/Akamai%20Technologies%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

Valued at a market cap of $10.9 billion, Akamai Technologies, Inc. (AKAM) is a leading American provider of cloud computing, cybersecurity, and content delivery network (CDN) services. Headquartered in Cambridge, Massachusetts, the company operates a global edge platform designed to optimize and secure digital experiences for enterprises and consumers worldwide.

Companies valued at $10 billion or more are typically classified as “large-cap stocks,” and AKAM fits the label perfectly, with its market cap exceeding this threshold, underscoring its size, influence, and dominance within the software infrastructure industry. Akamai Technologies remains a pivotal player in the digital infrastructure space, providing scalable and secure solutions to meet the evolving needs of the internet economy.

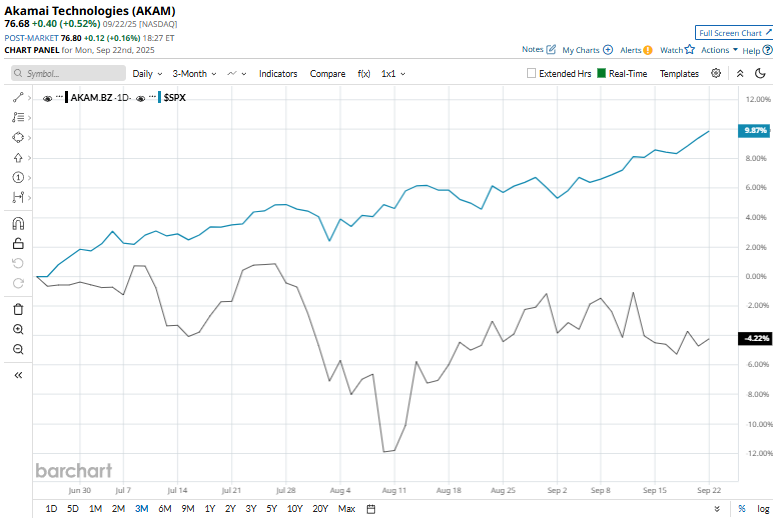

This tech company has dipped 28.2% from its 52-week high of $106.80, reached on Oct. 18, 2024. Shares of AKAM have declined 2.2% over the past three months, trailing the S&P 500 Index ($SPX), which has returned 12.2% over the same time frame.

In the longer term, AKAM has declined 23% over the past 52 weeks, significantly lagging behind $SPX’s 17.4% return over the same period. Moreover, on a YTD basis, shares of AKAM are down 19.8%, compared to $SPX’s 17.4% uptick.

To confirm its bearish trend, AKAM has been trading below its 200-day moving average since the end of February, and it has been below ined under its 50-day moving average since late July.

On Aug. 7, the company released its fiscal 2025 second-quarter results, and its shares dipped 5.7% in the next trading session. Its revenue rose 7% year-over-year to $1.04 billion and non-GAAP EPS stood at $1.73, surpassing analyst expectations. Segment-wise, security and cloud infrastructure services led growth, increasing by 11% and 30%, respectively, while delivery revenue declined by 3%. Geographically, U.S. revenue increased 4% and international revenue improved 10%. With Q3 revenue guidance of $1.035–$1.050 billion and full-year non-GAAP EPS projected at $6.60–$6.80, Akamai is well-positioned for continued expansion, driven by strong demand in security and cloud services.

Akamai Technologies has also significantly underperformed its rival, Cloudflare, Inc. (NET), which surged 176.9% over the past 52 weeks and 112% on a YTD basis.

The stock has a consensus rating of "Hold” from the 21 analysts covering it, and the mean price target of $93.31 suggests a 21.7% premium to its current price levels.