The Reserve Bank has lifted interest rates for the fifth month in a row, increasing the cash rate by 0.5 percentage points to 2.35 per cent, a seven-year high.

Look back on Tuesday's developments.

Key events

- If inflation is being caused by global factors, how will increasing interest rates fix it? Gareth Hutchens explains

- Why is the RBA lifting rates so quickly? Gareth Hutchens explains

- Have you been impacted by the rise in interest rates?

- How much extra could mortgage repayments cost now the cash rate is 2.35 per cent?

- Treasurer: 'This will be difficult news for a lot of Australians with a mortgage'

- RBA raises interest rates by 0.5 of a percentage point

- Are all these interest rate rises feeling a little sudden? That’s because they are

Live updates

By Bridget Judd

Stay across the latest interest rate updates

This is where we'll have to leave things for this evening, but thanks for following along.

If you've been impacted by the rise in interest rates, you can share your experience with us or submit your own question.

You can also use our repayments calculator to figure out how much extra you may have to pay each month.

By Bridget Judd

Can't the government increase taxes instead of the RBA increasing interest rates? Gareth Hutchens explains

"Can’t government just increase taxes, rather than leave it to the reserve bank to raise interest rates? If the whole idea is to reduce spending by reducing discretionary income, then that will achieve the same goal right?" — Luke

Thanks for your question, Luke. Here's business reporter Gareth Hutchens:

"That’s a good point. In the last 30 years, in the neoliberal era, fiscal policy (taxes and government spending) has been out of favour with policymakers as a demand management tool, except for during crises. It’s meant monetary policy (interest rates) has been responsible for demand management.

"So, if demand has been too hot interest rates have gone up, and if demand has been too cool interest rates have come down.

"That’s been the basic idea. But in previous eras things were done differently. In the 1950s, for example, when Australia was hit by much higher inflation than we’re facing today (thanks to the Korean War), Prime Minister Robert Menzies decided to suck inflation out of the system by increasing company tax, income tax, excise tax and sales tax, among other things."

By Bridget Judd

Will households cut back on spending when tax returns are coming back?

Business reporter Gareth Hutchens is tackling some of your questions about this afternoon's announcement. The next one comes from Jamie, one of our readers:

Put interest rates [up] but to curb spending in the same period tax returns are coming and people spending them. Is the reserve bank out of touch? - Jamie

Here's what Gareth had to say:

"The RBA might argue that it wouldn’t have to raise rates by so much if people weren’t getting tax cuts. Without tax cuts there’d less money to spend, and less demand in the economy."

By Bridget Judd

The RBA said rates wouldn't rise until 2024, but the world 'changed in a handful of weeks', economist says

Leading economist Chris Richardson says he still has faith in the RBA governor, adding he thought "similar things about interest rates at the same time".

"Don't underestimate how much the world changed in a handful of weeks late February, through to early March.

"You got Russia invading Ukraine, you got China locking down in response to Omicron cases of COVID, and you got floods up and down the eastern seaboard in Australia.

"That absolutely supercharged inflation. That meant all over the world central banks are playing catch-up."

By Bridget Judd

RBA may be going 'too hard, too fast', leading economist says

Leading economist Chris Richardson says he fears the RBA is going "too hard, too fast".

"Look, I am worried. If they go too fast, you hurt the economy too much. You have people unemployed who don't need to be unemployed.

"If they go too slow, inflation can hang around longer than you need. That means the pain hangs around for longer too."

He says of the two mistakes: "I would say the Reserve Bank is a little closer to overdoing it".

"To hurting unemployment down the track more than it needs to, with the sheer pace of what it's doing."

By Bridget Judd

Nick McKim: 'There has to be some accountability in the system'

As we heard a short time ago, the Greens are calling for RBA governor Philip Lowe to resign after another increase to interest rates.

Speaking on ABC News, Senator Nick McKim says Philip Lowe "effectively induced a lot of Australians into taking on massive debt levels".

"Borrowing significant amounts of money to purchase a house or a property in the expectation that he would stick to his word and not put interest rates up until 2024.

"They're going up through the roof now. This is going to send some households to the wall and there has to be some accountability in the system.

"So we're saying Dr Lowe should go."

Pressed on whether new homeowners should have relied on more than just the RBA's word, Senator McKim said "people absolutely have to exercise due diligence".

"But I also think that Australians are entitled to believe someone in the incredibly powerful and I might add, incredibly well paid position that Dr Lowe [is in], we can't allow the independence of the Reserve Bank to be mistaken for a lack of accountability.

"Ultimately when people whose words and actions can have such a massive negative material impact on the lives of ordinary Australians, they have to be held accountable for what they do and say."

By Bridget Judd

Australians are going to 'feel real financial pain', Shadow Treasurer says

Angus Taylor says he expects the latest rate rise hike will have a big impact on Australians.

Speaking earlier, the Shadow Treasurer says it'll take a few months for the financial impact of the decision to filter through to households.

"That means when they're doing their Christmas grocery shopping, when they're buying gifts for their loved ones, they're going to feel real financial pain."

By Bridget Judd

If inflation is being caused by global factors, how will increasing interest rates fix it? Gareth Hutchens explains

"I'm very much getting the idea that the RBA isn't looking after the majority of Australians with these decisions. They've said that the inflation is primarily caused by international forces (Ukraine war etc). So how does jacking up interest rates subdue these international forces?" - Ben

Hey Ben, thanks for your question. We've put it to business reporter Gareth Hutchens.

He says jacking up interest rates can’t subdue those international forces.

"That’s a big part of the problem with the current situation. The RBA can’t do anything about oil and gas prices. Or floods that wipe out farming districts and send food prices higher.

"But we’re living with the consequences of the RBA’s decision to push rates down to historically low levels during the pandemic to encourage the 'wealth effect' during the COVID emergency (those ultra-low interest rates made asset prices soar, which made the owners of assets feel wealthier and more likely to spend, which may have helped to support economic activity during the crisis).

"The RBA is now trying to lift rates higher to dampen inflation, and those rate rises are taking place in an economy that suddenly has a whole lot more mortgage debt in it."

By Bridget Judd

RBA trying to get 'back towards that even keel', economist says

Chief economist at Impact Economics and Policy, Dr Angela Jackson, says says the Reserve Bank is looking to bring down inflationary pressures as fast as it possibly can.

She says while many Australians will feel the pinch, the RBA believes it's the right decision.

"It's clearly made the judgment that the economy can withstand another half a percentage point increase without it significantly impacting growth and unemployment.

"And it's looking to get us back towards that sort of even keel where demand and supply are more in balance and that will take off some off the inflationary pressures that we've seen in the economy."

By Bridget Judd

Why is the RBA lifting rates so quickly? Gareth Hutchens explains

Business reporter Gareth Hutchens is on deck to unpack this afternoon's announcement and to tackle some of your questions.

So why is the RBA lifting rates so quickly?

"Interest rate rises are coming every month, there are no gaps to measure if they are working. They should do nothing for three months then look at the data otherwise they will go to far and force a recession" - Bigbobbyg

Here's Gareth Hutchens:

As reader Bobby has pointed out, with sharp interest rate increases coming every month it feels like there’s no time to measure if they’re working or not. Shouldn’t the RBA take a breather for a few months to see what’s happening to the data? Otherwise, won’t they risk going too far and sparking a recession?

They’re good points, so let’s go through them.

Firstly, the RBA kept the cash rate target at 0.1 per cent from November 2020 until May 2022.

Plenty of economists say it was kept too low for too long. They say the RBA should have started lifting the target last year, so now it’s playing catch-up.

Secondly, the RBA has been spooked by the rapid increase in inflation this year, and it’s trying to reassert some control.

It fears that peoples’ behaviour will change if we start to expect that inflation will be higher in the future, so it’s trying to keep peoples’ expectations in check. That’s why it’s being so assertive.

Thirdly, there’s a definite risk the RBA is moving so quickly that it could do economic damage, because there’s a clear lag effect with rate rises.

When it comes to mortgages, the RBA has even said itself that there are millions of households with fixed-rate mortgages that will roll over onto variable rates around the middle of next year, at which point they will experience a big financial shock with a big jump in interest rates. So, what will happen to consumption then?

Many economists have also noted that the RBA’s rate increases will likely be so high, and so swift, that it may have to start cutting rates again by the end of next year once growth starts to falter and unemployment starts rising.

The RBA knows all of these things.

But it’s arguing that, even though house prices have started falling, and consumer sentiment is deteriorating, households are still spending (for now) and unemployment is still declining (for now).

It thinks the economy is strong enough to withstand these rate rises.

By Bridget Judd

Philip Lowe: 'The path to achieving this balance is a narrow one and clouded in uncertainty'

There are some tentative indications the RBA may start slowing the pace of rate rises from next month on.

For the first time, RBA governor Philip Lowe acknowledged that most borrowers had yet to feel the full effects of the rate rises the RBA had already implemented.

However, Mr Lowe also noted that many households had large financial buffers, while saying that most people were having little trouble finding work, extra hours and pay rises.

With Russia's invasion of Ukraine and reduction in gas supplies to Europe, as well as China's ongoing COVID-19 lockdowns, Mr Lowe acknowledged it was hard to know how far rates would have to rise to contain inflation without tanking the economy.

"The path to achieving this balance is a narrow one and clouded in uncertainty, not least because of global developments," he observed.

You can catch up on the full wrap by business reporters Michael Janda and Rhiana Whitson.

By Bridget Judd

Greens call on RBA governor to resign after interest rate rise

The Greens are calling for RBA governor Philip Lowe to resign after another increase to interest rates.

Greens senator Nick McKim says there should be consequences for Philip Lowe misleading the public.

"Dr Lowe has got to go. He's smashing renters, he's smashing small business owners who are in debt, and he's doing it even though he told them interest rates would not go up until 2024."

By Bridget Judd

Have you been impacted by the rise in interest rates?

We want to hear from you.

How has the rise in interest rates impacted you?

By Bridget Judd

The economy survived the pandemic, 'but the challenges are much harder' now

The ABC's senior business correspondent Peter Ryan says it's "incredible" to think that this time two years ago, "the economy looked like it was heading towards a re-run of the Great Depression".

"We have come out of that but the challenges are much harder at the moment, and when you consider the Reserve Bank was being criticised for not getting inflation high enough, they're now being criticised for not being in front of the curve enough to control it early on and leaving interest rates too low for too long."

By Bridget Judd

Foodbank: 'This will force families to make incredibly difficult decisions'

Speaking a short time ago, Brianna Casey, the chief executive of Foodbank Australia, says the growing cost of living is taking a noticeable toll.

"We are seeing a large spike in numbers. We were already seeing a million people a month requiring Foodbank services coming into today's increase.

"This will force families to make incredibly difficult decisions."

By Bridget Judd

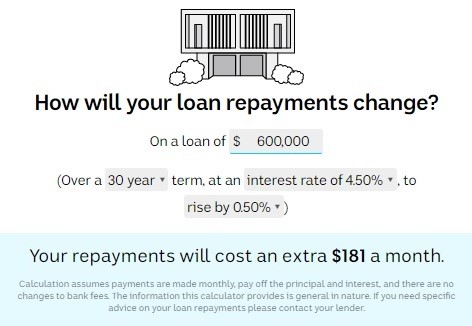

How much extra could mortgage repayments cost now the cash rate is 2.35 per cent?

Can you provide a link or repost the calculator to work out how much more it means for our home loans that I remember you posting last month. Thank you

- Brett

Hey Brett, you can find that right here.

This repayments calculator shows how much extra you may have to pay each month.

Plug in your current loan size, term and interest rate to see the difference.

By Bridget Judd

NAB economist says RBA will continue to lift rates, albeit more slowly

NAB economist Ivan Calhoun says the cash rate will continue to rise, though he predicts the RBA will move more slowly over the coming months.

"Perhaps the first phase of getting interest rates to a more normal level is complete, but they're still saying they're going to have to do some more," he says.

"Because of course, inflation is way above their target and the very final line [in their statement] is that they're committed to do what is necessary to get inflation back to come, so some more to come."

By Bridget Judd

Treasurer: 'It is not for the government to interfere' with decisions of Reserve Bank

Treasurer Jim Chalmers says the government has been "up front about the nature of the inflation challenge".

"It is not for the government to interfere with the independent decisions of the Reserve Bank. It is our job to do what we responsibly can to help Australians deal with these pressures in the near term and to build a much more resilient economy into the future that is able to withstand some of those global and domestic shocks."

By Bridget Judd

Australians with a $500,000 mortgage are facing an extra $145 per month

Treasurer Jim Chalmer says average homeowners owing $330,000 will have to find about $95 more for repayments.

"For Australians with a typical $500,000, it's about an extra $145 a month in addition to the extra $475 they've had to find since rates started raising before the election in May," he says.

"So interest rate rises do mean that Australians will have to make more hard decisions about how to make ends meet."

By Bridget Judd

Treasurer: 'This will be difficult news for a lot of Australians with a mortgage'

Treasurer Jim Chalmer is speaking now.

He says the fact that people were expecting an increase in interest rates doesn't make it any eaiser.

"Now, this will be very difficult news for a lot of Australians with a mortgage. Once again, it isn't a surprise to anyone, the bank had flagged more increases, the markets had anticipated it and homeowners were expecting it as well.

"But the fact that we knew it was coming doesn't make it any easier for people. This is tough. This will tighten the screws on family budgets."