/Invesco%20Ltd%20building%20logo-by%20Poetra_RH%20via%20Shutterstock.jpg)

With a market cap of $9.4 billion, Invesco Ltd. (IVZ) is a global independent investment manager offering products and services across various asset classes, including money market, fixed income, balanced income, equity, and alternatives. Invesco distributes its products through two primary channels: Retail and Institutional.

The Atlanta, Georgia-based company's shares have outperformed the broader market over the past 52 weeks. IVZ stock has surged 40.5% over this time frame, while the broader S&P 500 Index ($SPX) has increased nearly 22%. In addition, shares of Invesco are up 20.3% on a YTD basis, compared to SPX’s 7.5% gain.

Looking closer, Invesco stock has also outpaced the Financial Select Sector SPDR Fund’s (XLF) 26.4% return over the past 52 weeks.

Despite weaker-than-expected Q2 2025 adjusted EPS of $0.36 and adjusted revenue of $1.1 billion, IVZ shares rose 5.2% on Jul. 22 due to investor optimism around the firm’s solid AUM growth, which reached $2 trillion, up 16.6% year over year, driven by strong net inflows, especially in ETFs and international segments.

For the current fiscal year, ending in December 2025, analysts expect IVZ’s adjusted EPS to grow 4.7% year-over-year to $1.79. The company’s earnings surprise history is mixed. It beat or met the consensus estimates in three of the last four quarters while missing on another occasion.

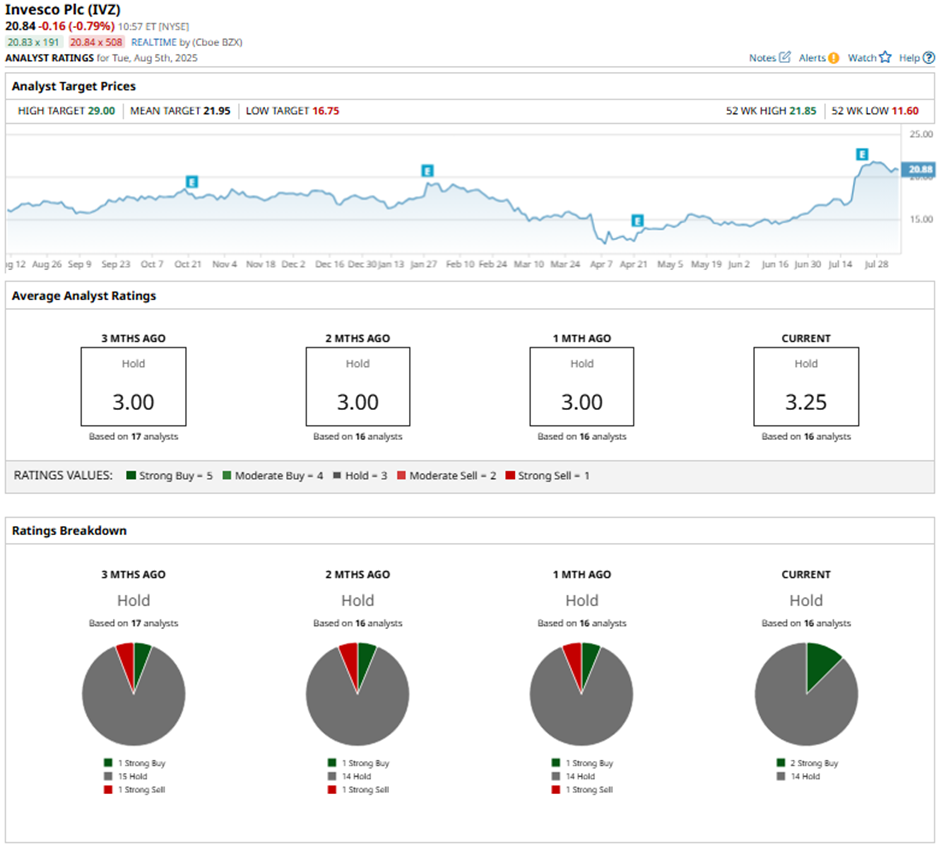

Among the 16 analysts covering the stock, the consensus rating is a “Hold.” That’s based on two “Strong Buy” ratings and 14 “Holds.”

On Jul. 21, TD Cowen upgraded Invesco to “Buy” with a price target increase to $25.

As of writing, the stock is trading below the mean price target of $21.95. The Street-high price target of $29 implies a potential upside of 39.2% from the current price levels.