Walmart (WMT) has shown resilience, navigating challenges such as tariffs and maintaining solid sales and earnings growth. In fact, the company’s strong performance recently pushed its stock to an all-time high of $106.11.

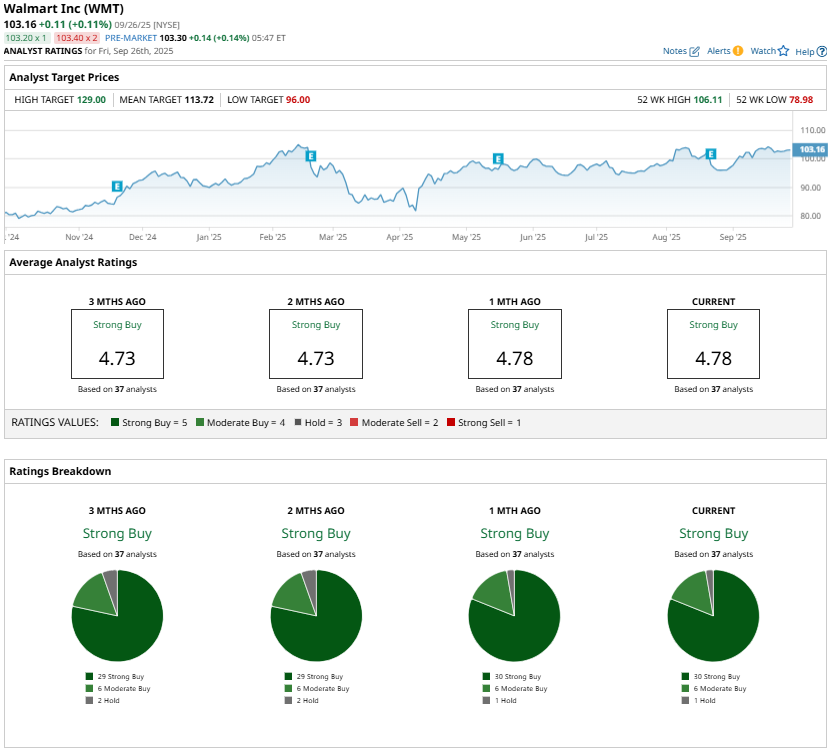

Walmart’s diversified revenue base and strength in the higher-margin businesses, which are increasingly contributing to profitability, augur well for growth. Thanks to these positives, analysts remain optimistic and see upside potential in WMT stock. Meanwhile, the highest price target for Walmart stock is $129, suggesting potential upside of roughly 25% from its closing price of $103.16 on Sept. 26.

Walmart Lifts Full-Year Outlook

Thanks to the ongoing momentum in its business, Walmart increased its full-year guidance. The company raised its sales growth outlook in constant currency by 75 basis points, now targeting a range of 3.75% to 4.75%. This upward adjustment reflects both the strength of Walmart’s year-to-date performance and its expectations for continued share gains in the latter half of the year.

While merchandise category mix may continue to create some headwinds, the overall business mix is expected to remain a margin tailwind. Walmart maintained its adjusted operating income growth forecast at 3.5% to 5.5% in constant currency, signaling steady structural margin improvements despite cost pressures. Meanwhile, the company also raised its full-year EPS guidance slightly, projecting earnings of $2.52 to $2.62 per share, up from the previous range of $2.50 to $2.60.

E-Commerce: The Growth Engine of Walmart

Walmart’s massive store footprint remains the backbone of its operations, with e-commerce emerging as a significant engine for future growth. The retailer’s digital sales increased by 25% in the second quarter compared to the same period last year, reflecting its ability to capitalize on customers’ growing preference for fast and convenient delivery.

Walmart U.S. e-commerce sales grew 26%, an acceleration from the low-20% pace seen in the prior four quarters. Growth was broad-based across fulfillment channels, with delivery from store recording a 50% jump. The company’s fast delivery is a key driver of growth as one-third of recent store deliveries reached customers in three hours or less, and 20% of those were completed in just 30 minutes. This efficiency reflects the advantage of Walmart’s extensive store network, which functions as both retail space and a fulfillment hub.

Marketplace sales also remained solid, rising nearly 20% as more sellers tapped into Walmart’s fulfillment services. This signifies Walmart’s positioning as a retailer and a platform operator, broadening its revenue opportunities while leveraging scale.

Walmart Is Expanding Beyond Retail Margins

Walmart’s profitability is also improving. The company is no longer as dependent on thin retail margins as it is witnessing a growing share of operating income stemming from higher-margin streams such as advertising and membership fees.

In the second quarter, Walmart U.S. e-commerce profitability improved, driven by efficiencies in delivery costs and the rapid expansion of its advertising business. Globally, advertising revenues surged nearly 50%, with Walmart Connect in the U.S. (excluding Vizio) growing more than 30%. Sam’s Club advertising rose 24%, while Flipkart supported growth in international markets. These figures highlight how Walmart is steadily building a digital advertising ecosystem that complements its retail dominance.

Membership income is another durable driver of long-term margins. Enterprise-wide membership fees climbed more than 15%, supported by strong results from Sam’s Club and Walmart+. Sam’s Club achieved 7.6% growth in membership income, underpinned by rising member counts, strong renewal rates, and deeper penetration of higher-tier Plus memberships. Walmart+ continued to expand at a double-digit rate, highlighting the value customers see in its bundled services and benefits.

Looking ahead, the launch of Walmart’s OnePay cash rewards credit card could be a new catalyst. Slated to roll out before the holiday season, the card offers cash back, which will likely encourage spending within the Walmart ecosystem and strengthen customer loyalty.

Conclusion: Can Walmart Stock Reach $129?

Walmart’s ability to adapt, diversify its revenue streams, and leverage its massive physical and digital presence positions it well to deliver solid growth. With momentum in e-commerce and the expansion of higher-margin businesses, such as advertising and membership, Walmart is well-positioned to grow profitably.

With structural advantages stemming from its vast store network, value pricing strategy, continued efficiency gains, and an expected boost from the upcoming Holiday season, Walmart has the fundamentals that could support its stock to climb toward $129 in 2025.