Rachel Reeves has said the Bank of England’s (BoE) interest rates cut could knock £100 off monthly mortgage payments for first-time buyers.

On Thursday, the Monetary Policy Committee (MPC) voted 5-4 in favour of cutting interest rates from 4 per cent down to 3.75 per cent, the fourth rate cut of the year as inflation continues to ease.

The chancellor told broadcasters after the decision: “What it means for a first-time buyer with an average-sized mortgage is £100 less a month because of the successive cuts in interest rates.”

The cut marks the lowest point interest rates have been at in close to three years, since February 2023.

It will likely result in another sharp cut to savings rates, a blow to some households, but others will hope the wider mortgage market will be boosted by more product rate drops over the coming weeks, with up to 1.9m people expected to see their fixed rate deals end in 2026.

While most mortgage deals are not immediately affected by rate cuts, lenders will adjust their rates for new deals based on swap rates - agreements based on future expectations of interest rate movements.

Key Points

- Bank of England cuts interest rates to 3.75 per cent

- Rachel Reeves hails 'fastest pace of cuts in 17 years'

- Still a 'massive question mark' over 2026 despite interest rates cut

- Analysis: Interest rates cut will be notable after rampant inflation

– What does the cut say about other aspects of the economy?

17:29 , Athena StavrouInterest rates are also often cut in a bid to help stimulate economic growth, with high rates sometimes weighing on investment and spending.

UK gross domestic product (GDP) grew by 0.1% in the third quarter of the year and is on track to be flat for the final quarter.

The MPC’s report also highlighted “building slack in the labour market”, while pay growth is also set to ease further.

It comes after Office for National Statistics data showed that unemployment lifted to 5.1% in the three months to September.

What does interest rate cut actually mean?

17:00 , Athena StavrouThe base rate helps dictate how expensive it is to take out a mortgage or a loan.

Many lenders have been chopping rates in recent months in expectation of the Bank of England lowering its base rate.

Mortgage borrowers therefore typically seek a reduction in interest rates in order to help bring down variable rates, or to allow for lower mortgage rates when they next remortgage.

However, savings rates are also linked to the interest rate and will be reduced in the coming weeks.

Further cuts will be a 'closer call', BoE governor says

16:34 , Athena StavrouInterest rates have been reduced to their lowest in nearly three years as Budget measures are set to push down on inflation but the Bank of England cautioned that further cuts will be a “closer call”.

The Bank’s Monetary Policy Committee (MPC) voted to reduce rates from 4% to 3.75%.

Governor Andrew Bailey said the UK has “passed the recent peak in inflation and it has continued to fall”, allowing the MPC to cut borrowing costs for the fourth time this year.

“We still think rates are on a gradual path downward,” he added.

“But with every cut we make, how much further we go becomes a closer call.”

Full story: What the latest interest rates change means for your mortgage, savings and bills

16:08 , Athena Stavrou

What the latest interest rates change means for your mortgage, savings and bills

Pound holds firm after interest rates decision

15:49 , Athena StavrouThe pound, which had earlier weakened against the dollar, held firm at 1.34 dollars following the Bank’s decision to cut rates.

Sterling was 0.2 per cent higher at 1.14 euros.

On the London market, the FTSE 100 Index was largely unchanged, down 2.1 points at 9772.3.

Trade union calls on Bank of England to go 'further and faster'

15:38 , Athena StavrouThe trade union TUC has said that while the decision is welcome, it does not go far enough to support the UK’s fragile economy and has called for the Bank of England to go “further and faster” in 2026.

TUC General Secretary Paul Nowak said: “This rate cut is welcome – but one cut every now and again isn’t enough for a fragile economy struggling with stagnant demand and failing confidence.

“The Bank must go further and faster next year after a cautious 2025 – it’s vital this marks the start of a sequence of quick fire and substantial rate cuts.

“That’s what households and firms need right now. More money in the pockets of working people means more spend on our high streets – and lower interest rates will give firms the confidence to invest and incentivise wealthier households to spend."

Who were the five members who voted in favour of the cut?

15:18 , Athena StavrouThe Bank of England said members of the Bank’s Monetary Policy Committee (MPC) voted 5-4 to reduce interest rates to 3.75 per cent.

Five members – Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor – voted in favour of the cut, securing a majority.

What impact has the Government had on interest rates?

14:57 , Athena StavrouOn Thursday, Chancellor Rachel Reeves hailed the rate cut as “good news for families with mortgages and businesses with loans”.

The cut came as the Bank said measures from last month’s Budget will help bring down inflation quicker than previously thought.

Budget measures are likely to lower CPI inflation by around 0.5 percentage points, according to the MPC.

Lower inflation expectations are likely to have contributed to the decision to cut rates.

However, numerous members of the MPC also linked their vote for an interest rate cut to weak growth in the UK economy.

Deputy governor Dave Ramsden highlighted a “sluggish growth outlook” and “consistently weak consumer confidence” in justifying his vote for a cut.

What happened to interest rates on Thursday?

14:37 , Athena StavrouThe Bank of England’s Monetary Policy Committee (MPC) reduced the base interest rate by 0.25 percentage points, to 3.75%.

The nine-member committee voted five to four in favour of the cut.

Five members – Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor – voted for the reduction.

Meanwhile, four – Megan Greene, Clare Lombardelli, Catherine Mann and Huw Pill – preferred to keep rates at 4%.

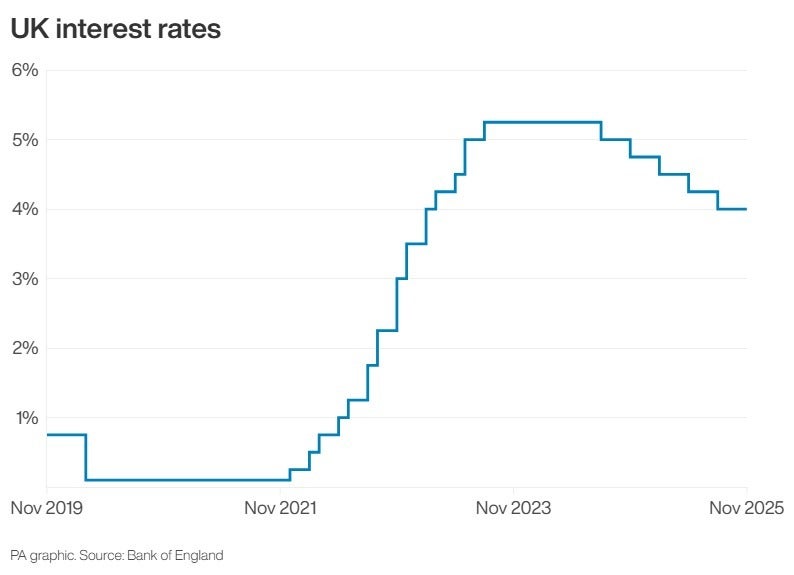

The reduction was the sixth time interest rates have been cut since the start of last year, coming down from a peak of 5.25%.

What about savings accounts?

14:13 , Athena StavrouThe Independent’s business and money editor Karl Matchett reports:

If you have money in a savings account, it’s the other side of the see-saw to mortgages: rates going down mean you’ll earn less interest.

As there has been a bit of a fierce battle raging among banks and building societies for customers, it’s still possible to get good deals if you are happy to lock in money for a fixed period of time or contribute regular amounts, with several offering more than 4 per cent until recently.

However, it’s likely some will be removed from the market or have their rates altered in the coming days, while many of the best deals in easy access accounts have been below 4.5 per cent for a while now.

There are always terms and conditions to be met, so ensure any accounts you open suit your circumstances, but the opportunity still remains to save and earn money at a better rate than inflation, which currently sits around 3.2 per cent.

Do be aware of the amount of interest you can earn without being taxed, though. If your savings account interest rate isn’t fixed, banks can always change the rate you get up or down.

A tax-efficient way of saving is to use a Cash ISA, where everyone (for now!) has a £20,000 personal allowance each year, which will drop to £12,000 soon with the other £8,000 reserved for tax-free investing.

Interest rates cut to cut £100 monthly mortgage payments - Reeves

13:52 , Athena StavrouRachel Reeves said the interest rates cut could knock £100 off monthly mortgage payments for first-time buyers.

The Chancellor told broadcasters during a visit to a north London community centre: “It’s welcome news for families and businesses that the Bank of England have now cut interest rates six times since the general election, taking interest rates to 3.75%, the lowest in nearly three years, and the fastest pace of interest rate reduction for 17 years.

“What it means for a first-time buyer with an average-sized mortgage is £100 less a month because of the successive cuts in interest rates.”

What does the interest rate mean for mortgages?

13:42 , Athena StavrouThe Independent’s business and money editor Karl Matchett reports:

Broadly speaking, as increasing interest rates over the last few years have meant mortgage repayments going up, then the reverse also holds true: lower rates, lower repayments. However, there are several important things to note.

Firstly, that it’s only the interest on the repayments which should change — your capital repayments will naturally decrease the more you pay off your mortgage. Secondly, the base rate isn’t the rate you are necessarily charged by your bank or lender for the mortgage — they’ll base theirs off the BoE rate but it doesn’t have to be the same.

More than half a million people do, however, have a mortgage which tracks the BoE interest rate and those will see an immediate change. Far more have fixed term deals which expire each year and need renegotiating - almost 2m homes are expected to seek renewed deals in 2026.

If you’ve got a fixed term on a mortgage plan, you won’t see a change in any case until that comes to an end and you start a new one, but if you’ve already finished and moved onto a standard variable rate (SVR) deal then you might see a change in your repayments.

New mortgage products tend to be based on swap rates - market agreements based on future expectations of interest rates movements - rather than the current Bank Rate, which is why there has been a recent battle between lenders dropping their rates even before the cut today.

'Credit where it's due': Budget measures to help inflation

13:30 , Athena StavrouExperts have explained how measures in Rachel Reeves’ Budget have impacted falling inflation.

Laith Khalaf, head of investment analysis at AJ Bell, said: “A Christmas rate cut will bring some much needed financial cheer to households and businesses across the country, especially those who are battling to keep the show on the road. But there were definite signs of hawkishness in the minutes of the MPC meeting.

“Inflation is now expected to fall back closer to the 2% target in the spring, which would be a real boost to consumers. The Bank reckons this is largely down to the energy price measures included in Rachel Reeves’ recent Budget, so credit where it’s due.”

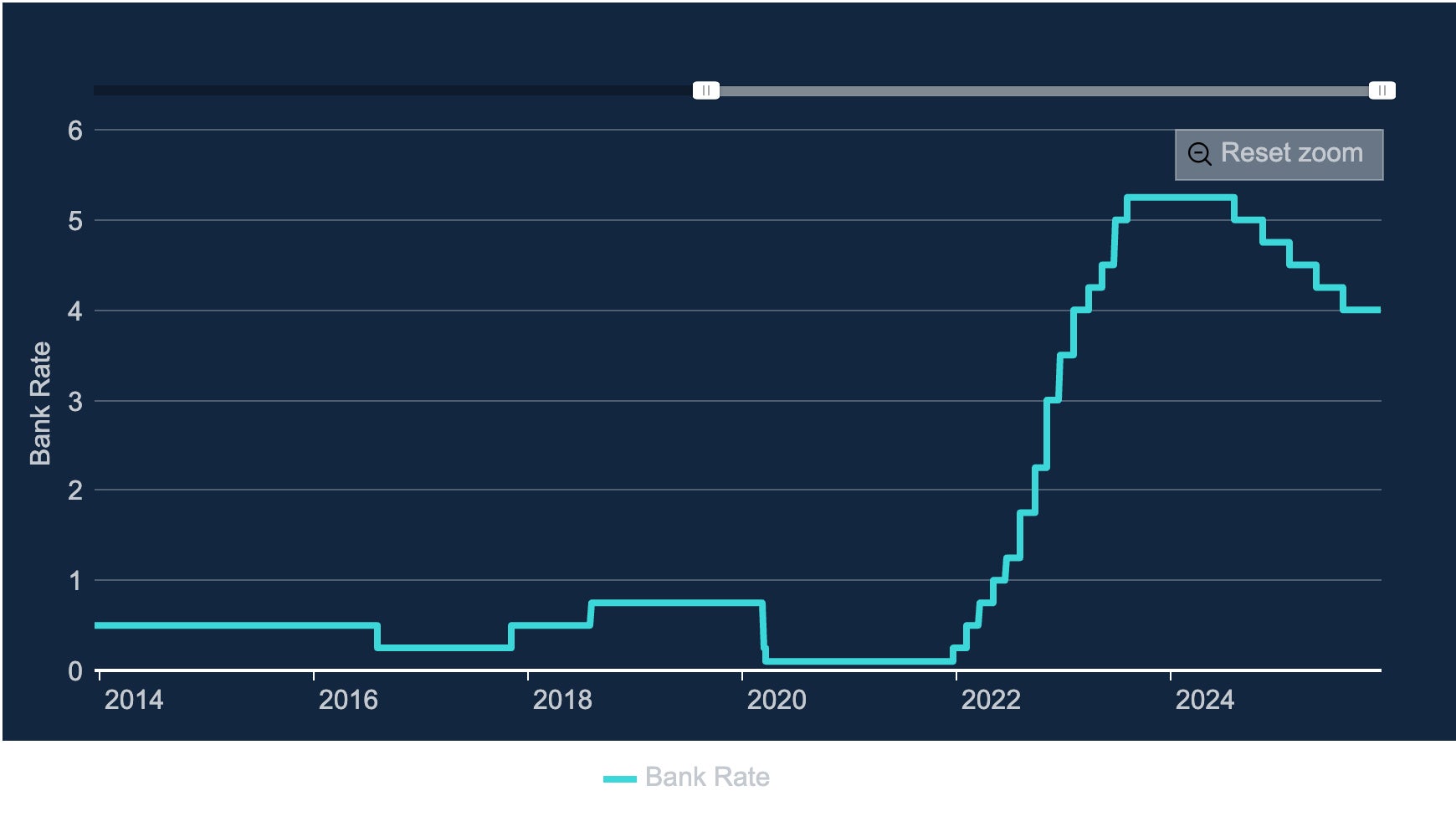

Graph: UK interest rates

13:15 , Athena Stavrou.jpeg)

Interest rates cut will be a 'Christmas present' for mortgage holders

12:59 , Holly EvansLorna Hopes, mortgage specialist at the financial advisers Smith & Pinching: “The Bank of England has delivered the Christmas present that thousands of homebuyers, and anyone about to remortgage, was hoping for.

“Many borrowers can now get a fixed rate of well under 4 per cent, and there are some eye-catching deals available to some remortgagers and buyers with a big deposit.

“Anyone with a variable rate mortgage will see their monthly payments tick down automatically as a result of today’s decision, but the biggest winners might be the thousands of people due to come off a two-year fixed rate deal in 2026; they should be able to remortgage onto a much lower rate."

What the latest interest rates change means for your mortgage, savings and bills

12:50 , Holly EvansThe Bank of England (BoE) announced on Thursday its decision to cut interest rates to 3.75 per cent, a fourth cut of the year.

For December’s vote, the bank’s nine-person Monetary Policy Committee (MPC) showed just a slight swing compared to last time out pre-Budget in November; a 5-4 split then favouring a hold became a 5-4 split in favour of cutting this time, with governor Andrew Bailey a key switcher.

Following on from falling inflation rates, poor economic figures and rising unemployment, it brings the base rate down to the lowest level in almost three years.

Here’s a brief rundown of what the current interest rate might mean for you:

Read the full article here:

What the latest interest rates change means for your mortgage, savings and bills

BofE governor says UK has 'passed the recent peak in inflation'

12:41 , Holly EvansGovernor Andrew Bailey said the UK has “passed the recent peak in inflation and it has continued to fall”, allowing the MPC to cut borrowing costs for the fourth time this year.

It takes the bank’s base interest rate to its lowest level since early 2023.

The nine-person committee voted five-to-four for a cut, with Mr Bailey among those preferring to lower rates at the Bank’s final meeting of the year.

The decision comes after official figures showed Consumer Prices Index (CPI) inflation fell sharply to 3.2 per cent in November, from 3.6 per cent in October.

Minutes of the MPC’s meeting read: “This was above the 2 per cent target but, following the Budget announcements on administered prices and indirect taxes, headline inflation was now expected to fall back more quickly in April, to closer to 2 per cent.”

It means CPI will near the Bank’s target level considerably earlier than the early 2027 timeframe that it had forecast in November.

Labour need 'clear focus on delivery' in 2026, says expert

12:33 , Holly EvansA business expert has said that this latest cut will provide some relief, but has called on the Labour government to have a “clear focus on delivery” ahead of 2026.

Muniya Barua, Deputy Chief Executive at BusinessLDN, said: “This cut to interest rates will provide a measure of relief for some firms but, with growth flatlining, what they really need to see is new action to get the economy moving again.

“The Government must have a clear focus on delivery as we head into 2026 if it is to bolster business confidence.

“Tackling barriers that could hold up major infrastructure projects, thinking again about reforms to the business rates system that could hit investment, and ensuring that a proposed overnight stay levy is ringfenced to support growth would help to start the new year on the right footing.”

Expert says savers facing 'blow after blow'

12:29 , Holly EvansKate Steere, personal finance expert at comparison site Finder, said: “It's blow after blow for savers at present. Following the budget, which saw cash ISA allowances cut and tax on savings interest increased, they’ve now been hit with a further base rate cut.

“While widely expected, this will act as a green light for providers to slash their rates further. In fact, NatWest and Bank of Ireland already dropped rates on several products yesterday and today before the cut was even announced.

"Despite a notable drop in inflation, savings rates continue to lag behind, eroding Brits' hard-earned cash.

“Finder research shows that almost half of Brits were already earning less than November’s inflation figure on their savings - a figure likely to rise following today's rate cut. Don't wait until the new year to find a new home for your savings. It's crucial to secure the highest rate available to make your money work for you."

Pound holds firm after interest rates decision

12:24 , Holly EvansThe pound, which had earlier weakened against the dollar, held firm at 1.34 dollars following the Bank’s decision to cut rates.

Sterling was 0.2 per cent higher at 1.14 euros.

On the London market, the FTSE 100 Index was largely unchanged, down 2.1 points at 9772.3.

Shadow chancellor says cut shows 'growing concerns about the weakness of our economy'

12:23 , Holly EvansResponding to the latest interest rates cut, shadow chancellor Sir Mel Stride said: “Lower interest rates will be welcome news for many families – but rates are being cut despite inflation remaining well above target, thanks to rising unemployment and low growth under Labour.

“This decision reflects growing concerns about the weakness of our economy. Labour’s choices have left us with the highest inflation in the G7, while the latest figures showed the economy shrinking and unemployment back to pandemic levels.

“The economic mismanagement of Rachel Reeves has left the Bank of England with an impossible dilemma, balancing high inflation against a fragile economy.

“Only the Conservatives have a leader with a backbone, a clear plan and a strong team to deliver a stronger economy.”

Lower interest rates will be welcome news for many families - but rates are being cut despite inflation remaining well above target, thanks to rising unemployment and low growth under Labour.

— Mel Stride (@MelJStride) December 18, 2025

This decision reflects growing concerns about the weakness of our economy. Labour's… https://t.co/JOkuuuwWW3

Trade union calls on Bank of England to go 'further and faster'

12:19 , Holly EvansThe trade union TUC has said that while the decision is welcome, it does not go far enough to support the UK’s fragile economy and has called for the Bank of England to go “further and faster” in 2026.

TUC General Secretary Paul Nowak said: “This rate cut is welcome – but one cut every now and again isn’t enough for a fragile economy struggling with stagnant demand and failing confidence.

“The Bank must go further and faster next year after a cautious 2025 – it’s vital this marks the start of a sequence of quick fire and substantial rate cuts.

“That’s what households and firms need right now. More money in the pockets of working people means more spend on our high streets – and lower interest rates will give firms the confidence to invest and incentivise wealthier households to spend."

Base rate cut is a 'positive boost' for housing market

12:17 , Holly EvansGuy Gittins, CEO of Foxtons, commented: “Today’s base rate cut is a positive boost for the housing market and should help maintain the momentum we’ve seen building throughout 2025 as we head towards the new year.

Lower borrowing costs will improve affordability for buyers, while giving additional confidence to sellers that demand will continue to strengthen following the removal of Autumn Budget uncertainty."

Analysis: Vote indicates what the Bank of England hope for 2026

12:13 , Holly EvansOur business correspondent writes...

There's more to understand from today's minutes which might give us an indication of what's next...or rather, what the BoE hope is next.

"Although [inflation is] above the 2 per cent target, it is now expected to fall back towards target more quickly in the near term," says the MPC.

"The extent of further easing in monetary policy will depend on the evolution of the outlook for inflation."

In plain English: inflation is lower, and going the right direction, but for any further interest rate cuts the voting members need to see more data which continues to suggest exactly that.

Primary in their sights will be future ONS numbers around employment levels and, especially, wage growth levels, which are still higher than might be expected at present.

Rachel Reeves hails 'fastest pace of cuts in 17 years'

12:10 , Holly EvansChancellor Rachel Reeves said: “This is the sixth interest rate cut since the election – that’s the fastest pace of cuts in 17 years, good news for families with mortgages and businesses with loans.

“But I know there’s more to do to help families with the cost of living.

“That’s why at the Budget we froze rail fares and prescription charges, and will be cutting £150 off the average energy bill next year.”

Who were the five members who voted in favour of the cut?

12:06 , Holly EvansThe Bank of England said members of the Bank’s Monetary Policy Committee (MPC) voted 5-4 to reduce interest rates to 3.75 per cent.

Five members – Andrew Bailey, Sarah Breeden, Swati Dhingra, Dave Ramsden and Alan Taylor – voted in favour of the cut, securing a majority.

Analysis: Cut expected but concerns remain over inflation

12:05 , Holly EvansOur business correspondent Karl Matchett writes...

As expected, the rate is cut to 3.75%, but the detail for today was always about the vote split and the comments thereafter.

Now we know: it's a 5-4 split, just edged in favour of the cut by governor Andrew Bailey switching his vote compared to the one taken pre-Budget in November.

However, there's still concern about "forward-looking evidence on services inflation, wage growth and inflation expectations above target-consistent levels", says the MPC minutes of today's vote.

Essentially, that means the four voters who wanted to stay at 4 per cent are worried that lowering interest rates too early will see us return to higher costs and inflation.

Bank of England cuts interest rates to 3.75 per cent

12:00 , Holly EvansThe Bank of England (BoE) has cut interest rates from 4 per cent down to 3.75 per cent, after Monetary Policy Committee (MPC) members voted in favour of the cut.

What are the influential factors that could sway interest rates?

11:40 , Holly EvansThe MPC has nine members, and their votes decide whether the base rate is cut, raised, or kept the same.

Among the elements MPC members will have been looking at are job and wages data, the level of inflation across the UK, and economic growth.

Each of those has come in for November over the past week and at face value, each says cut, cut, cut will be the outcome: rising unemployment, lowering inflation and no economic growth at all – in fact UK GDP fell 0.1 per cent in the three months to October.

Higher inflation is a reason to keep interest rates up, as it can discourage businesses from investing in new projects or hiring – things that in turn raise earnings and spending power. Conversely, fewer jobs and lower wages means less spending power and lower demand, which helps to stem further price rises.

Recent key data has shown salary growth slowing and unemployment rising throughout the year. These are factors that can see interest rates decrease, while there are also external factors that can affect the UK, which the government and Bank of England can have little or no control over.

Will interest rates go down today? Bank of England’s key factors and 2026 predictions

11:07 , Holly EvansThe Bank of England’s (BoE) next meeting to determine interest rates is today (18 December), and all eyes will be on the Monetary Policy Committee (MPC) and whether its members opt to continue lowering rates.

The base rate – currently at 4 per cent after being cut three times this year – impacts business, consumers and taxpayers through everything from mortgages to loans and savings, so what do experts foresee, both this week and beyond?

Will interest rates be cut?

Read our full explainer here:

Will interest rates go down tomorrow? Key factors and 2026 predictions

Governor's guidance will set the tone for 2026, says analyst

10:29 , Holly EvansChris Beauchamp, chief market analyst UK at investment platform IG said: “While today’s decision is the foregone conclusion – next year’s outlook is the crucial element. Yesterday's inflation data has handed the BoE the justification it needs to move more aggressively in the new year.

“With headline inflation undershooting expectations and wage pressures finally easing, the obstacles to further cuts are rapidly disappearing.

“Governor Andrew Bailey's guidance will set the tone for early 2026. And the committee's updated forecasts will be crucial.

“If they downgrade inflation projections for 2026, that effectively pre-announces further easing. Markets are already pricing two to three cuts next year, and that could shift higher if the BoE signals comfort with the inflation outlook."

Will an interest rate cut affect my savings?

09:58 , Karl MatchettThis question is a more immediate issue for many people. Savings rates have been pretty good for a couple of years now - that's the flip side of rising inflation (which everybody hates), that interest rate increases mean you can earn money on your money (which everybody likes).

For quite a while we've been able to earn an easy 5 per cent or more in very basic easy-access savings accounts, but in the past few months that has dropped down to 4.5 per cent for only the very best accounts.

Most offer less already, and if you've not moved your money by now you've likely missed the boat for even those. Easy access accounts tend to be variable rate, which means they'll move in tandem with the BoE's rate.

If the MPC votes for a cut today, then many bank accounts will follow suit, lowering the rate you earn - which is why it's important to keep moving your money to ensure you're getting as good a rate as possible.

The major exception here is if you've locked money away in a fixed-term savings account (also called a fixed-term bond); in these, the interest rate at the moment you put your money in is the rate you'll get for the full term, be it a year or two years or sometimes even more.

The negative is that you usually can't withdraw your cash from these until the end of the deal; on the positive side though, you'll still get that higher initial rate even if the BoE cuts interest rates multiple times during that period.

How do interest rates affect mortgages?

09:44 , Karl MatchettFirst thing to note is, your mortgage might not be immediately affected when interest rates change. If you are on a fixed rate deal, you'll stay on whatever that rate is until it expires - typically two, three or five years, but it can be very different.

But for people on SVR (standard variable rate) or tracker mortgages, those deals should switch up straight away...so lower, in this instance, after a rate cut is confirmed.

The wider picture is the mortgage market: banks and building societies jostling for position and custom, trying to out-do each other with better rates, better terms and lower fees to attract you the next time you have to renew your mortgage deal.

With the UK property market being in a fairly poor state right now - lots of pre-Budget uncertainty made people hesitate when they might have been considering buying or selling up - that competition for custom has increased significantly, with a clutch of lenders such as Barclays, Nationwide, HSBC and Santander all offering plenty of deals at below 4 per cent interest.

Barclays last week offered one specific deal at 3.51 per cent, in fact. So how do they go lower than the BoE's base rate?

That's because mortgages are based on swap rates - essentially, expectations of future interest rate movements - and they are traded on markets with regularity, allowing lenders to move their own prices and products ahead of any change in the main interest rate.

What has impacted inflation figures?

09:28 , Holly EvansThe BoE doesn’t only consider inflation: economic growth, wages, employment rates and plenty of other factors in the geopolitical landscape can come into play.

But with a government-set target of 2 per cent inflation to aim for, interest rates tend to be left higher until inflation looks to be under more control and heading back towards its intended target.

Consumer Prices Index (CPI) inflation is usually the figure used as the headline number - that’s at 3.2 per cent now. But it’s important to also look at the CPI data which includes costs for running households (CPIH), and this was 3.5 per cent for last month. CPIH is the preferred metric for the Office for National Statistics (ONS), who are responsible for collecting and releasing the data.

Rising food and drink prices for much of this year and wage growth not slowing to comfortable levels have been problems hampering further rate cuts this year.

But food prices did drop in November, as did wage growth, while unemployment rates rose and the economy contracted 0.1 per cent - all this means interest rates should drop this time around.

Risk that Bank of England 'may need to play catch-up in 2026'

09:08 , Holly Evans“UK price pressures are rapidly easing amid persistent softness in demand growth. We expect headline inflation to fall towards the BoE’s 2 per cent target over the course of next year,” said Peel Hunt chief economist Kallum Pickering.

Mr Pickering thinks the risk now is that the BoE has “fallen behind the curve and may need to play catch-up in 2026”.

“We will be paying careful attention to the voting pattern and forward guidance which accompany tomorrow’s BoE decision for a signal that the bank is ready to lean harder against downside risks,” he explained.

“Do not be surprised if the BoE sends dovish signals that it stands ready to lean against downside risks next year – implying cuts at successive meetings.

Analysis: Interest rates cut will be notable after rampant inflation

08:45 , Holly EvansOur business correspondent Karl Matchett writes...

Assuming the rate cut does indeed arrive, it'll be a notable one: the lowest that the base rate has been for nearly three years, since it jumped from 3.5 per cent to 4 per cent in February 2023.

This year we've had three rate cuts already and the last time we had four or more in a single year was way back in 2008, when we had five in quick succession in the aftermath of the financial crisis.

Very different circumstances this time around thankfully, but rates have been high for a clear and difficult reason in the UK - rampant inflation, especially across 2022 and 2023.

Yesterday's data showed CPI has dropped down to 3.2 per cent, but it's still well above the target of 2%, which is why interest rates haven't come down quite as quickly as some were hoping for.

How rising inflation impacts your mortgage and savings

08:22 , Holly EvansInflation has been on a difficult path in 2025, initially dropping before surging back up from April onwards.

However, it appeared to peak over summer and the latest figures thankfully have inflation back on the downward path, with Consumer Prices Index (CPI) inflation rate falling back to 3.2 per cent in November.

While the rate is lowering, remember, that does not mean prices are coming down - it means they are rising more slowly than previously.

In part as a result of this tough-to-shift inflation, the Bank of England (BoE)’s Monetary Policy Committee have held interest rates higher than hoped for, though they are now likely to vote for a pre-Christmas cut to move the base rate down to 3.75 per cent.

Read the full explainer from our business correspondent here:

How did the FTSE 100 fare on Wednesday?

07:55 , Holly EvansThe FTSE 100 made strong headway on Wednesday, supported by a larger-than-expected cooling in inflation and a spike in the oil price.

The FTSE 100 index closed up 89.53 points, 0.9 per cent, at 9,774.32. It had earlier traded as high as 9,853.13.

The FTSE 250 ended 123.78 points higher, 0.6 per cent, at 22,164.76, and the AIM All-Share ended up 2.07 points, 0.3 per cent, at 751.48.

The soft UK inflation data sealed the Bank of England’s (BoE) expected interest rate cut on Thursday and increased the likelihood of further reductions in 2026, analysts said.

Sharp drop in November inflation 'green lights' December rate cut

07:46 , Holly EvansJames Smith, developed market economist for ING, said the sharp drop in November inflation “green lights” a December rate cut.

“Christmas has come early for the doves at the Bank of England, with inflation coming in well below expectations in November,” he said.

Mr Smith said he was expecting inflation to edge higher in December, partly due to a seasonal spike in air fares.

However, he said the “latest drop in inflation fits into a broader body of evidence suggesting that price pressures are cooling”, adding: “We expect headline inflation to fall pretty close to 2 per cent by May.”

He is forecasting another two cuts to interest rates in February and April next year.

Alongside falling inflation, the MPC is expected to take note of other signs that the economy is cooling including rising unemployment, slower wage growth and stagnant economic growth.

Still a 'massive question mark' over 2026 despite interest rates cut

07:28 , Holly EvansDanni Hewson, head of financial analysis for AJ Bell, said: “Although 3.2 per cent is still way above the Bank of England’s target, it is expected to be the final piece in the puzzle which will enable rate setters to deliver their own festive gift to borrowers with an interest rate cut on Thursday.”

The Bank is tasked with bringing inflation down to the 2 per cent target level.

Ms Hewson added: “There are still massive question marks about what 2026 will bring and markets don’t expect the Bank of England to cut interest rates more than once or twice over the next year, so borrowers hoping to see a return to the ultra-low levels many people had become used to will have to adapt.”

Bank of England poised for Christmas interest rate cut after inflation slows

07:23 , Holly EvansInterest rates are set to be cut before Christmas after inflation fell to an eight-month low in November, economists think.

The Bank of England is widely expected to reduce borrowing costs to 3.75 per cent from 4 per cent when it next announces its next decision on Thursday.

This would bring borrowing costs down to the lowest rate since the beginning of February 2023.

Experts have said the Bank’s Monetary Policy Committee (MPC) will be encouraged by recent economic data to lower rates at its final meeting of the year.

In particular, the decision follows the release of the latest inflation data, which showed a bigger drop to Consumer Prices Index (CPI) inflation than analysts had been expecting.

The rate of CPI fell to 3.2 per cent in November, from 3.6 per cent in October, the Office for National Statistics (ONS) said.

This was largely driven by food and drink inflation which dropped to 4.2 per cent from 4.9 per cent, while alcohol and tobacco prices also eased.