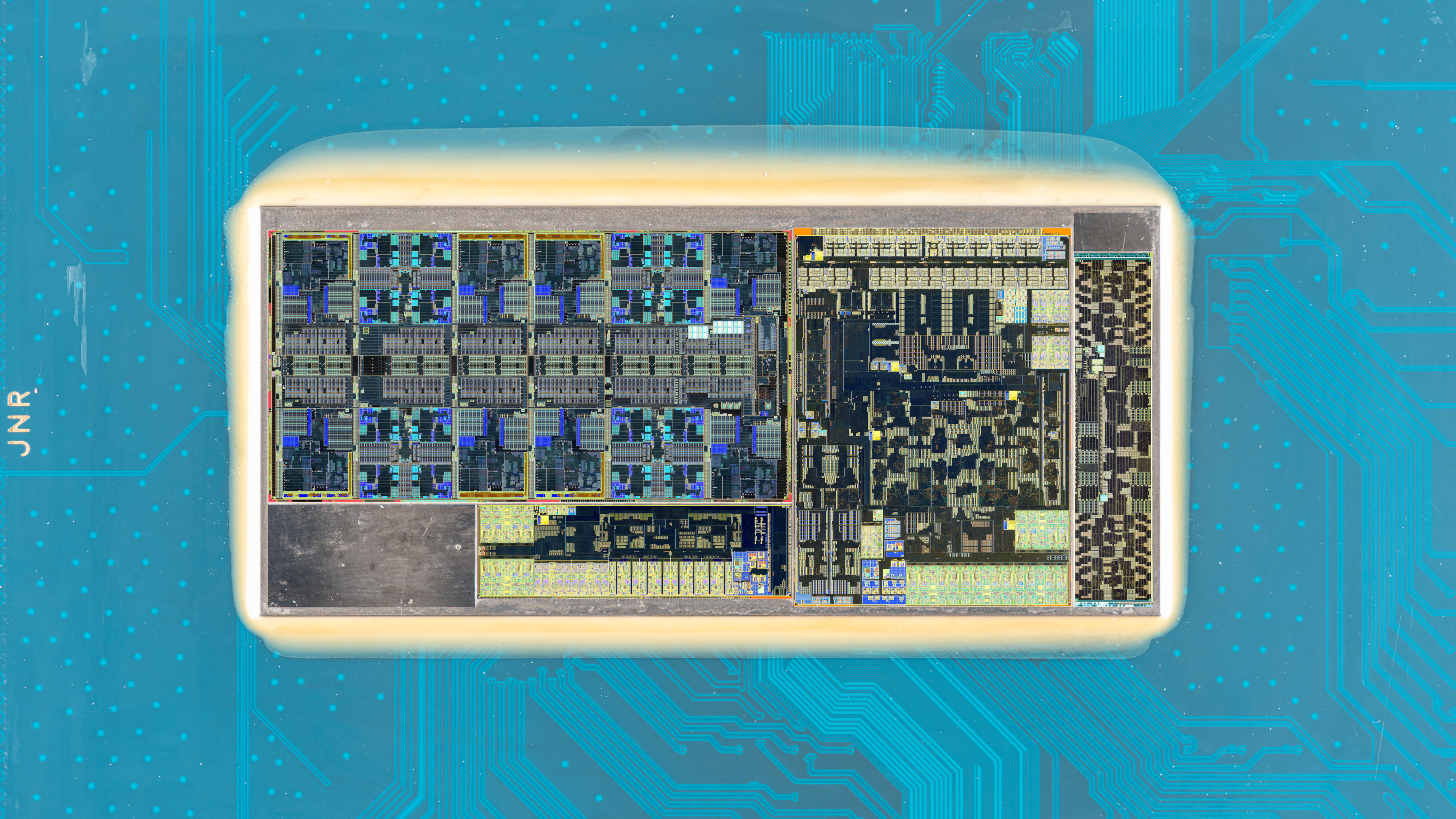

Another one bites the dust. According to a new report from Reuters, Intel's customer foundry business could largely give up on its all-important 18A node. Instead, Intel will retain 18A as an internal node for chips like its upcoming Panther Lake laptop CPU and shift the focus to promoting its 14A for external customers.

If true, this follows Intel's wholesale cancellation of the 20A node, along with limited roll outs of Intel 4 and Intel 3 (Intel has never and likely will never make any consumer CPUs on those nodes). As things stand, you have to go back to 10 nm, rebranded Intel 7, to find a node that the company used across its full portfolio of enterprise and consumer chips. In the meantime, Intel has been paying Taiwanese foundry TSMC to make CPUs like its Lunar Lake laptop and Arrow Lake desktop chips.

Reuters claims that Intel's new CEO Lip Bun Tan has been voicing concerns that its 18A node has been losing appeal to customers. "Tan's preliminary answer to this challenge: focus more resources on 14A, a next-generation chipmaking process where Intel expects to have advantages over Taiwan's TSMC," Reuters claims, adding that Intel is weighing up whether to, "put aside external sales of 18A and its variant 18A-P, manufacturing processes that have cost Intel billions of dollars to develop."

As to how accurate the Reuters report is, Intel has already been gently adjusting expectations for the 18A node for a few months now. Back in May, Intel's CFO David Zinsner said, "we always expected that the predominant amount of volume on 18A was going to be internal." Indeed, in that same interview, Zinsner seemed to more broadly de-emphasise the importance of Intel's plans to make chips for customers.

When asked about Intel's customer foundry plans, the assumption that Intel's fabs would be breaking even in 2027 and how much external business that would require, Zinsner said, "it doesn't require a ton of revenue for Foundry, it's somewhere in the low to mid single digit billions that Foundry's gotta get from external sources. But I would just remind you that some of that is going to be our partnership with UMC, some of that's going to be our partnership with Tower, some of that's going to be packaging, some of that's going to be 18A, some of that's going to be older generations, for example Intel 16. So, it's not a ton that has to come from 18A."

For now, this all remains a rumour. Moreover, Reuter's track record when it comes to Intel's operations isn't exactly flawless. The outlet has previously claimed that Intel and TSMC were working on a joint venture to run the former's fabs, something which has yet to materialise.

However, it's certainly true that Intel has yet to announce a healthy list of customers for 18A, with Amazon one of the few design wins the company has been able to tout. As the months and indeed years tick by, that surely becomes more problematic.

By now, the assumption is that most customers for next-gen cutting edge nodes will have decided between Intel's 18A node and TSMC's upcoming N2 node. The fact that Intel hasn't been able to announce significant contracts for 18A certainly doesn't bode well.

The question then becomes one of Intel's ability to deliver a future node customers do want. As things stand, and for whatever the reasons, be it the quality of its nodes or the tools it provides to customers to use those nodes, Intel hasn't been able to convince many chip designers to use Intel 4, Intel 3, Intel 20 and now, it seems, Intel 18A. So, the emphasis moves to 14A.

At some point, however, you have to think Intel needs a win. It can't keep investing billions in new nodes that get limited or no use. For years now, we've been told that 18A is all important. Ex-CEO Pat Gelsigner said he'd literally bet the company on 18A. If it turns out 18A isn't all it was cracked up to be, it's hard to see how that isn't a major problem for Intel.