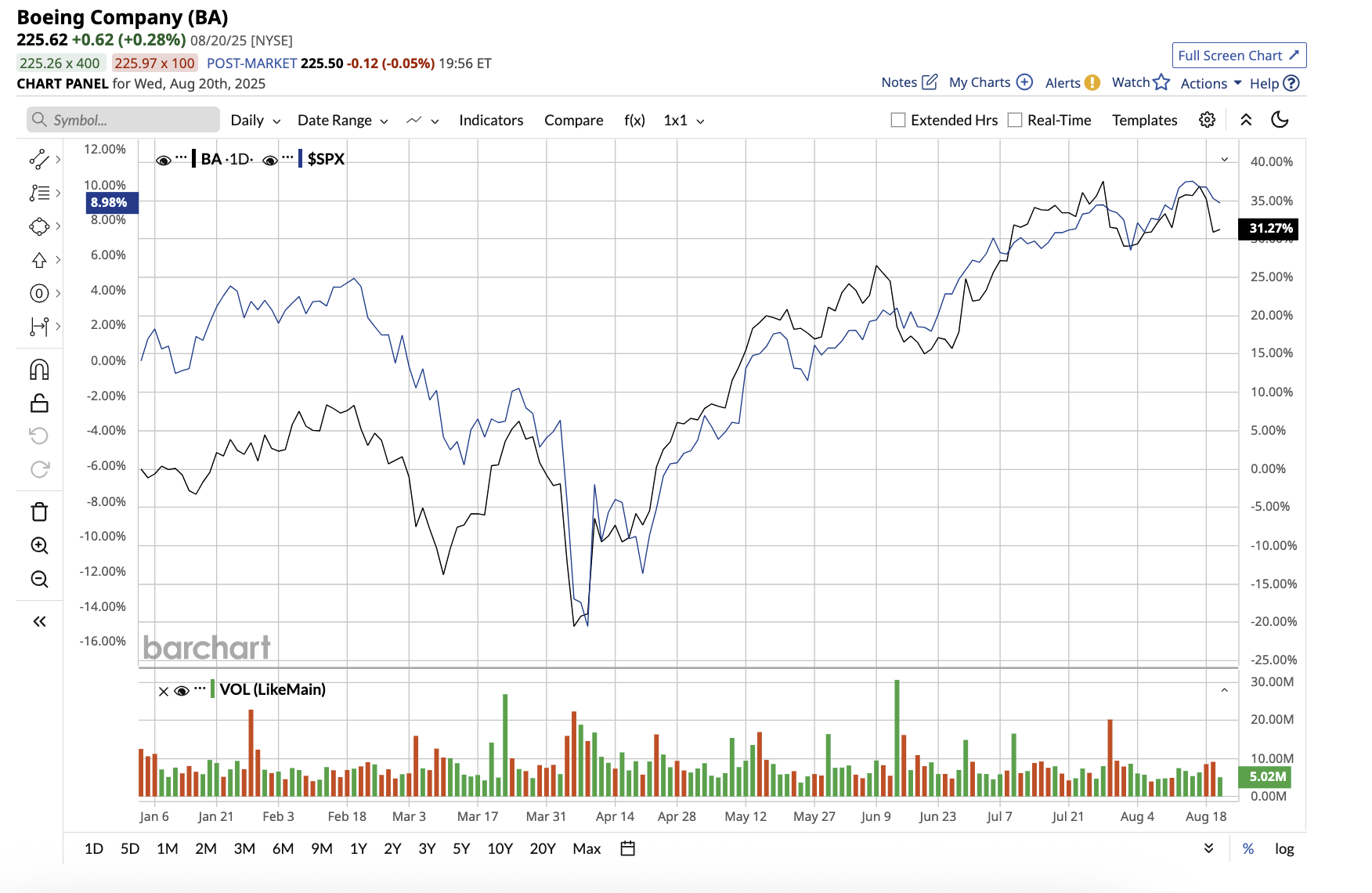

Valued at $170.6 billion, Boeing’s stock has only returned 28% over the past five years, falling short of the market’s overall gain of 82%. So far this year, Boeing stock has shown momentum and is up 27.8%. Let’s find out whether Boeing stock is worth buying amid these circumstances.

Financial Picture Is Getting Better, But It’s Not Perfect

Boeing’s second-quarter results painted a cautiously optimistic picture of a company stabilizing operations, regaining customer trust, and gradually repairing its reputation. The new CEO, Kelly Ortberg, who took over the role in August 2024, emphasized that Boeing’s recovery plan is “taking hold.” Boeing delivered 150 commercial jets in Q2 and 280 in the first half of 2025, the most since 2018. According to Ortberg, “almost every customer” reports better-quality deliveries, which is crucial feedback for a business that is still trying to forget about previous safety incidents.

Boeing’s 737 MAX has been gradually returning to capacity. The company is getting ready to ask the FAA for permission to ramp up to 42 aircraft per month after reaching a steady production rate of 38. The focus is on demonstrating sustained quality control at current rates, which is a lesson the company has learned from earlier rush-to-ramp mistakes.

With all key performance indicators in the green and a current production rate of seven aircraft per month, the 787 Dreamliner continues to show momentum. Like the 737 program, the company is prioritizing stability before pursuing the next production increase.

Additionally, with $6.6 billion in revenue, up 10% year over year, Boeing Defense, Space & Security reported a better quarter. The backlog now stands at $74 billion, driven by $19 billion in new orders.

In the second quarter, total revenue reached $22.7 billion, a 35% year-over-year increase. From $2.90 per share in the year-ago quarter to $1.24 per share, the core loss per share narrowed. Boeing had $53.3 billion in debt at the end of the quarter, down a little from maturing debt repayments, and $23 billion in cash. Assuming steady trade conditions and delivery schedules, management anticipates positive free cash flow in Q4.

Risks Still Loom

The first fatal accident involving the Dreamliner and the deadliest aviation disaster in a decade occurred in June 2025 when Air India Flight 171, a Boeing 787-8, crashed. Although no mechanical issue has been verified, preliminary investigation results indicated that the aircraft’s fuel control switches were inexplicably moved to cutoff, stopping thrust.

This tragedy has a wide range of ramifications for Boeing, including eroding public confidence, resulting in people avoiding Boeing flights, triggering potential design and training reviews, strained customer relations with a significant buyer, and increased legal and financial uncertainty. Rebuilding trust takes years. Therefore, Boeing’s recovery could be derailed if the final investigation report reveals a safety or quality lapse.

Other headwinds, such as tariff disputes, play an important role, as the company’s $600 billion backlog is heavily international, making free trade policies critical to its long-term growth. Previous attempts to increase production have resulted in quality issues, so history may repeat itself if discipline is not maintained. Boeing may be able to enter 2026 as a more streamlined and disciplined aerospace leader if management can maintain quality and execution standards while managing the impact of external headwinds. Analysts covering the stock expect the company to report a profit by 2026.

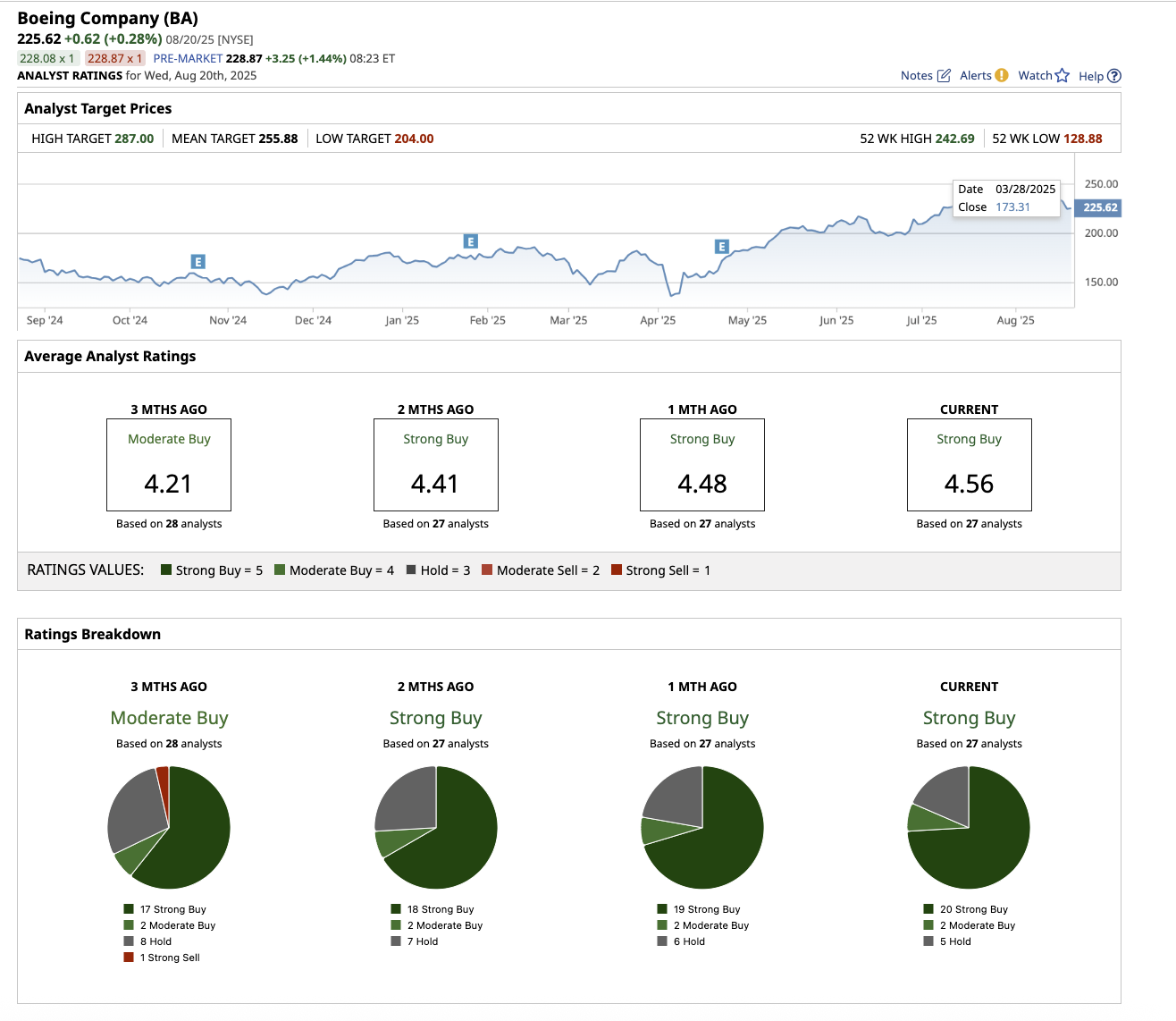

What Does Wall Street Say About Boeing Stock?

Overall, on Wall Street, Boeing stock is a “Strong Buy.” Among the 27 analysts covering BA stock, 20 rate it a “Strong Buy,” two have given it a “Moderate Buy” rating, while five suggest a “Hold.” Its average price target of $255.88 suggests the stock can rally 14% from current levels. The high price estimate of $287 implies upside potential of 27% over the next 12 months.

The Verdict

Boeing’s second-quarter results show the company is finally recovering from its long nosedive. Production is levelling off, defense and services are delivering, and trade tensions are easing. However, the path ahead requires constant discipline, particularly in terms of quality, safety, and certification deadlines.

Thus, for long-term investors, Boeing may be shifting from a high-risk recovery story to a more balanced growth story, but it is still not “finally ready for takeoff.” While Wall Street remains bullish, I would advise taking a cautious approach until the company reports consistent profits.