Intel Corp. (NASDAQ:INTC) CEO Lip-Bu Tan is reportedly evaluating whether to stop marketing the company's costly 18A chipmaking process to outside customers, a move that could signal a major strategic pivot amid mounting financial losses and fierce competition from Taiwan Semiconductor Manufacturing Company (NYSE:TSM)

What Happened: Tan has grown skeptical of continuing external sales of 18A and its variant 18A-P — advanced manufacturing processes that have cost Intel billions to develop, but have struggled to attract major customers, reported Reuters, citing two people familiar with the matter.

Scrapping the effort could trigger a write-off potentially amounting to hundreds of millions or more, the report said.

Responding to the publication, Intel declined to comment on "hypothetical scenarios," but said it plans to use 18A for its own upcoming chips, including the Panther Lake laptop processor expected in late 2025. Intel will also fulfill limited existing commitments to Amazon.com, Inc. (NASDAQ:AMZN) and Microsoft Corporation (NASDAQ:MSFT) using 18A.

See Also: Jensen Huang Gave $12.6 Million To Charity, Then Nvidia's Stock Made It Billions

"Lip-Bu and the executive team are committed to strengthening our roadmap, building trust with our customers, and improving our financial position for the future," the company told the publication.

Why It's Important: Tan is now shifting focus toward 14A, a next-generation process Intel believes may offer stronger advantages over TSMC's advanced nodes, the report added.

Discussions with the board could take place as early as this month, though a final decision may not come until fall.

The deliberations mark one of the most significant strategic inflection points for Intel under Tan's leadership. After posting an $18.8 billion loss in 2024—its first unprofitable year since 1986—the company is under pressure to revamp its foundry business and regain technological leadership in a global chip race dominated by TSMC.

Intel's most recently reported quarterly revenue was $12.67 billion. For the full year ending December 2024, the company generated $53 billion in total revenue.

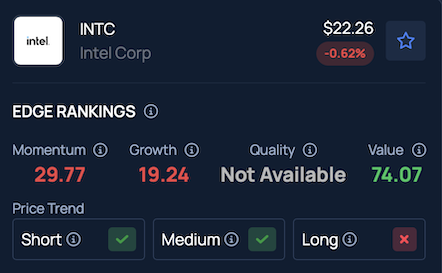

Price Action: Intel (INTC) shares rose 2.01% during Tuesday's regular session and edged up an additional 0.18% in after-hours trading, according to Benzinga Pro data. The stock is up 13.01% year-to-date but has dropped 26.46% over the past 12 months.

Benzinga's Edge Stock Rankings indicate that INTC shows a solid upward trend in the short and medium term but trends downward over the long term. While its value ranking remains strong, its momentum score is weaker. More detailed performance data is available here.

Read Next:

Photo: Tada Images/ Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.