Boeing (BA) has had a decent start to the year, up about 10% in 2023. But most investors have been following the stock’s rally off the fourth-quarter low.

From the October low to the February high, Boeing stock rallied more than 82%. At one point in that stretch, it rallied in 13 of 15 weeks.

The move came at a time where travel stocks, airlines and names like General Electric (GE) were booming. For its part, GE stock is still rallying.

Don't Miss: Trading the Dow: Laggard or Leader Going Forward?

But while Boeing stock has been quiet over the past month, that doesn’t mean it’s out of favor. I think it’s just consolidating. After such a massive rally, the bulls should be happy to see some sideways digestive price action.

The bears will argue that Boeing stock is likely heading lower if recession closes in, but one could say that about any stock. For now, I’d rather stick to the price action and the trend, which continues to favor the bulls.

Trading Boeing Stock

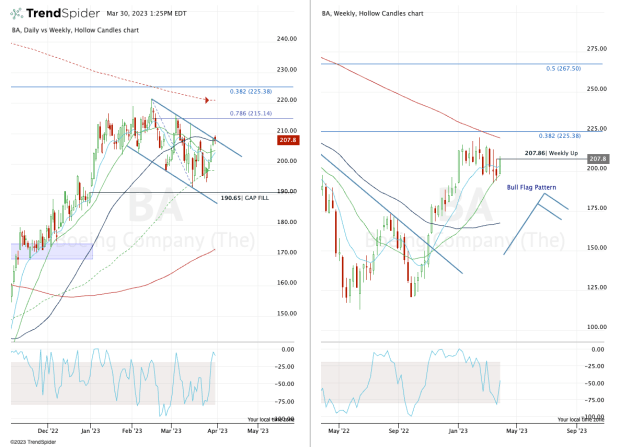

Chart courtesy of TrendSpider.com

In the image above, we have the daily chart on the left and the weekly chart on the right. As you can see on the right, Boeing stock is sandwiched between the rising 21-week moving average and the falling 200-week moving average.

As Boeing stock tries to rotate over last week’s high of $207.86, notice how it’s also trying to clear the 50-day moving average and downtrend resistance (blue line).

This is resistance, but if the stock can clear it, the door opens up to the $215 to $220 area. The shares stalled in this area, while just above it the stock finds its 200-week moving average.

Above these measures the $225 mark is on the table before it potentially gains even more altitude.

Don't Miss: JPMorgan Stock Has Been Toughing Out the Volatility. Check the Chart.

On the downside, the $197 to $200 zone has been support. The bulls will want to see that that remains the case going forward, in the event that Boeing stock is unable to break out of its current pattern.

Below $200 and traders must be on watch for a retest of the March low near $192.50. If the shares dip below that mark, the focus will shift to the gap-fill near $190.50, followed by potentially more selling pressure.

That would shift the chart to a much more defensive tone, as Boeing stock would be below the 10-day, 21-day, 50-day, 10-week and 21-week moving averages.

For now, keep an eye on the $208 area, followed by $220-ish.