It’s becoming a familiar theme amid this challenging economic environment. Although tax-preparation giant Intuit (INTU) delivered strong results for its fiscal fourth quarter, investors didn’t like what was hiding in the fine print. As such, INTU stock tanked on Friday, ultimately losing a hair over 5%. While it was an ugly ride for another otherwise reliably boring enterprise, the volatility could open doors for bullish speculators.

Outside of any other context, Intuit would appear to be a resoundingly strong business. In fiscal Q4, the company posted non-GAAP earnings per share of $2.75, beating the consensus view of $2.65. Notably, the bottom-line print represented a 38.2% jump from the year-ago quarter. On the top line, the tax prep specialist generated $3.83 billion, again beating estimates, which in this case stood at $3.74 billion. Further, the latest tally shot up 20.3% year-over-year.

As Barchart content partner Zacks Investment Research mentioned, the robust results “reflected a rise in Global Business Solutions, Consumer, Credit Karma and ProTax revenues year over year.” With so much good news, what contributed to the disappointing performance in INTU stock?

Some of the volatility likely could be traced to Mailchimp, Intuit’s email marketing and automation platform, which it acquired in 2021. Unfortunately, integration pains with small businesses — the business unit’s core audience — weighed down overall results.

But what really may have freaked out market participants was the perceived weak guidance. For fiscal 2026, Intuit anticipates revenue to land between $20.997 billion and $21.186 billion, indicating a growth rate of about 12% to 13%. That’s awfully conservative relative to the growth rate just witnessed in Q4, suggesting that the company may have hit a near-term peak.

Still, with the fallout, those who are willing to take a wager may be staring at a discounted opportunity.

INTU Stock Lights Up the Unusual Options Screener

Not surprisingly, INTU stock made the ranks of Barchart’s Unusual Stock Options Volume screener. Among the top 500 securities broadcasting aberrant transactions relative to near-term norms, Intuit clocked in at number nine.

By the closing bell Friday, total options volume had hit 50,865 contracts, representing a 549.29% leap over the trailing one-month average. Interestingly, though, call volume landed at 21,122 contracts, while put volume spiked to 29,743 contracts, generating an elevated put/call ratio of nearly 1.41.

Ordinarily, this might concern investors as the ratio implies more traders buying puts than calls. However, options can be bought and sold, thus changing the character of the position from debit-based to credit. That could change the entire meaning of the trade itself.

A potentially more insightful analysis comes from options flow, which focuses exclusively on big block transactions likely placed by institutional investors. Heading into the weekend, net trade sentiment stood at $1.616 million above parity, favoring the bulls. However, the dollar volume was relatively evenly split between bulls and bears, possibly suggesting that many of the transactions were part of multi-leg strategies.

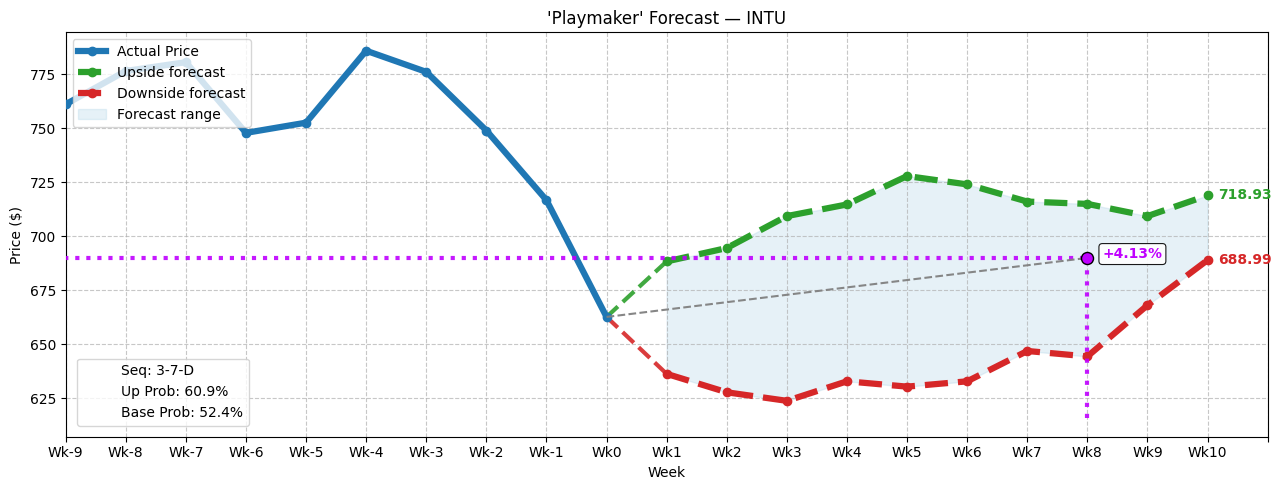

From a framework of discrete-state analysis, in the past 10 weeks, the market voted to buy INTU stock three times and sell seven times. Throughout this period, the stock incurred a downward trajectory. For classification purposes, this sequence can be labeled as 3-7-D.

What’s notable here is that in 60.9% of cases, the week following the flashing of the 3-7-D results in upside, with a median return of 3.88%. Should the bulls maintain control of the market over the next 10 weeks, past analogs suggest that INTU stock could potentially reach just under $719. Interestingly, the downside pathway is eventually projected to rise to $689 at the 10-week mark.

That’s not to say that INTU stock is devoid of risk. Over the next several weeks, the risk and reward envelopes may resemble a football. In other words, INTU may offer great rewards but it may also impose high risks.

Nevertheless, if you’re willing to accept the downside dangers, there’s a particular trade that stands out.

Taking Advantage of the Market’s Generosity

Using the market intelligence above, aggressive but rational traders may consider the 680/690 bull call spread expiring Oct. 17. This transaction involves buying the $680 call and simultaneously selling the $690 call, for a net debit paid of $480 (the most that can be lost in the trade). Should INTU stock rise through the short strike price ($690) at expiration, the maximum profit is $520, a payout of over 108%.

What makes this trade appealing is that the price target is roughly in the middle of the risk and reward envelopes. As well, there are approximately eight weeks to expiration, which should give plenty of time for INTU stock to rise by 4.13%. That should be a doable target considering that Intuit is now on a relative discount.

Finally, while management acknowledged difficulties and challenges in the most recently disclosed quarter, it also anticipates improving conditions — especially for Mailchimp. If so, INTU stock would be well worth considering.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.