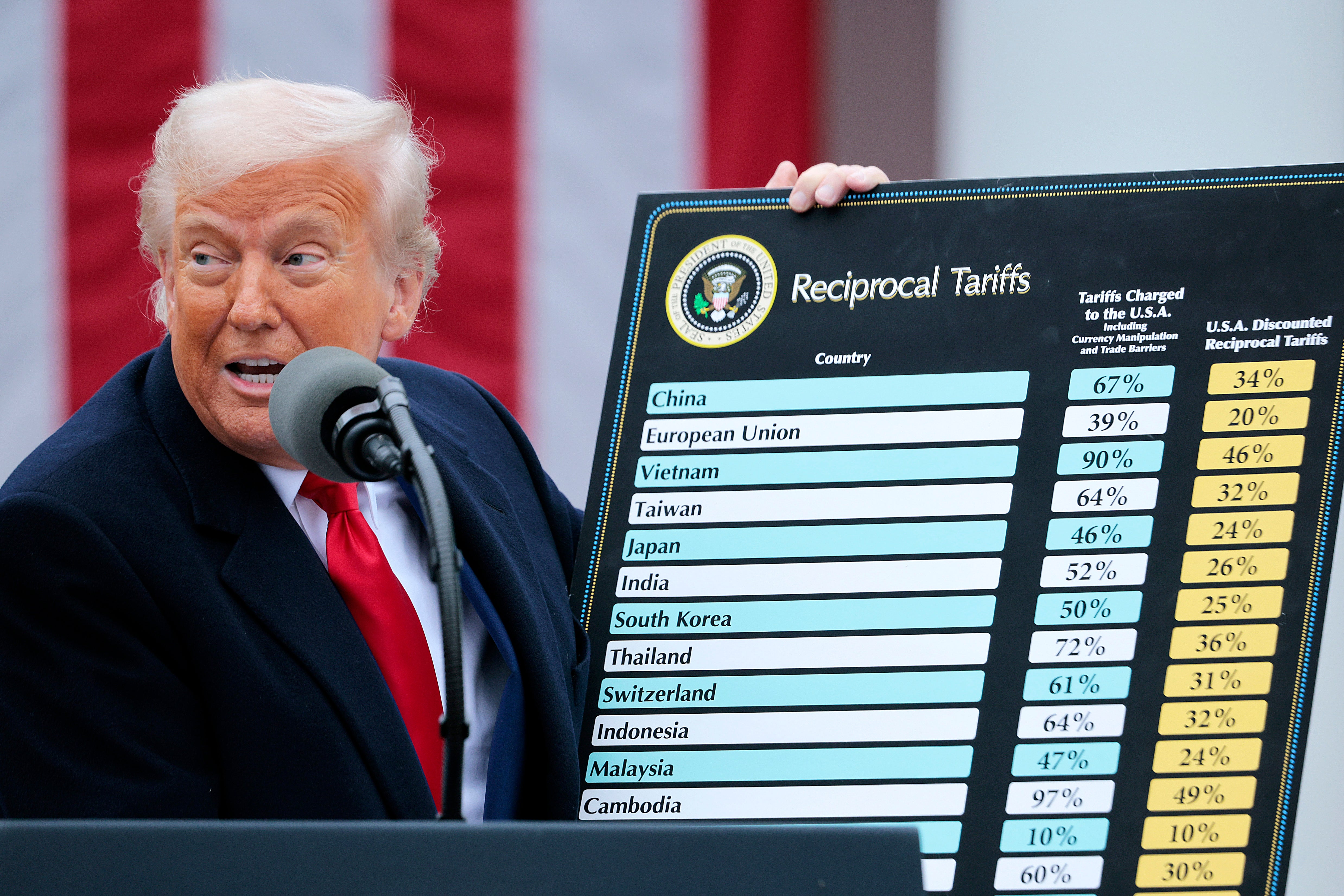

Inflation rose 0.4 percent in the month of August — and 2.9 percent in the past 12 months — in a sign that President Donald Trump’s reciprocal tariffs have begun to affect the U.S. economy.

The Bureau of Labor Statistics released its Consumer Price Index data for August on Thursday, the first month that most of Trump’s tariffs took effect after an initial pause.

The rise in inflation comes as the job market looks increasingly bleak. The Bureau of Labor Statistics reported that the U.S. economy added only 22,000 jobs in August. This came despite the fact that Trump fired Erika McEntarfer, the non-partisan commissioner of the bureau, after a weak jobs number in July.

And applications for unemployment benefits jumped last week to the highest level in almost four years, according to data also released Thursday, by the Labor Department. That could indicate more businesses are laying off workers. Initial claims rose by 27,000 to 263,000 in the week ended Sept. 6, the highest since October 2021, according to Bloomberg.

Earlier this week, the BLS also revised down the number of jobs added in the last year by 911,000. Trump has said this proves that the Bureau of Labor Statistics is corrupt, despite the bureau releasing downward revisions annually.

Food and shelter prices drove the spike in consumer prices. The index for food rose by 0.5 percent in August and 3.2 percent in the past twelve months. Some of the biggest increases in food came from beef and veal, which rose 2.7 percent. Fruits also contributed to the increase, with apples rising 3.5 percent and bananas by 2.1 percent.

The price of coffee also spiked, with the index jumping by 3.6 percent. This comes as Trump enacted a 50 percent tariff against Brazil in retailation against the trial of the country’s former president Jair Bolsonaro. Trump also set tariffs on Colombia, another major source of coffee for American consumers, at 10 percent.

The costs for shelter also rose by 0.4 percent in the past month, with the index for rent increasing by 0.3 percent and the index for the owner’s equivalent of rent increased 0.4 percent.

In addition, energy also increased at 0.7 percent in the past month as the price of gas rose 1.9 percent in August. In the past 12 months, the energy index rose 0.2 percent while the gasoline index has dropped 6.6 percent.

The numbers for inflation are also higher even without the increase in food and energy. The core CPI, which measures all other cost increases, rose 0.3 percent in the last month and rose by 3.1 percent in the past 12 months, the same as it did in the month of July.

Alongside essential items, airline fares rose by 5.9 percent in the past month while the index for used cars and trucks rose 1 percent.

The president has insisted throughout his second term that consumers would not pay the price of tariffs, but rather other countries and companies would.

The increase in consumer prices combined with the anemic job growth makes the likelihood that the Federal Reserve will lower interest rates. The Federal Open Market Committee will convene next week to determine interest rates.

The president for his part has criticized Federal Reserve Chairman Jerome Powell for refusing to raise interest rates and the central bank has largely decided to wait to see what the effect of tariffs will be on the larger economy.

“Although elevated inflation is proving to be sticky, the downside risks to the labor market have grown considerably, creating more urgency to act to keep the jobs market from falling apart,” an analysis from Wells Fargo read.

But a weak labor market will likely spur the Federal Reserve to prioritize keeping unemployment low over its other goal of tempering inflation.

Trump meets Scottish First Minister to talk whisky prices

A murky pipeline deal to send Russian gas to China shows Beijing's dominance in the relationship

US added 900k fewer jobs in year to March, revised figures show amid Trump anger over stats

Charlie Kirk shooter’s movements revealed, high-powered rifle recovered — what we know so far