With a market cap of $57.5 billion, American Electric Power Company, Inc. (AEP) is one of the largest integrated utility companies in the United States. Serving over 5.6 million customers across 11 states, AEP generates, transmits, and distributes electricity through a diverse energy portfolio that includes coal, natural gas, nuclear, renewables, hydro, solar, and wind.

Companies valued at $10 billion or more are generally classified as “large-cap” stocks, and American Electric Power fits this criterion perfectly. The company operates extensive transmission and distribution infrastructure while also engaging in energy trading and marketing.

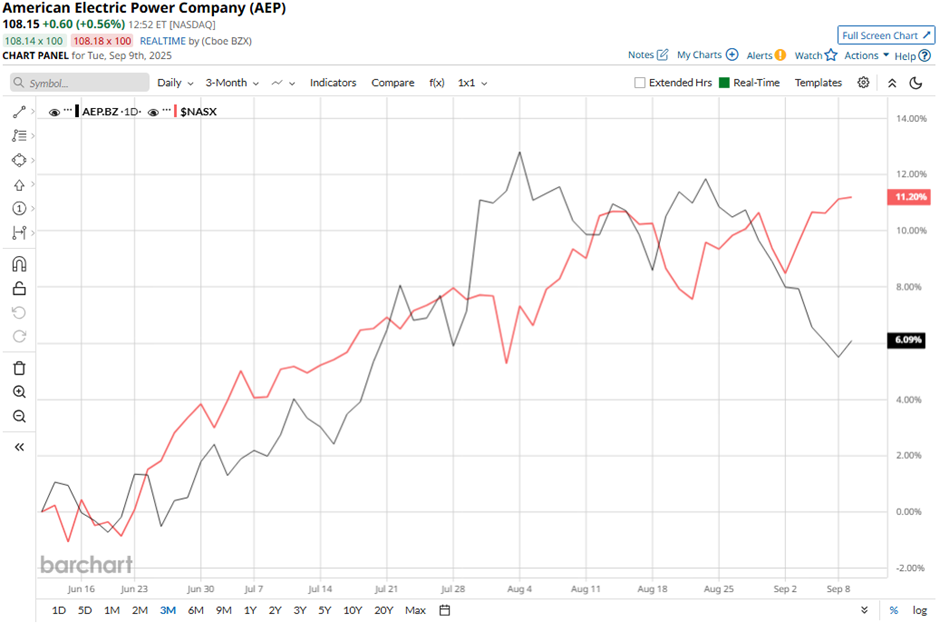

Despite this, shares of the Columbus, Ohio-based company have declined 6.2% from its 52-week high of $115.36. AEP stock has risen 6.6% over the past three months, underperforming the Nasdaq Composite’s ($NASX) 11.3% increase over the same time frame.

In the longer term, shares of the company have gained 4.3% over the past 52 weeks, lagging behind NASX’s 29.2% return over the same time frame. However, AEP stock is up 17.2% on a YTD basis, outperforming NASX’s nearly 13% gain.

Despite few fluctuations, the stock has been trading above its 200-day moving average since last year.

Shares of AEP climbed 3.7% on Jul. 30 after the company posted stronger-than-expected Q2 2025 results, with adjusted EPS of $1.43 and revenue reaching $5.1 billion. The earnings beat was driven largely by higher electricity rates obtained through rate case proceedings, reflecting investments and expenses in service delivery. Investor sentiment was further boosted by AEP’s reaffirmation of its full-year profit guidance of $5.75 per share - $5.95 per share, now expected toward the upper end, and plans to unveil a $70 billion five-year capital plan this fall to meet rising U.S. energy demand.

In contrast, rival Dominion Energy, Inc. (D) has lagged behind AEP stock. Shares of Dominion Energy have risen 8.7% on a YTD basis and 2.1% over the past 52 weeks.

Despite the stock’s underperformance relative to the Nasdaq, analysts remain moderately optimistic on American Electric Power. The stock has a consensus rating of “Moderate Buy” from 19 analysts in coverage, and the mean price target of $115.86 is a premium of 7.1% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here..jpg?w=600)