/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

On Wall Street, few signals attract more attention than insider trades — the moves made by those who know a company best. When insiders sell their own stock, it stirs unease. It’s not always a red flag, but it does raise questions as to whether the selling is routine profit-taking, has to do with personal liquidity, or represents valuation concerns. In markets running hot, it often leans toward the latter. Lately, insider activity has dominated the Street, especially in artificial intelligence (AI), where fortunes are created — and tested — at lightning speed.

That brings us to CoreWeave (CRWV), a rising AI infrastructure juggernaut powering next-gen data centers. The company’s billion-dollar partnerships have turned it into a vital player in the GPU economy. Yet, as October has rolled in, insiders have been cashing out — over $1 billion sold post-lockup, with co-founder Brannin McBee and director Jack Cogen leading the exits.

With early backers locking in massive gains, should investors read the signals and consider selling CRWV, too?

About CoreWeave Stock

Based in Livingston, New Jersey, CoreWeave started in 2017 as a scrappy crypto miner and has since transformed into a powerhouse in GPU-optimized cloud services for AI training and inference. Today, with a $62 billion market capitalization, CoreWeave is carving out a central role in the AI infrastructure game.

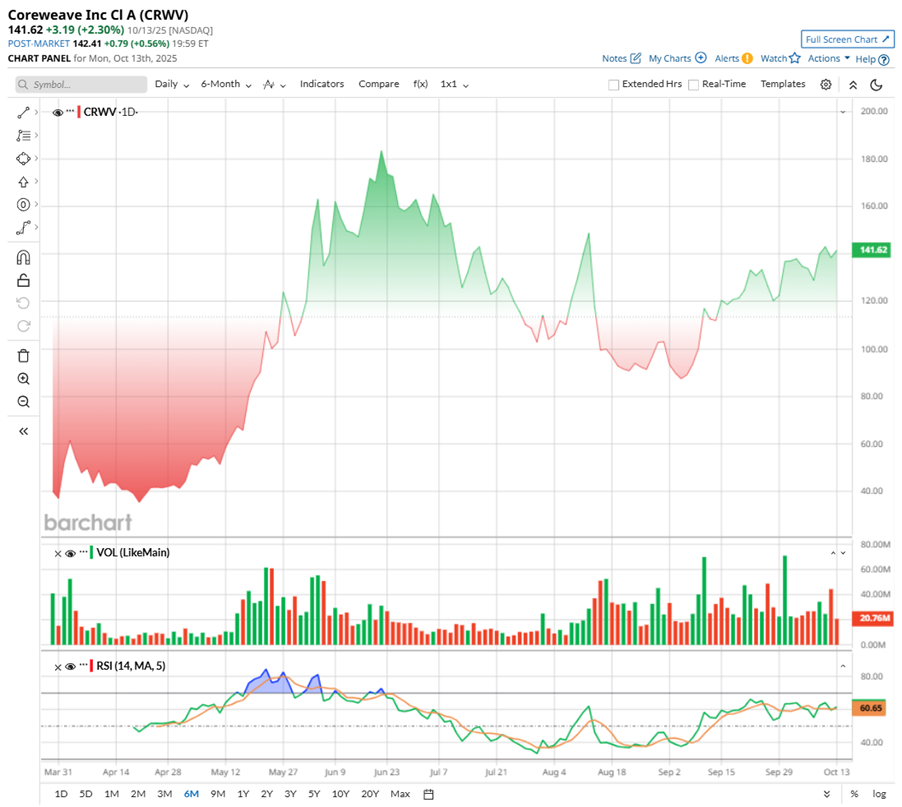

CRWV stock has been moving with steady momentum. Since debuting at $40 in March 2025, the stock has more than tripled, peaking at $187 on June 20 before easing 33% to the $125 range now. Despite the pullback, the stock remains up 253% in the past six months.

The stock has been on a tear in recent months, powered by blockbuster deals and bold expansion moves. The company sealed $20-plus billion in AI cloud contracts with Meta Platforms (META) and OpenAI, acquired Monolith AI to push into industrial simulation, and partnered with Aston Martin F1 — cementing its status as the AI infrastructure backbone powering the global boom.

CoreWeave’s 14–day RSI recently sat near 60, marking balanced momentum — strong but not overheated. The indicator suggests the stock is stabilizing. Trading volumes also remain high, showing investors are still actively circling CRWV stock even as price movements cool.

CoreWeave’s stock trades at a hefty 17.6 times forward sales, signaling a premium over peers. The valuation reflects Wall Street’s excitement for its AI cloud dominance, blockbuster contracts, and rapid growth. But with that kind of premium, even a small stumble could make the ride pretty bumpy.

Insiders Take Their Profits

When CoreWeave’s post-IPO lockup expired in mid-August, insiders didn’t just test the waters — they dove straight in. After the stock’s meteoric surge since its March debut, company leaders moved to secure hefty profits.

Director Jack Cogen sold shares worth $477 million while co-founder and Chief Development Officer Brannin McBee offloaded about $426 million — equivalent to roughly 14% of his stake — under pre-arranged 10b5-1 trading plans. This marked the insiders' first chance to cash out after the IPO.

Meanwhile, major investor Magnetar Financial sold nearly $1.9 billion in shares but still holds over 20% of CoreWeave’s Class A stock. Together, these moves made CoreWeave one of the third quarter's biggest insider selloffs — a striking moment for a company at the heart of the AI boom.

CoreWeave's Q2 Earnings and Outlook

CoreWeave’s second-quarter 2025 earnings report, released on Aug. 12, was a blend of explosive growth tempered by the realities of scaling fast in the AI infrastructure game. Revenue shot up 207% year-over-year (YOY) to $1.2 billion, handily beating expectations, while the backlog swelled to $30.1 billion, signaling a tidal wave of AI demand waiting to be fulfilled. While this is the kind of growth that makes Wall Street sit up, profitability told a more cautious tale.

Rising costs pushed the company to a net loss of $290.5 million, or $0.60 per share, narrower than last year’s $323 million loss (or $1.62 per-share loss) but still significant. On an adjusted basis, net loss widened dramatically to $130.8 million, up from a $5.1 million loss a year ago.

Still, adjusted EBITDA hit $753.2 million, with an impressive 62% margin, and adjusted operating income climbed to $199.8 million, yielding a 16% margin — proof that CoreWeave can monetize the AI frenzy if expenses are managed.

Management raised full-year guidance, projecting revenue to be between $5.15 billion and $5.35 billion, with Q3 revenue anticipated to be between $1.26 billion and $1.3 billion, signaling confidence that demand isn’t slowing anytime soon.

But analysts caution the journey won’t be smooth. Losses for fiscal 2025 are expected to double annually to $2.68 per share, before improving 53% YOY to a $1.26 per-share loss in fiscal 2026.

What Do Analysts Expect for CoreWeave Stock?

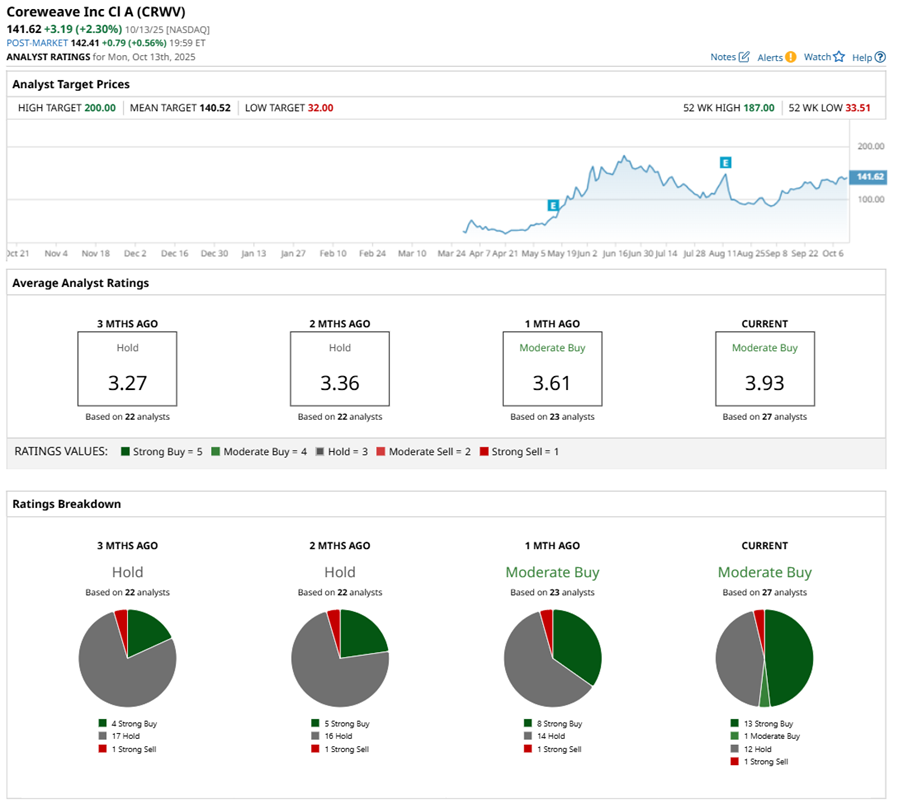

CRWV stock has a consensus “Moderate Buy” rating overall — an upgrade from the “Hold” rating three months ago. Out of 27 analysts covering the stock now, 13 recommend a “Strong Buy,” one has a “Moderate Buy,” 12 analysts play it safe with a “Hold” rating, and one analyst advises a “Strong Sell” rating.

The average analyst price target of $140.52 implies potential upside of 12% from current levels. Meanwhile, the Street-high target price of $200 suggests 60% potential upside ahead.