Madison, Wisconsin-based Alliant Energy Corporation (LNT) operates as a utility holding company, providing regulated electricity and natural gas services. Valued at $16.5 billion by market cap, Alliant serves nearly 1 million electric and 425,000 natural gas retail customers across Iowa and Wisconsin.

Companies worth $10 billion or more are generally described as "large-cap stocks." LNT fits right into that category, with its market cap exceeding this threshold, reflecting its notable size and influence in the utilities sector.

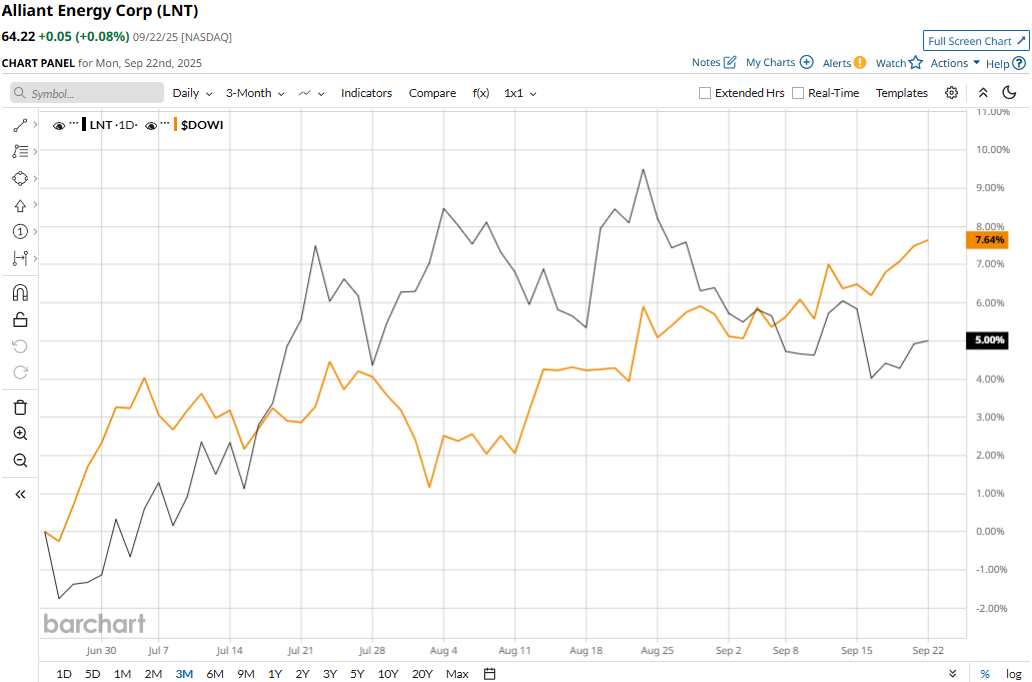

LNT touched its all-time high of $67.11 on Aug. 22 and is currently trading 4.3% below that peak. Meanwhile, the stock has gained 6.1% over the past three months, slightly underperforming the Dow Jones Industrial Average’s ($DOWI) 9.9% surge during the same time frame.

LNT has also underperformed by a thin margin over the longer term. The stock has gained 8.6% on a YTD basis and 7.5% over the past 52 weeks, compared to the Dow’s 9% uptick in 2025 and 10.3% surge over the past year.

Further, the stock has traded mostly above its 200-day moving average over the past year and above its 50-day moving average since early July, with some fluctuations, underscoring LNT’s uptrend.

Alliant Energy’s stock prices observed a marginal dip in the trading session following the release of its mixed Q2 results on Aug. 7. Driven by solid growth in electric utility revenues, along with notable growth in gas utility and other revenues, the company’s overall topline for the quarter came in at $961 million, up 7.5% year-over-year. However, the figure fell 2.7% short of Street’s expectations. Meanwhile, Alliant’s EPS soared by an impressive 100% year-over-year to $0.68, beating the consensus estimates by 9.7%.

When compared to its peer, Alliant has significantly outperformed Public Service Enterprise Group Incorporated’s (PEG) 3.3% dip in 2025 and 5.8% decline over the past year.

Among the 11 analysts covering the LNT stock, the consensus rating is a “Moderate Buy.” Its mean price target of $68.67 suggests a 6.9% upside potential from current price levels.