Angela Rayner has resigned from government after it emerged that she underpaid stamp duty on a seaside flat, breaching the ministerial code.

Ms Rayner’s admission followed mounting pressure and media reports alleging she saved £40,000 on the property in Hove, East Sussex, by removing her name from the deeds of a family home in her Ashton-under-Lyne constituency.

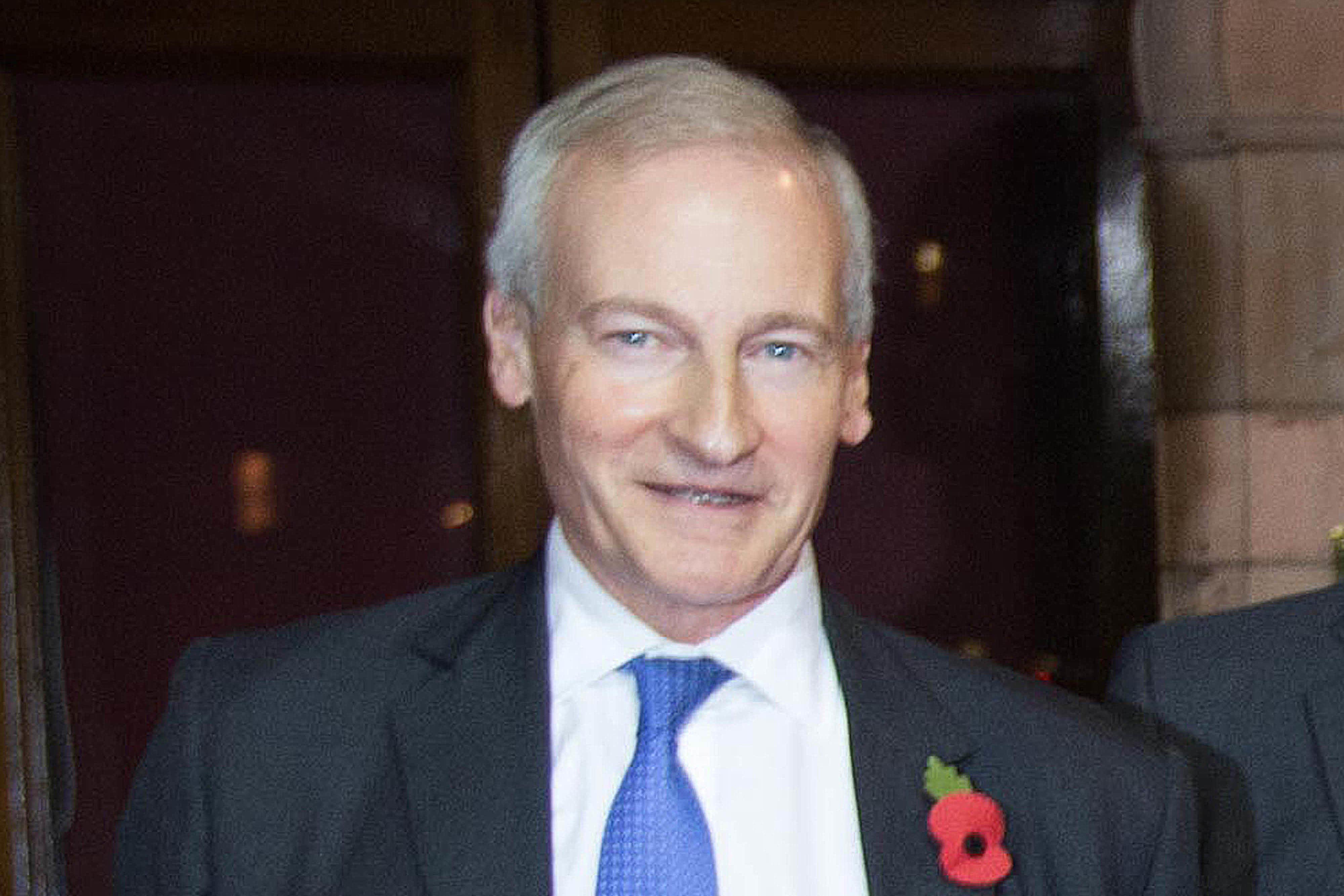

Her resignation follows the findings of ministerial ethics adviser Sir Laurie Magnus, to whom she referred herself on Wednesday.

Sir Laurie Magnus said the outgoing deputy prime minister had "acted with integrity", but failed to "heed the caution" contained within legal advice she received when buying the £800,000 property in Hove.

In her resignation letter, the former deputy PM wrote: “I have long believed that people who serve the British public in government must always observe the highest standards.

“While the Independent Adviser has concluded that I acted in good faith and with honesty and integrity throughout, I accept that I did not meet the highest standards in relation to my recent property purchase.”

Here, The Independent explains the issue and how it led to the resignation of one of the top figures in British politics:

What are the rules around stamp duty?

For those buying their first home, or moving from one to another, stamp duty is usually quite straightforward. There are several rates liable on the purchase, ranging from zero to 12 per cent, based on its value.

When it comes to second homes, the rules can be more complex. The threshold at which the standard rates need to be paid is lowered, and there is also a 5 per cent surcharge which can rise with value.

Between £40,000 and £125,000, the surcharge rate is 5 per cent. This rises to a maximum of 17 per cent on properties worth over £1.5m.

Why did Rayner not pay enough tax on her Hove flat?

Ms Rayner referred herself to the ministerial ethics adviser on Wednesday after admitting, following days of silence, that she had wrongly listed her flat.

When purchasing the £800,000 property in Hove in May, she paid the standard rate of stamp duty, estimated to be £30,000. However, the higher rate for second homes would have made this as much as £70,000.

The former deputy PM explained: "When purchasing the property, my understanding, on advice from lawyers, was that my circumstances meant I was liable for the standard rate of stamp duty.”

She says she did this because she had sold her stake in her constituency home in Greater Manchester into a trust of which her son is the beneficiary.

Ms Rayner explained that she then bought the Hove flat, using the £162,500 lump sum from selling her stake in her Ashton home, “which was the only property I owned and where my savings were”, for the deposit on my new one. She maintains she initially believed, based on legal advice, she was liable for the standard rate of stamp duty.

However, Ms Rayner was later advised that, despite not owning any other property at the time of the purchase, "complex provisions relating to the trust gives rise to additional stamp duty liabilities".

In his report, ethics adviser Sir Laurie explains: “Having sold her 25% share in the family home in Ashton-under-Lyne, Ms Rayner ceased to own any part of that property. However, under the relevant legislation, a person who does not own a property can nonetheless be deemed to hold an interest in it if certain circumstances apply; these include where that property is held by a trust, and the beneficiary of the trust is a child of that person under the age of 18.

“I understand there are additional complexities, for example concerning the particular type of trust in question and the reason for which the trust was established. Taken together, it appears that - particularly in the context of the specialist type of trust in question - the interpretation of these rules is complex.”

What did the ethics adviser conclude?

Due to complexities in the way stamp duty works, Ms Rayner was due to pay more tax on the purchase of her Hove home even though she is not a trustee of her son’s trust (which owns her family home).

The key question remained around whether Ms Rayner had received incorrect advice, or whether she had sought to lower her tax bill purposefully.

After a few days of investigation, Sir Laurie concluded that Ms Rayner had not aimed to do this. The ethics adviser writes that he had reviewed the details of the property transaction and found that Ms Rayner’s understanding that she needed only to pay the standard rate of stamp duty was “held in good faith.”

However, Sir Laurie adds that the advice Ms Rayner received, while incorrectly informing her that she only had to pay standard stamp duty, “was qualified by the acknowledgement that it did not constitute expert tax advice.”

Moreover, the advice recommended this expert tax advice be obtained by Ms Rayner, which she did not do. The ethics adviser writes that “it is deeply regrettable that the specific tax advice was not sought.”

He concludes that while “Ms Rayner has acted with integrity and with a dedicated and exemplary commitment to public service,” she did not meet the “highest possible standards of proper conduct” according to the ministerial code.

“Accordingly, it is with deep regret that I must advise you that in these circumstances, I consider the Code to have been breached.”

Where did Rayner get the money for the Hove flat?

The former deputy PM says she sold her stake in her family home to her son’s trust in January 2025. This gave her the money to pay the deposit for the Hove flat, which she owns with a mortgage.

The court-instructed trust was set up in 2020 using a payment that was granted after “a deeply personal and distressing incident” involving her son as a premature baby, she says. Now in his late teens, he has life-long disabilities, including blindness.

In a statement, she said: “The trust was established to manage the award on his behalf – a standard practice in circumstances like ours.

“To ensure he continued to have stability in the family home, which had been adapted for his needs, we agreed that our interest in the family home would be transferred to this court-instructed trust of which he is the sole beneficiary.

“Some of the interest in our family home was transferred to the trust in 2023.”

She then sold all of her interest in the Ashton-under-Lyne property to this trust in 2025, although it remains her family home. It is Ms Rayner’s son’s trust that now holds equity in the Ashton house.

What are her family arrangements?

Ms Rayner has two sons with her ex-husband Mark Rayner, and one from an earlier relationship when she was 16.

After divorcing Mr Rayner in 2023, she agreed to a “nesting arrangement” with her former husband that means her son remains in the family home full-time, while they alternatively live there.

The house was only partly put into the trust at this point, with them and law firm Shoosmiths as trustees.

The deputy PM sold her remaining stake of the Ashton house to the trust in January, she says, removing her name from the deeds.

Rayner becomes the eleventh Government departure for Labour. Here’s who else has gone

Angela Rayner resigns from government after stamp duty row: UK politics live

Angela Rayner: The ‘teenage mum from a council estate’ who became deputy PM

Watch live: Farage addresses Reform UK party conference after Rayner resigns

Angela Rayner’s resignation letter in full as she steps down over tax row

How Angela Rayner went from Labour working-class hero to mired in tax scandal