Home Depot (HD) stock has been a terrific buy-and-hold bet for truly long-term shareholders. Thanks to a history of innovation and adaptation, the nation's largest home improvement retailer has managed to stay on top through both economic ups and downs and technological disruptions.

Back in the day, hardware stores, be they mom-and-pop shops or regional chains, had relatively modest retail formats. That made it hard for them to service both professional contractors and do-it-yourselfers (DIY) at scale.

That's where Home Depot saw an opportunity. Founded in the late 1970s, the company reimagined hardware stores for the big-box age. Sprawling warehouse-style locations would not only be able to offer one-stop shopping for consumers and contractors alike, but they would be able to leverage scale into fatter margins and greater profitability.

Home Depot expanded rapidly over the 1980s and 1990s to overtake all rivals. By the beginning of the 21st century, the national chain started expanding overseas. Price, convenience and clever marketing – such as offering do-it-yourself clinics and classes for homeowners – made it the No. 1 brand in home improvement.

Home Depot, which was added to the Dow Jones Industrial Average in 1999, was just getting started. A company with a bit more than $50 billion in annual revenue was growing its top line at a double-digit percent rate. Gross margins of more than 30% and operating margins of around 15% led to impressive profits – and free cash flows.

Naturally, the company had its ups and downs. It rode the benefits of the housing boom – and suffered during the bust. As a brick-and-mortar retailer, it had to roll out a digital strategy for the e-commerce age. And while business took off during the pandemic, the past few years of pricey homes and higher mortgage rates have been a headwind for HD.

Nevertheless, this blue chip stock has managed to deliver market-beating returns over the long haul.

The bottom line on Home Depot stock

As noted above, higher rates and the ongoing recession in the housing market haven't been great for HD stock. Shares trail the S&P 500 on an annualized total return basis over the past one-, three- and five-year periods. As for the past decade, it's been a draw.

But anyone who's been in the stock longer than that has enjoyed strong outperformance. For its entire life as a publicly traded company, HD generated an annualized total return (price change plus dividends) of 17.8%. That beats the broader market by 7 percentage points.

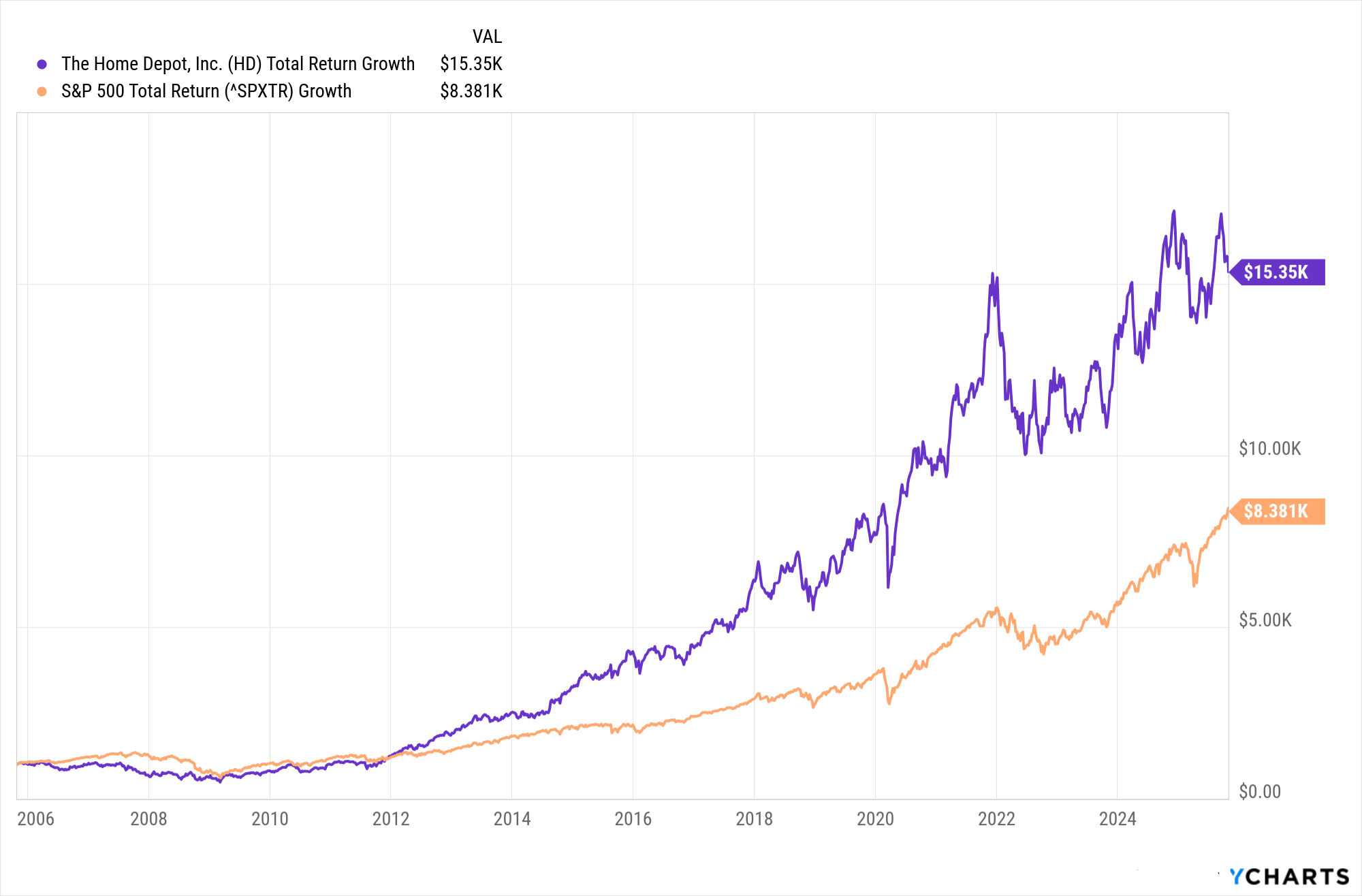

And as for anyone who plonked down a thousand bucks two decades ago, have a look at the chart below.

If you'd put $1,000 into Home Depot stock 20 years ago, today it would be worth more than $15,000 – good for an annualized total return of 14.6%.

The same amount invested in an S&P 500 ETF would theoretically be worth about $8,300 today, or an annualized total return of 11.2%.

That's a great buy-and-hold bet. Happily for bulls, Wall Street expects more outperformance ahead.

Of the 37 analysts covering HD surveyed by S&P Global Market Intelligence, 21 rate it at Strong Buy, four say Buy, 11 have it at Hold and one calls it a Sell. That works out to a consensus recommendation of Buy, with high conviction.

"We believe HD's customers are financially healthy and have significant capacity for future spending," writes Argus Research analyst Christopher Graja, who rates shares at Buy. "HD estimates that there are 'literally trillions' of dollars of home equity that might eventually be tapped for home renovations."

HD is also a great stock for dependable dividend growth. Indeed, the company has hiked its payout annually for 16 years. Moreover, HD's dividend has grown at a compound annual rate of 9% over the past five years.