Income-focused investors don’t have to sacrifice stability for returns. These three high-yield dividend stocks not only offer attractive payouts but are also backed by strong fundamentals, making them compelling buys for long-term portfolios.

Dividend Stock #1: Verizon Communications (VZ)

Dividend Yield: 6.36%

My first pick is Verizon Communications (VZ), which continues to show why it is one of the market's most consistent dividend payers. Verizon is a major U.S. telecommunications and technology firm that offers wireless services, broadband, and enterprise solutions to consumers, businesses, and governments.

Verizon is known for offering a high dividend yield of 6.32%, with a healthy payout ratio of 56.7%, leaving plenty of possibility for dividend growth. Furthermore, Verizon has a 21-year track record of paying and increasing dividends, which is driven by its strong business model. The company is even getting close to achieving the "Dividend Aristocrat" title, which is given to companies that have continuously increased their dividends for 25 years in a row.

Looking ahead, Verizon has revised its projection for 2025, now expecting adjusted EPS growth of up to 3% and free cash flow of $19.5 billion to $20.5 billion, which should cover dividend payments. Verizon's broadband and fixed wireless access (FWA) division is quickly expanding, with more than five million subscribers as of the second quarter. The company expects to attain 8 million to 9 million subscribers by 2028. This positions Verizon to capture demand for high-speed, dependable internet across the nation, serving as a long-term growth engine.

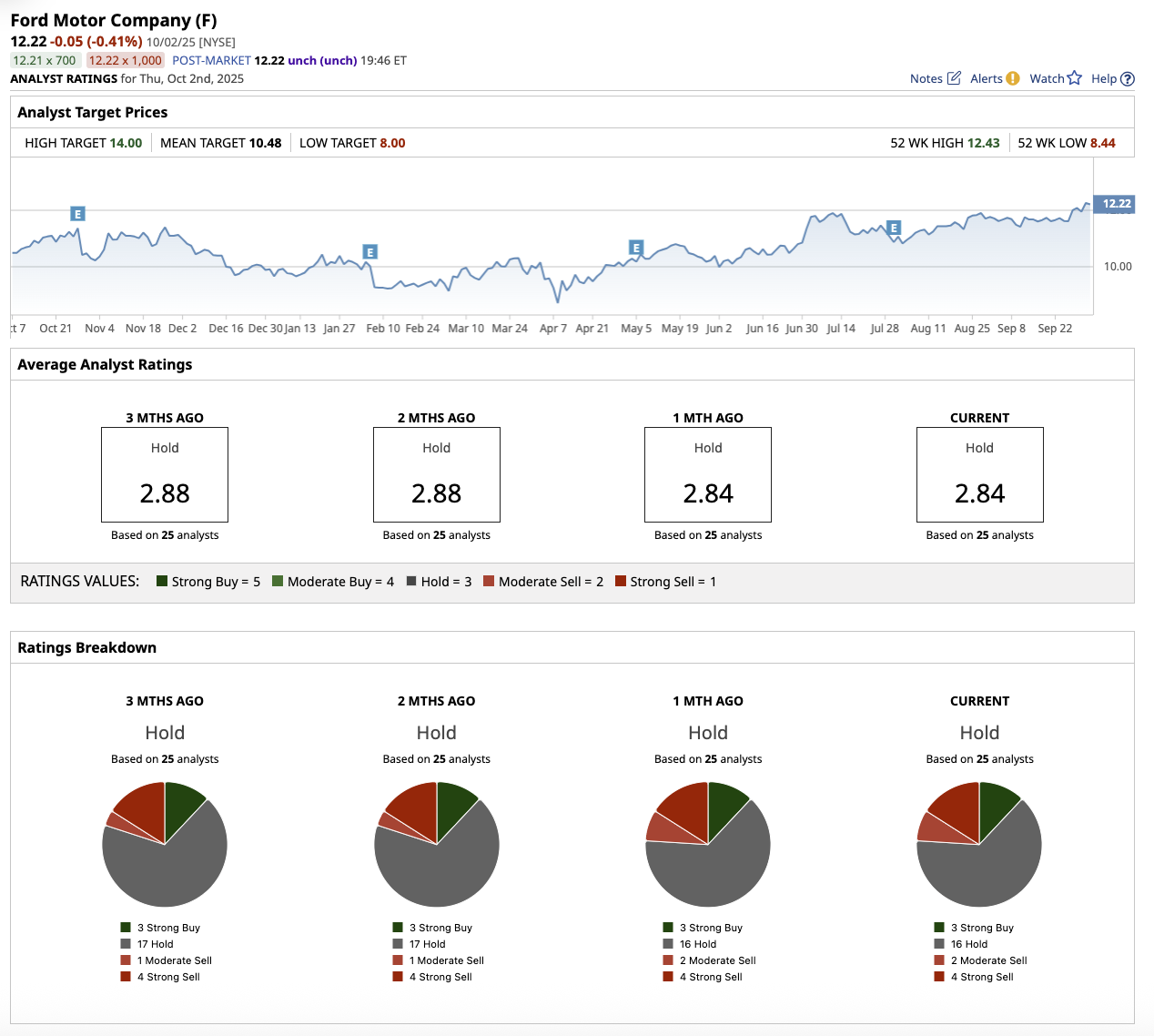

Overall, Wall Street rates VZ stock as a "Moderate Buy." Of the 29 analysts that cover the stock, nine rate it a “Strong Buy,” three recommend a “Moderate Buy,” and 17 suggest a “Hold.” Based on the average target price of $48.23, the stock has an upside potential of 11.1% from current levels. Its Street-high estimate of $58 further implies VZ stock can go as high as 33.6% in the next 12 months.

Dividend Stock #2: Altria (MO)

Dividend Yield: 6.4%

My second pick is Altria Group (MO), one of the largest tobacco and nicotine product companies in the U.S. Its core business is selling smokable products (mostly Marlboro cigarettes). Still, it also deals in oral tobacco and holds stakes in alcohol and cannabis businesses.

Altria continues to reinforce its reputation as one of the market’s most reliable dividend payers, even as the tobacco industry faces shifting dynamics. The company has continually grown its dividends more than 60 times, with the most recent increase of 3.9%, placing it among the elite group of “Dividend Kings.” Its 6.4% yield, which is greater than the 1.8% average for consumer staples, continues to interest income investors.

While Altria’s earnings dipped in the second quarter, adjusted EPS climbed 7.2% to $2.67 in the first half of 2025. Importantly for income-focused investors, Altria continues to deliver substantial shareholder returns. The company paid $3.5 billion in dividends in the first half and repurchased 10.4 million shares worth $600 million. With $400 million remaining in its buyback program, Altria expects to return even more capital by the end of the year.

Looking ahead, management revised its full-year 2025 EPS projection to a range of $5.35 to $5.45, indicating a 3% to 5% increase over 2024. With pricing power, resilient margins, and a strong commitment to capital returns, Altria continues to stand out as a dividend stock investors can count on for now.

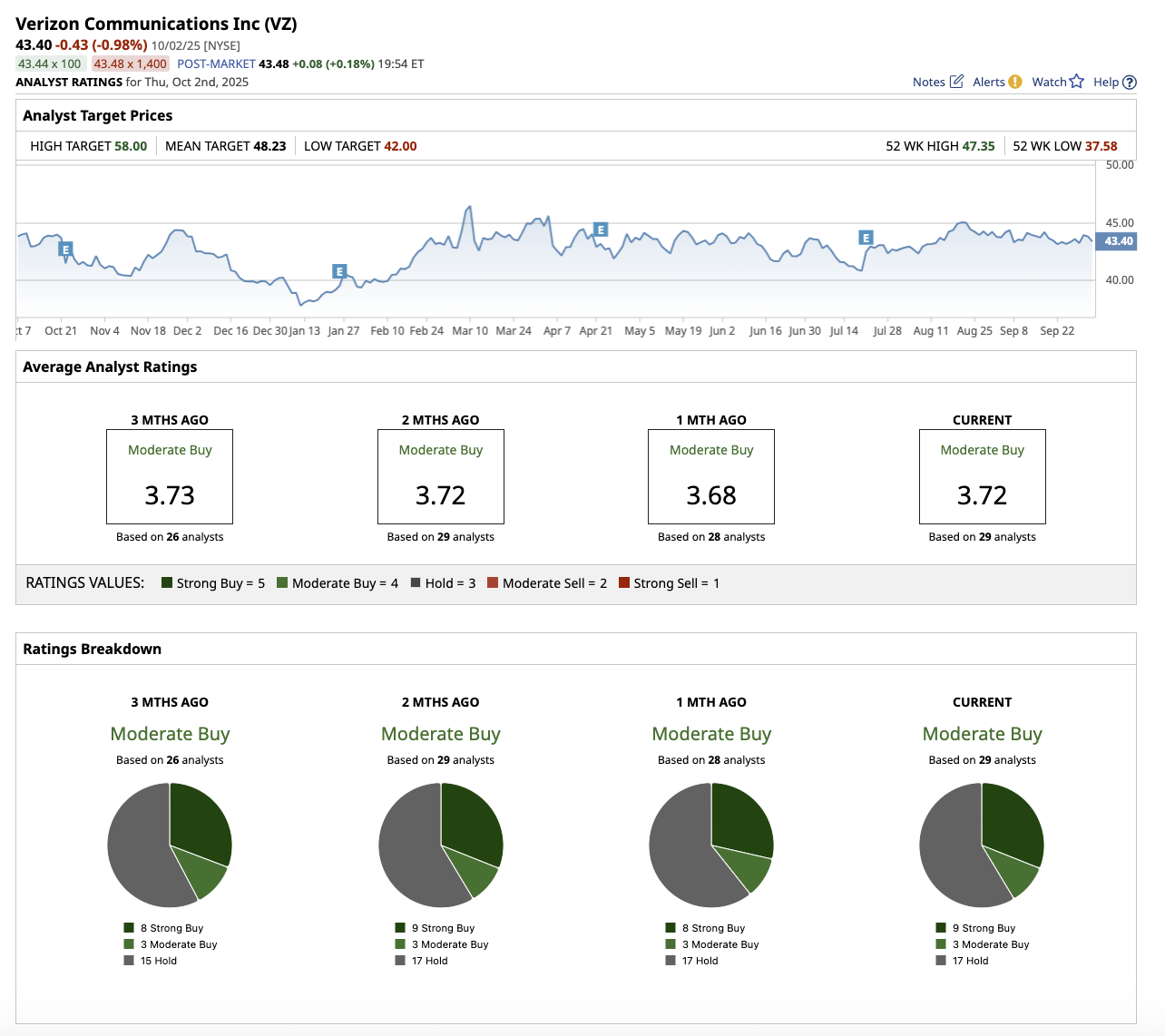

Overall, on Wall Street, MO stock is a “Hold.” Of the 15 analysts covering the stock, four rate it a “Strong Buy,” nine rate it a “Hold,” one says it is a “Moderate Sell,” and one rates it a “Strong Sell.” So far this year, Altria has surpassed its average target price of $61.64. But its high price target of $72 implies the stock can climb as much as 9.5% from current levels.

Dividend Stock #3: Ford (F)

Dividend Yield: 4.9%

My final pick is Ford Motor (F), which remains committed to returning value to its shareholders. Ford is a global automotive company that designs, manufactures, markets, and services a wide range of vehicles, from traditional internal combustion cars and trucks to electric vehicles (EVs). It continues to demonstrate resilience as it balances near-term challenges with long-term growth opportunities.

Ford’s attractive dividend yield of 4.88% is significantly higher than the consumer discretionary average of 1.89%. Furthermore, its low dividend payout ratio of 42.9% is also sustainable for now.

While Ford's EV division continued to struggle, with $1.3 billion in losses in the second quarter, revenue more than doubled, indicating progress in electrification efforts. Despite tariff challenges, Ford Blue managed to increase its market share profitably. Ford has a solid financial platform to support ongoing dividends, with a reaffirmed full-year forecast of $6.5 billion to $7.5 billion in adjusted EBIT and up to $4.5 billion in free cash flow. Overall, the carmaker's mix of strong cash flow, a consistent dividend, and long-term transformation via EVs and Ford Pro makes it an appealing option for income-focused investors looking for stability and growth potential.

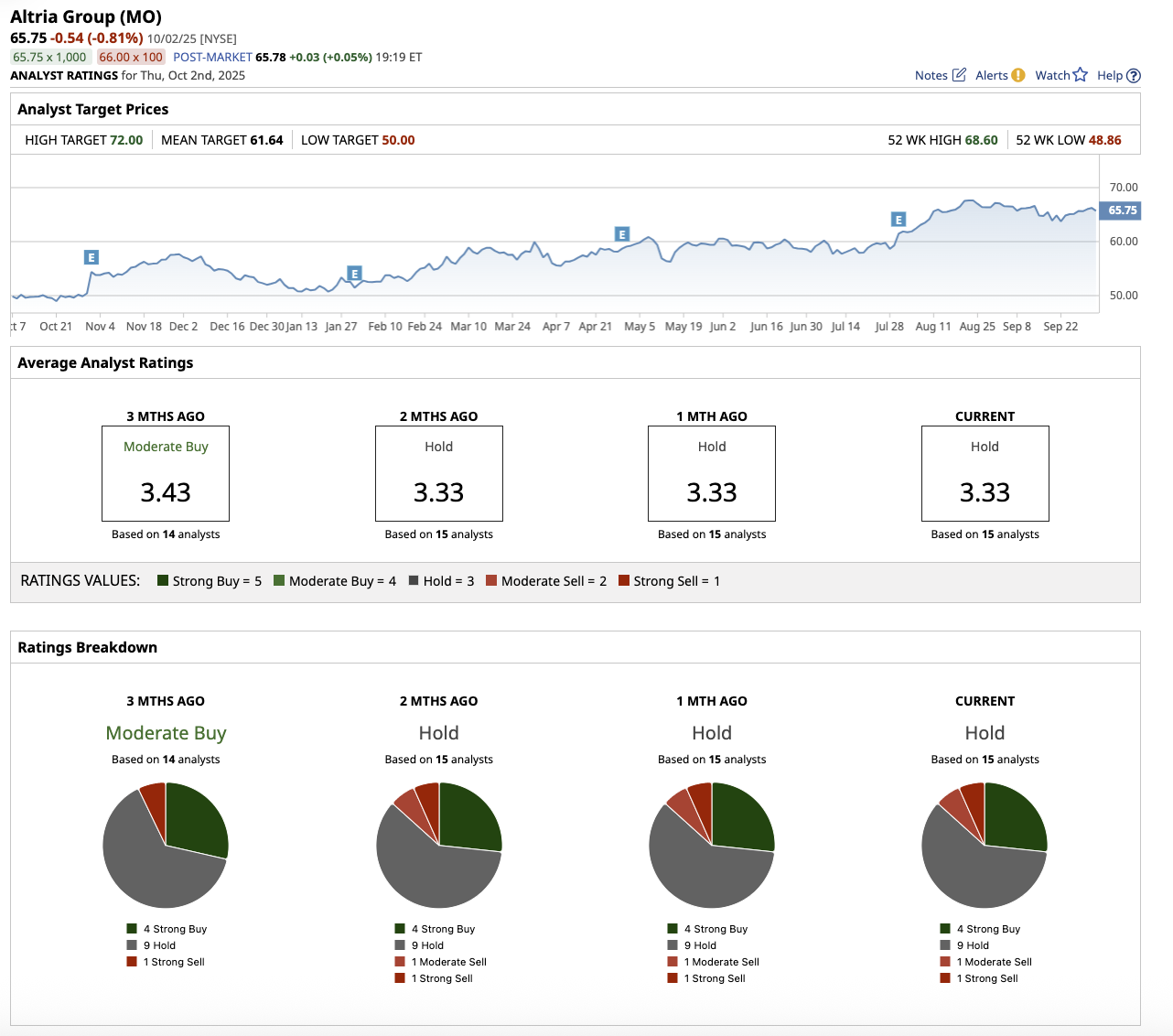

On Wall Street, F stock is rated an overall “Hold.” Of the 25 analysts that cover the stock, three rate it a “Strong Buy,” 16 rate it a “Hold,” two say it is a “Moderate Sell,” and four rate it a “Strong Sell.” Ford’s stock has surpassed the average analyst target price of $10.48. However, its high target price of $14.00 implies that the stock could rise as much as 14.5% from current levels.