The artificial intelligence (AI) gold rush has been a boon for investors in Advanced Micro Devices (AMD). Massive demand from the buildout of data centers has AMD stock soaring.

After falling nearly 20% in 2024, AMD stock returned close to 80% in 2025, and the outlook would appear bright. Indeed, analysts have never been more collectively bullish on the tech stock's prospects.

But while AMD has been a market-beater for more than a decade, truly long-term shareholders are sitting on disappointing returns. That's because the chipmaker spent the first part of the past 20 years having a sort of "lost decade." As much success as AMD is enjoying now, it wasn't too long ago that shares were essentially priced for irrelevance, or worse.

Founded in 1969, AMD spent decades as a second-class citizen to Intel (INTC), which came to dominate the market for PCs. Intel was the innovator, and AMD licensed the former's technology to make clones.

By the early 2000s, however, the company began to shape its own destiny – and to compete directly against Intel. The key was AMD's Athlon 64 technology, which gave customers a competitive, and sometimes superior, alternative, to Intel's CPUs.

Sadly, the good times didn't last long. Although its 2006 acquisition of graphics chipmaker ATI laid the foundation for AMD's success in GPUs today, the $5.4 billion price tag nearly bankrupted the company.

Bigger troubles were to come. By the 2010s, AMD and Intel were locked in a CPU arms race to develop ever more powerful chips. When its much-anticipated Bulldozer architecture proved to be slower, hotter and less energy efficient than Intel's latest chips, it looked like AMD might be finished.

If AMD had a nadir, it was July 27, 2015. With analysts and investors fretting about bankruptcy, AMD hit an all-time low of $1.61.

No wonder CEO Lisa Su is credited with executing one of the greatest turnarounds in history. AMD dropped its legacy as a low-cost supplier, pivoting to high-performance computing. Its Ryzen multi-core technology became a hit in the PC market, while EPYC processors began to systematically strip market share from Intel in the lucrative data center market.

If there were any doubts that AMD was for real, they were put to rest by the 2022 acquisition of Xilinx. The $49 billion deal was the largest in the history of the semiconductor industry. It also marked another AMD pivot, this time toward AI.

The bottom line on AMD stock?

Long-time shareholders have put up with a lot of angst and drama over the years, and for most of them it's paid off.

Over its entire life as a publicly traded company, the large-cap stock generated an annualized total return (price change plus dividends) of 12.1%. That beats the S&P 500 over the same span by more than a percentage point.

Other standardized time frames are even more impressive. AMD stock has outperformed the broader market – often by wide to gaping margins – over the past one-, three-, five-, 10- and 15-year periods too.

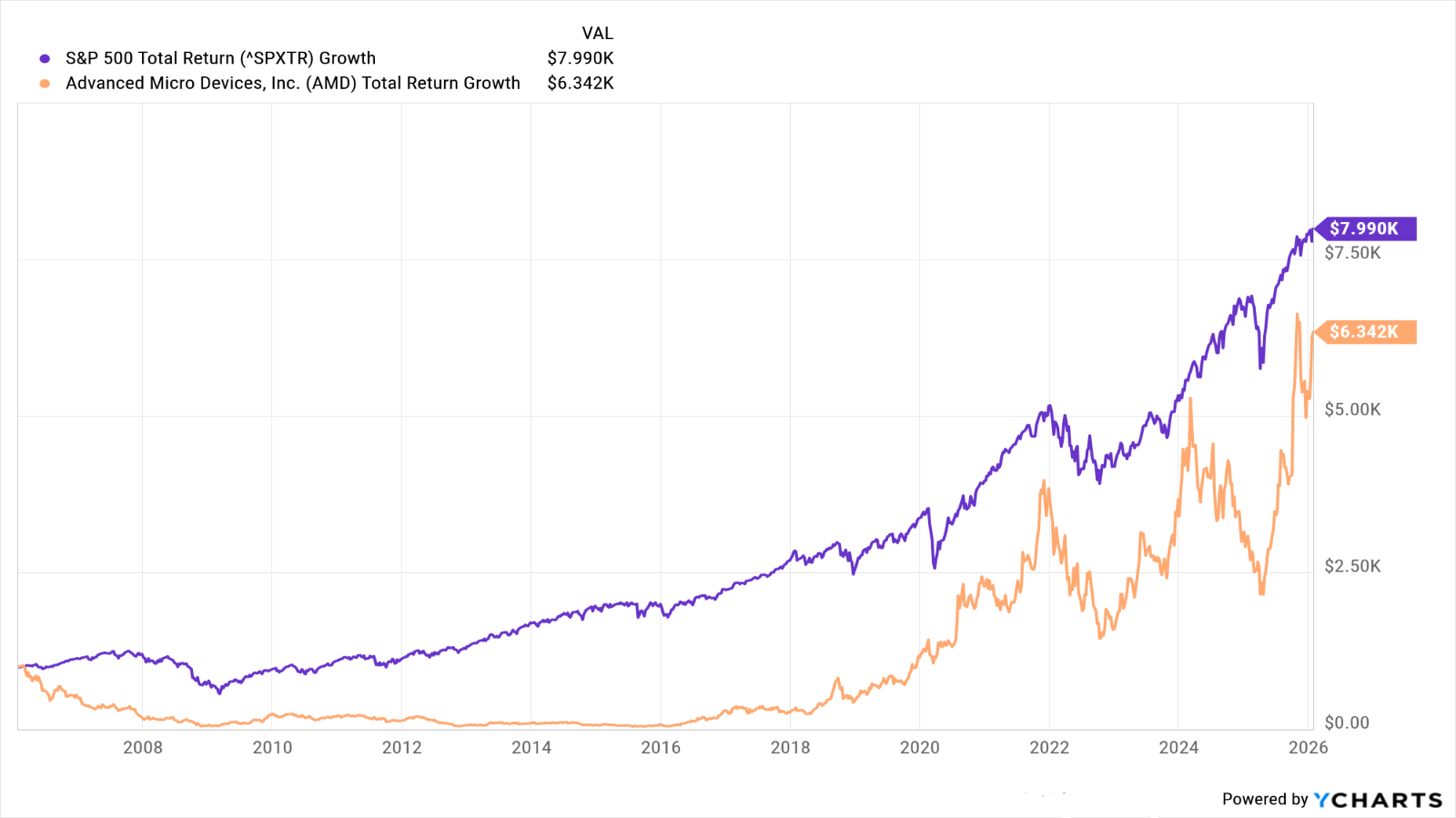

Sadly, timing, while not everything, very much matters. Investors who made a lump-sum investment in the semiconductor stock two decades ago are playing catch-up.

Have a look at the above chart and you'll see that if you'd put $1,000 into AMD stock 20 years ago, it would today be worth $6,300, or an annualized return of 9.7%

The same sum invested in the S&P 500 would theoretically be worth almost $8,000 today – good for a return of 11%.

As for where AMD goes from here, as noted above, Wall Street has never been this bullish on AMD stock before. Of the 53 analysts covering the name, 36 call it a Strong Buy, five say Buy and 12 have it at Hold, according to S&P Global Market Intelligence. That works out to a consensus recommendation of Buy, with very high conviction.