/Baxter%20International%20Inc_%20logo%20on%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)

Baxter International Inc. (BAX), headquartered in Deerfield, Illinois, develops and provides a portfolio of healthcare products. With a market cap of $11.9 billion, the company develops, manufactures, and markets products and technologies related to hemophilia, immune disorders, infectious diseases, kidney disease, trauma and other chronic and acute medical conditions. The company's products are used by hospitals, kidney dialysis centers, nursing homes, rehabilitation centers, doctors' offices, and research laboratories.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and BAX perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the medical instruments & supplies industry. Baxter excels through diversified healthcare products and innovative expansions. Strategic acquisitions enhance its connected care solutions, while investments in new launches and geographic expansion solidify its medical technology.

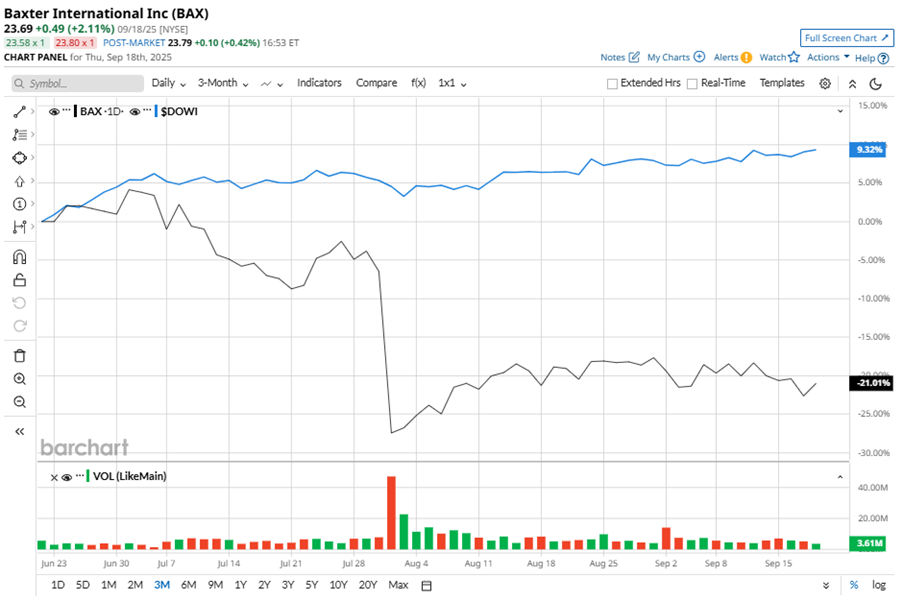

Despite its notable strength, BAX shares have slipped 41.5% from their 52-week high of $40.49, achieved on Sep. 17, 2024. Over the past three months, BAX stock has declined 20.5%, underperforming the Dow Jones Industrials Average’s ($DOWI) 9.4% gains during the same time frame.

In the longer term, shares of BAX dipped 18.8% on a YTD basis and fell 39.8% over the past 52 weeks, considerably underperforming DOWI’s YTD gains of 8.5% and 11.2% returns over the last year.

To confirm the bearish trend, BAX has been trading below its 50-day and 200-day moving averages since October 2024, with some fluctuations.

BAX’s weak performance is due to ongoing operational challenges and cautious hospital expenditure.

On Jul. 31, BAX shares plunged 22.4% after reporting its Q2 results. Its adjusted EPS increased 28.3% year-over-year to $0.59. The company’s revenue stood at $2.8 billion, up 4.3% from the year-ago quarter.

BAX’s rival, Becton, Dickinson and Company (BDX), has taken the lead over the stock, despite its shares plummeting 17% on a YTD basis and 18.7% over the past 52 weeks.

Wall Street analysts are cautious on BAX’s prospects. The stock has a consensus “Hold” rating from the 16 analysts covering it, and the mean price target of $27.86 suggests a potential upside of 17.6% from current price levels.

.jpg?w=600)